Expenses

October 30, 2020

What are “Expenses”?

Expenses are decreases in economic benefits for a company and arise from the depletion of assets or incurrences of liabilities. These expenses reduce profits and therefore reduce equity via retained earnings. We allocate expenses in the income statement based on the accruals principle, which means we recognize items when they occur rather than when the associated cash flows happen (just like with revenues).

In order to determine when an expense has occurred, we use the matching principle which states that revenues and any related expenses should be recognized in the same reporting period, i.e. costs should be matched with the revenue those costs helped generate. When expenses cannot be directly allocated to revenues, they are allocated to the time period in which they occurred.

Similar expenses are grouped together in a coherent manner. There are three main types of expense:

- Operational or operating expenses

- Financing or financial costs

- Tax costs

Key Learning Points

- Expenses are decreases in economic benefits for a company resulting in decreased profits via the retained earnings account

- Expenses are allocated using the same principle as revenues, which is when they occur as opposed to when the associated cash flows happen (accruals principle)

- Operating expenses are associated with the main activities of the business and are further divided into COGS and SG&A expenses

- Financial expenses are expenses associated with any financing the company incurs, including interest from debt

- Tax expenses are reported below the profit before tax line and are the expenses owed to authorities as a result of profits generated in the accounting period

Operating Expenses

Operating expenses are expenses associated with the main activities of the business and are often subdivided into cost of goods sold / COGS and selling, general and administrative / SG&A expenses. COGS are those that can be directly linked to sales and generally represent the cost of purchase or manufacture of the products sold. When revenue is generated, COGS is recognized. In other words, COGS are directly matched to revenues.

SG&A represent the support functions of the business, such as marketing and corporate center (they are not directly tied to the manufacturing of a product or service). We allocate these expenses to the time they occurred as they cannot be directly matched with revenue.

As companies in the same sector face similar industry dynamics, keeping operating costs in check is a key part of a company’s performance. As such, the operating costs are key when comparing companies in the same industry.

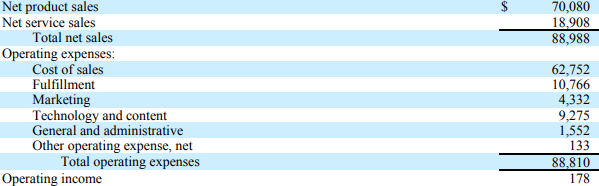

Amazon, Inc – Extract from Income Statement, 2016

Financial Costs

Financial expenses include interest expense generated by debt. Just like other expenses, financing expenses are recognized in the income statement when they occur and not when the cash flow happens.

Companies in the same industry can have widely different levels of debt (also known as funding structure). Therefore, including funding costs in bench-marking between companies, even in the same industry, reduces comparability.

Amazon, Inc – Extract from Income Statement, 2016

Tax costs

The tax expense represents the taxation implications of the profits earned for the period in question. Just like sales, this line item does not directly correspond to tax cash flows. The amounts may not even be due for payments to the tax authorities in the next or current periods, but they are still included in the income statement in line with the accrual or matching principle.

The tax expense is largely outside the control of the company and is driven by the tax regime of the country, or countries the company operates in. As taxes differ significantly between countries, it makes sense to use a pre-tax numbers when making comparisons between companies.

Amazon, Inc – Extract from Income Statement, 2016

Amazon’s Income Statement

The extracts show Amazon’s income statement for the year ended 31st of December 2016. Cost of sales is included within operating expenses instead of being reported separately. All other operating expenses reported relate to supporting Amazon’s sales (SG&A). Marketing is a great example of an expense that increases sales but is not directly tied to the production of a product or service.