Investment Strategy

June 21, 2021

What is an “Investment Strategy”?

An investment strategy is a definition that includes a set of principles and rules aimed at helping investors to achieve their personal financial objectives. Building a strategic plan that considers various components such as time horizon, investment goals, risk tolerance and liquidity requirements, is the first step in the investment process. Then the implementation of the plan includes constructing a portfolio of investments designed to follow the rules and goals of the investor. Given the markets and the personal circumstances of the individual investor change, investment strategies require regular reviews and adjustments.

Key Learning Points

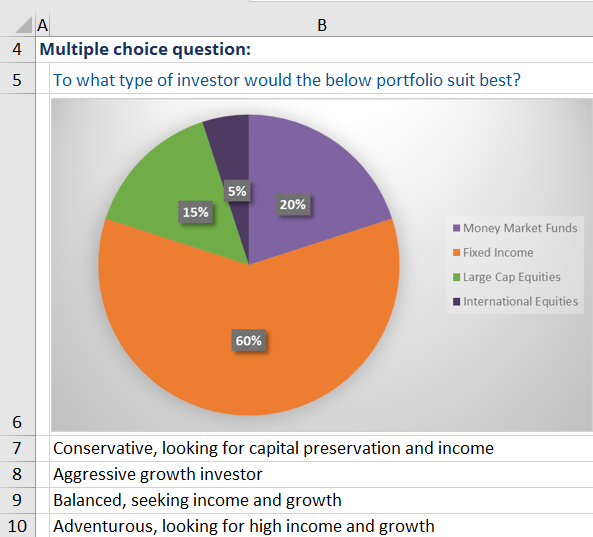

- An investment plan is the set of rules and principles that are created to help investors achieve their financial objectives

- Various components are considered when building investment strategies such as:

- Investment timeframe

- Personal inspirations

- Risk appetite

- Capital requirements

- In terms of financial goals, investment strategies could be broadly classified as: income, income and growth and growth

- From a risk perspective, most commonly strategies are divided into three groups – cautious, balanced or adventurous

- Style also plays an important role in the creation and implementation of an investment strategy. Most often style is classified as value, growth or blend

Building an Investment Strategy

The first stage of the process of building an investment strategy is to consider various factors such as investor’s objectives, investment horizon, financial and personal situation (including dependents and lifestyle), and risk tolerance. This is required in order to determine the investment approach that could deliver optimal results and then construct the right mix of asset classes and investment products.

In terms of risk, investors usually fall into one of the three broader profiles:

• Cautious (or Conservative) – suitable for risk-averse investors with low levels of loss tolerance. These can be mainly investors who seek to protect their capital and receive regular income. Typically, more than half of the portfolio will be allocated to high quality fixed income products, where the rest could be split between money market funds and quality large cap equities.

• Balanced (or Moderate) – investors with moderate risk appetite who are seeking a combination of capital growth and income. The majority of assets are expected to be equities (most of them established large cap companies and smaller portions of mid and small cap) alongside reasonable allocation in fixed income.

• Adventurous (or Aggressive) – suitable for investors with a long time horizon who are willing to take higher risk towards achieving higher returns through capital appreciation. Typically, an all-equity portfolio of predominantly large companies blended with mid and small-cap stocks.

Value Vs. Growth

Some investors may choose to emphasize on specific factors such as ‘value’ or ‘growth’ when deciding on their investment strategy. Value investing seeks to identify stocks that are underappreciated by the market and perceived to be trading below their fair value. On the other hand, buying companies with superior earnings growth potential (and possibly priced accordingly) is regarded as growth investing.

Example

One of the most popular investment strategies is the ‘core-satellite’ approach. It is designed of two components – the “core”, which represents the largest proportion of the portfolio and consists of low to moderate level of risk assets, and “satellites”, which are typically higher risk and more specialist investments that are expected to play the role of diversifiers.