Current Liabilities

October 14, 2020

What is a “Current Liability”?

A liability is a financial obligation representing a probable future outflow of cash and has a legal priority over shareholders’ claims. Companies report their liabilities on the balance sheet in two categories: current and non-current.

Current liabilities are payable within 12 months. Operating liabilities are connected to the day-to-day operations of the business and include: accounts payable (amounts owed to suppliers who have invoiced the company), and accrued expenses (amounts owed to suppliers where the company has not received an invoice and has to estimate the liability).

Non-operating liabilities are items connected to financing activities and include debt repayable within the next 12 months and dividends announced but not paid.

Key Learning Points

- A current liability represents a short-term financial obligation and is payable within 12 months

- They are reported in the balance sheet which presents a snapshot of the assets, liabilities, and equity of a company at a point in time

- Current liabilities are included in the calculation of various liquidity ratios which measure a company’s ability to pay its short-term obligations

- Lenders and investors normally expect a company to have current assets in excess of its short-term obligations, in other words, it has sufficient liquidity

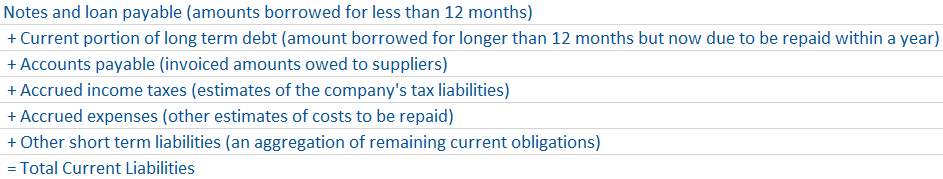

What Items Usually Appear Under Current Liabilities?

- Accounts payable

- Short-term debt

- Notes payable

- Dividends payable

- Accrued expenses

- Taxes payable

- Current maturities of long-term debt

- Interest payable

- Customer deposits

Typically, current liabilities are settled using the company’s current assets, which represent short-term uses of funds.

How are Current Liabilities Reported in the Balance Sheet?

Example

Below shows a snapshot of Coca-Cola’s current liabilities for the year ended December 31, 2014:

Coca-Cola Company – Extract from balance sheet 2014

Companies usually settle short-term obligations by liquidating their current assets or replacing them with other liabilities.

Key Ratios

Companies need to determine their ability to pay debts. Analysts use key ratios to measure this.

Current Ratio

It measures a company’s ability to pay short-term obligations with its current assets.

Current Ratio = Current Assets / Current Liabilities

Quick Ratio

Measures a company’s ability to settle short-term obligations with the most liquid current assets. Note this formula does not include inventory.

Quick Ratio = (Cash and Cash Equivalents + Marketable Securities + Accounts Receivable) / Current Liabilities

Cash Ratio

Measures a company’s ability to meet short-term liabilities using just its available cash balances.

Cash Ratio = Cash and Cash Equivalents / Current Liabilities

Summary

Current liabilities represent the short-term obligations that the company must meet within the next 12 months. Lenders and investors normally expect a company to have current assets in excess of its short-term obligations, in other words, it has sufficient liquidity.

Practice calculating current assets in a downloadable Excel file

Additional Resources

Cash Flow Statement