Par Value

October 1, 2020

What is Par Value?

The par value of a share, also known as the stated value per share is the minimum share value at which a company issues shares to the public. It is the nominal share amount that a company has stated on its stock certificate at the time issued. Par value bears no relation to the market value of shares.

Typically, a company issues common shares in excess of their par value. However, companies issue bonds and preference shares close to par value.

Additional paid-in capital is the value an investor pays in excess of the nominal value of the share when a company issues shares.

Depending on geographical location, companies are not required by law to issue shares at par value. Those companies issue no par value stock.

Key Learning Points

- Par value is the minimum share value a company issues its stock to the public and is stated on the stock certificate at the time of issuance

- Shares are usually issued in excess of their par value and the additional proceeds are reported in the additional paid-in capital account (APIC)

- Details on equity issuances, share buybacks and dividend payments can be found in the statement of changes in equity

- When a company issues shares, the company receives cash proceeds which increases its cash account, a corresponding increase in the common stock and APIC also occurs

Accounting for Share Issuances

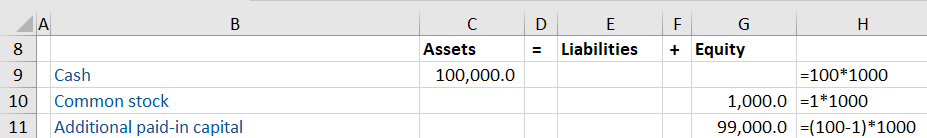

Company A sells 1,000 shares at $100 with a par value of $1.00. Entries in the balance sheet would be as follows:

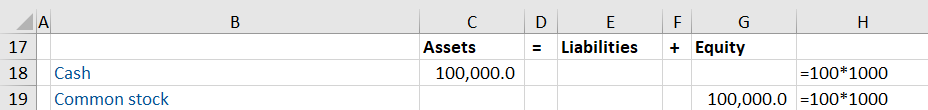

If company A had to sell 1,000 shares at $100 with no par value, entries in the balance sheet would be as follows:

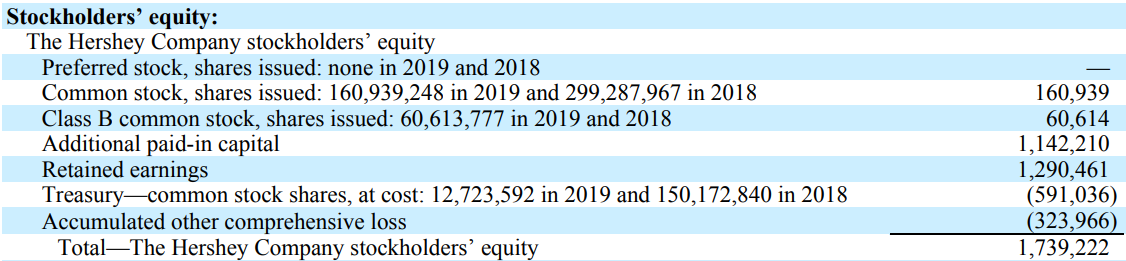

Below is an extract from the Consolidated Balance Sheet of Hershey Company for the year ended December 31, 2019:

Points to Note

- Hershey issued 160,939,248 shares in 2019

- Investors paid an additional $1,142,210 for the shares

- Hershey hold 591,036 shares in their treasury account (the number of shares the company has bought back from the market)