Restructuring Costs

March 10, 2020

What are “Restructuring Costs”?

A company will report restructuring costs when it incurs one-time or infrequent expenses in the process of reorganizing its operations to improve its long-term profitability and efficiency.

Restructuring costs are reported as non-operating charges and aren’t expected to recur in the future. Although they are non-recurring costs, they still are reported in the income statement and used to calculate the net income. Often analysts will ‘normalize’ or ‘clean’ earning of restructuring costs to give a better understanding of the long-term profitability of the firm.

Key Learning Points

- Restructuring costs are any infrequent expenses associated with the reorganization of its operations to improve long-term profitability and efficiency

- They are considered non-recurring as they are not part of the ongoing operations of the business

- Analysts will ‘normalize’ earnings by removing the impact of restructuring costs to generate an earnings figure which better showcases the long term profitability of the company

- Restructuring costs are reported in the income statement and additional information can often be found in the financial footnotes to the accounts

Common Restructuring Costs

- Mergers and acquisitions with companies

- Selling a subsidiary or downsizing

- Moving assets to a new location

- Laying off employees

Accounting for Restructuring Costs

Company A. has decided to make the following changes to its operations:

The total cost Company A would report in the income statement as Restructuring Costs would be $1,140,000.0 (1,000,000.0 + 100,000.0 + 10,000.0 + 30,000.0)

Although companies might need to pay out restructuring costs over time, the whole amount should be expensed as soon as reasonably probable. When a company reports the restructuring costs, it will expense them and create a liability until the cash is paid out.

Points to Note

- Amounts are shown in thousands.

- Company A has raised a restructuring provision, which it plans to pay over 3 years.

- Annual payments are $380,000.0 ($1,1400,00.0 / 3 years).

- The balance on the Restructuring provision at Year 1 after payment is $760,000.0 ($1,140,000 – $380,000.0).

- The balance on the Restructuring provision at Year 2 after payment is $380,000.0 ($760,000.0 – $380,000.0).

- The balance on the Restructuring provision at Year 3 after payment is $0 ($380,000.0 – $380,000.0).

- Often companies will present ‘cleaned’ or ‘normalized’ earnings to help investors understand the long-term profitability of the company..

Kellogg Inc.

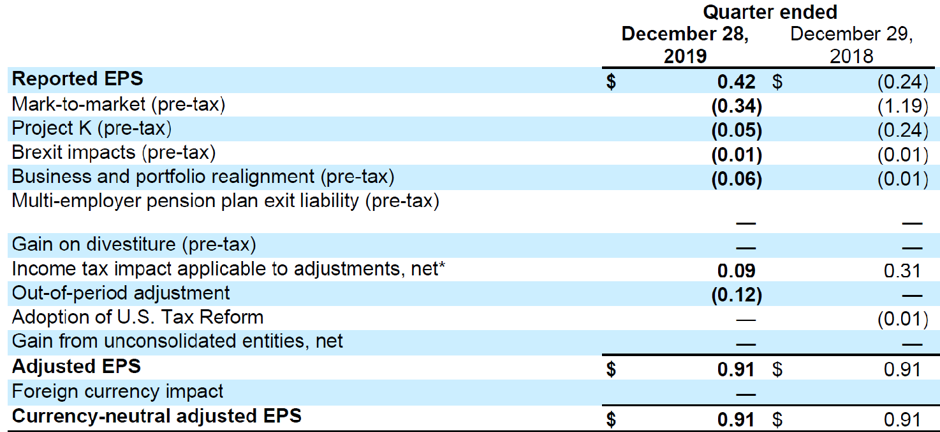

Below, Kellogg Inc. is reporting $0.42 cents per share, but adjusted for non-recurring items it’s suggesting its recurring EPS is $0.91 cents per share. The detail below is taken from Kellogg’s 8-K filing at the SEC. Companies usually present this type of analysis in the press release related to earnings announcements.

Kellogg Company – Extract from 8-K

Kellogg’s disclosure and explanation of the non-recurring items: