Asset Class

May 5, 2021

What is an “Asset Class”?

An asset class is a group of assets that have similar characteristics and behavior in the marketplace. Traditionally, the major asset classes are equities or stocks, fixed income or bonds (government and corporate), and real estate. In recent years, new asset classes termed “alternative asset classes or investments,” have emerged. These include commodities, cryptocurrencies, private equity, hedge funds, artwork, high-yield and emerging market bonds, among others. Such assets are highly illiquid and risky but can generate exceptionally high returns.

Key Learning Points

- The common types of asset classes are equities, bonds, and real estate.

- Correlation helps in measuring the relationship between the movement of prices of different asset classes. A negative correlation indicates that prices of two asset classes move in the opposite direction.

- Portfolio managers use correlations between asset classes for diversification and balancing the risks/rewards of portfolios.

Common Types of Asset Classes

Given below is a brief overview of the common types of asset classes:

Equities

Stocks, equities, or shares refer to buying an ownership stake in companies. As an asset class, stocks offer potentially high returns but they are also accompanied by a higher degree of risk. Within stocks, there are different sub-asset classes based on the following criteria:

- The market capitalization of the target company (e.g. large-cap stocks, mid-cap stocks, and small-cap stocks)

- Geography (e.g. US stocks, non-US stocks and emerging market stocks)

- Sectors (e.g. technology sector and pharma sector stocks)

Fixed Income Instruments

Fixed income instruments, such as bonds, offer a fixed return as per a fixed schedule. There are different sub-asset classes within bonds, such as government bonds (domestic and foreign), corporate bonds (investment grade and non-investment grade), etc. Bonds come with varying degrees of risks and rewards depending on the issuer. For example, bonds issued by the US government are less risky and offer lower returns than bonds issued by corporations.

Real Estate

Real estate is one of the oldest asset classes. There are multiple asset classes within real estate, such as residential, commercial, land, etc. Investors can buy these assets directly or invest in real estate through REITS (or real estate investment trusts). REITs own and operate income-generating real estate assets and allow investors to invest in real estate by buying shares of these companies without physically investing in properties themselves. Sub-asset classes of real estate include US real estate, real estate in emerging markets, etc.

Alternative Asset Classes

Alternative asset classes refer to a variety of investments beyond the traditional asset classes of equity, fixed income, and cash. These include real estate, private equity, infrastructure, and commodities. Alternative asset classes tend to be more illiquid than traditional ones, making them more suitable for long-term investors who do not require immediate access to their capital. They are often more esoteric, with a diverse set of investments within each class, and can be more challenging to value due to lower levels of publicly available information.

Benefits of Traditional Asset Classes

These asset classes offer three main potential benefits over traditional assets:

- They provide opportunities for skilled investors to find mispriced securities and generate higher returns.

- They often have lower correlations with traditional asset classes, offering good diversification benefits.

- Some alternative asset classes can provide returns that keep pace with or exceed inflation, either because they drive inflation (as with commodities) or their cash flows are inflation-linked (as with infrastructure investing)

Asset Classes and Diversification

Since asset classes differ in terms of rates of return, market volatility, risk factors, liquidity and taxation (among other factors), investors attempt to have a diversified portfolio that comprises of different asset classes which will earn maximum returns, while minimizing risks and costs.

Diversification works best when the asset classes are negatively correlated or uncorrelated. When two asset classes are negatively correlated, it means that when the price of one asset class falls (for example stocks), the price of the other rises (for example bonds) and vice versa.

Asset Allocation and Risk Tolerance

Asset allocation is the process of dividing an investment portfolio among different asset classes, such as equities, fixed income, and cash. The goal is to balance risk and reward by adjusting the percentage of each asset class based on the investor’s risk tolerance, investment goals, and time horizon.

Risk Tolerance

Risk tolerance refers to an investor’s ability and willingness to endure market volatility and potential losses in their investment portfolio. It is influenced by various factors, including financial situation, investment experience, and psychological comfort with risk. Here are some key points to consider:

- Understanding Risk Tolerance: Investors with a high risk tolerance are more comfortable with market fluctuations and potential losses, and they may allocate a larger portion of their portfolio to equities, which are generally riskier but offer higher potential returns. Conversely, investors with a low risk tolerance may prefer more stable investments like bonds and cash.

- Diversification: Diversifying investments across different asset classes can help manage risk. By spreading investments, investors can reduce the impact of poor performance in any single asset class. For example, if equities perform poorly, bonds or cash investments might perform better, balancing the overall portfolio performance.

- Adjusting Asset Allocation: Over time, an investor’s risk tolerance and financial goals may change. It’s important to periodically review and adjust the asset allocation to ensure it aligns with the current risk tolerance and investment objectives.

Example

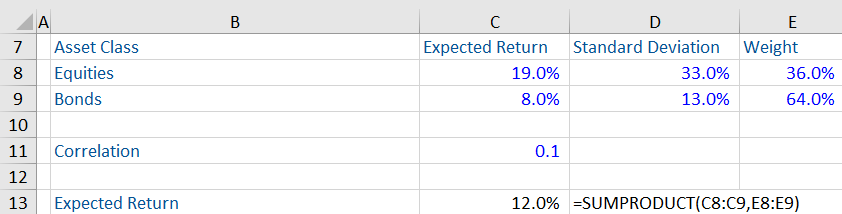

Given below is information from a portfolio that invests in two asset classes – equities and bonds.

Generally, stocks and bonds have low or negative correlations. In the example above, we can see they have a very low correlation of 0.1. This means that any upward or downward movement in one asset class, say equities, will have very little impact on the other asset class (bonds).

In the above example, equities are expected to give a higher rate of return (19%), while bonds are expected to give a lower rate of return (8.0%).

Standard deviation represents the risks associated with each of these asset classes (the risk of price volatility). Equities have a higher standard deviation than bonds, consequently, they represent higher risk.

Weights represent the percentage of each asset class in the portfolio. This portfolio invests a higher proportion in bonds (64.0%) than equities (36.0%).

Next, given below is the calculation of the expected return of this portfolio using the sumproduct function in Excel. The function uses the expected returns of both asset classes and the respective weight of each.

The expected return on this portfolio is lower than the expected return on equities but is higher than the expected return on bonds. Investing the entire amount in equities can lead to higher returns, but accompanied by higher risk. Investing the entire amount in bonds can reduce risk, but the returns are also expected to be lower.

Investing in two (or more) different asset classes helps in balancing the risk and reward of this portfolio.