Carbon Pricing

January 14, 2022

What is “Carbon Pricing”?

Carbon pricing is a concept under which a price or cost is put on releasing carbon dioxide emissions into the atmosphere. Carbon emissions are classified as greenhouse gas emissions and contribute to climate change. Policymakers have been looking at ways of making polluters pay for the fact that their activities contribute to climate change. One way of doing that is to put a price on the emissions generated. The most common method of pricing carbon emissions is through emissions trading schemes (ETS). An alternative tool open to policymakers are carbon taxes.

There are a variety of terms and definitions used to describe carbon pricing including carbon emission price and shadow carbon price. For polluting firms, carbon pricing means that they are not only penalized for their existing emissions but that they need to consider carbon costs when making investment decisions. Capital expenditure projects appraisal should reflect the cost of generating carbon emissions. By having to bear such costs, businesses are incentivized to adopt more modern, more environmentally friendly technologies.

Key Learning Points

- Carbon pricing reflects the cost a business incurs when releasing carbon dioxide emissions

- The carbon price is usually determined by emission trading systems. The overall supply of permits is determined by the authorities. The demand is determined by the entities that need to secure enough permits to match the number of emissions released as part of their business

- Carbon pricing can be used by companies to evaluate investment projects that they are considering

- Equity investors may use carbon pricing to evaluate the future profitability of polluting businesses

How carbon price is determined

Carbon pricing is most commonly determined using emissions trading systems. Such systems are used in many countries around the world and are a form of market mechanism to determine the price or cost of each emission permit. Each such allowance represents the right to release one ton of CO2 into the atmosphere. The overall supply of permits each year is determined by the governments who may allocate or auction off the permits to the polluting sectors of their economy. The governments themselves are bound by long-term emission reduction goals based on the international agreements they have signed.

The governments usually set predefined emissions reduction targets representing an overall annual cap that is reduced each year. The actual mechanism through which the polluters obtain the permits may be based on simple distribution to the polluters. Alternatively, the allowances may be auctioned. At the end of each period, the polluters must demonstrate a balance in their allowances and actual emissions released. Those entities that are short of allowances must buy them on the emissions trading system, while the entities that have operated more efficiently and did not use up their allowances can sell their surplus permits on the trading system. The demand and supply of emission permits then determine the carbon price, which is made available to the public.

The users of carbon prices

There are several groups of users of carbon prices. Businesses use them for budgeting and planning and to help appraise different investment alternatives. It helps them make investment decisions by comparing different projects that may be based on different levels of emissions and therefore different costs associated with using particular technologies or processes. Using carbon pricing also helps businesses identify inefficiencies.

In addition to companies themselves, analysts at banks, brokerage, and asset management firms will be using different carbon price assumptions when assessing companies’ future profitability and risk exposures. By incorporating the cost of carbon emission into their models, analysts are better equipped to make the correct investment recommendation. The challenge comes from the fact that while the current or recent carbon price is known, forecasting future carbon prices is challenging, adding to the uncertainty. Thankfully, several entities provide future carbon price forecasts for analysts and investors to use.

Example

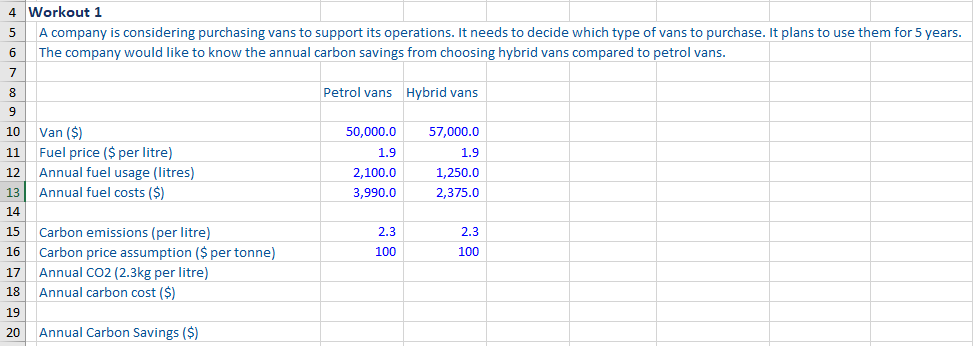

A company is appraising an investment it needs to make into new vans. Management is considering two possible types of vans, based on different technologies. One costs less to acquire than the other but will operate less efficiently and release more carbon emissions into the atmosphere than the other system that costs more to acquire but is cheaper to operate and releases fewer emissions. Based on the information below we have been asked to calculate the carbon saving from choosing hybrid vans compared to petrol vans:

The company should consider the carbon cost associated with the expected carbon emissions of the two vans, incorporate those expectations into the appraisal models to decide which of the two options is likely to generate better returns for the company.

As you can see the hybrid vans have a higher initial cost but provide annual carbon savings when compared to the petrol vans of $195.50.

Conclusion

Carbon pricing plays an increasingly important role in business decision-making and valuation. Carbon pricing reflects the cost of releasing emissions into the atmosphere and can be determined in different ways, most typically through emission permit trading systems. Carbon prices are used by companies when evaluating investment projects that should reflect costs associated with pollution. Analysts valuing the companies will also use future carbon price assumptions in their valuation models.