Long and Short Positions

August 19, 2025

What are Long and Short Positions?

Long and short positions are fundamental in investment management and refer to two opposing approaches to capitalizing on price movements within financial markets.

A long position refers to the purchase of an asset, for example, a stock, with the expectation that its market value will appreciate (i.e. its price will go up) over time. By “going long”, also known as being “bullish” on the stock, investors are aiming to realize a profit by selling the asset at a higher price in the future.

On the other hand, short positions are more complex and involve selling a borrowed asset with the anticipation that its price will go down. The investor will later repurchase the asset at a cheaper rate to return it to the lender and will profit from the price difference. This approach is also known as being “bearish” on the asset and is inherently speculative and higher risk.

In this video we provide a detailed introduction on long and short positions.

Key Learning Points

- Long positions involve buying an asset with the expectation that its price will appreciate, and the investor could profit from selling it later at a higher price

- Short positions are betting on the price of an asset declining. It involves borrowing and selling the asset anticipating a drop in its price, and potentially making a profit by repurchasing at a lower price

- While long positions have limited loss potential, “going short” carries higher risk as, in theory, losses could be unlimited

Long Positions

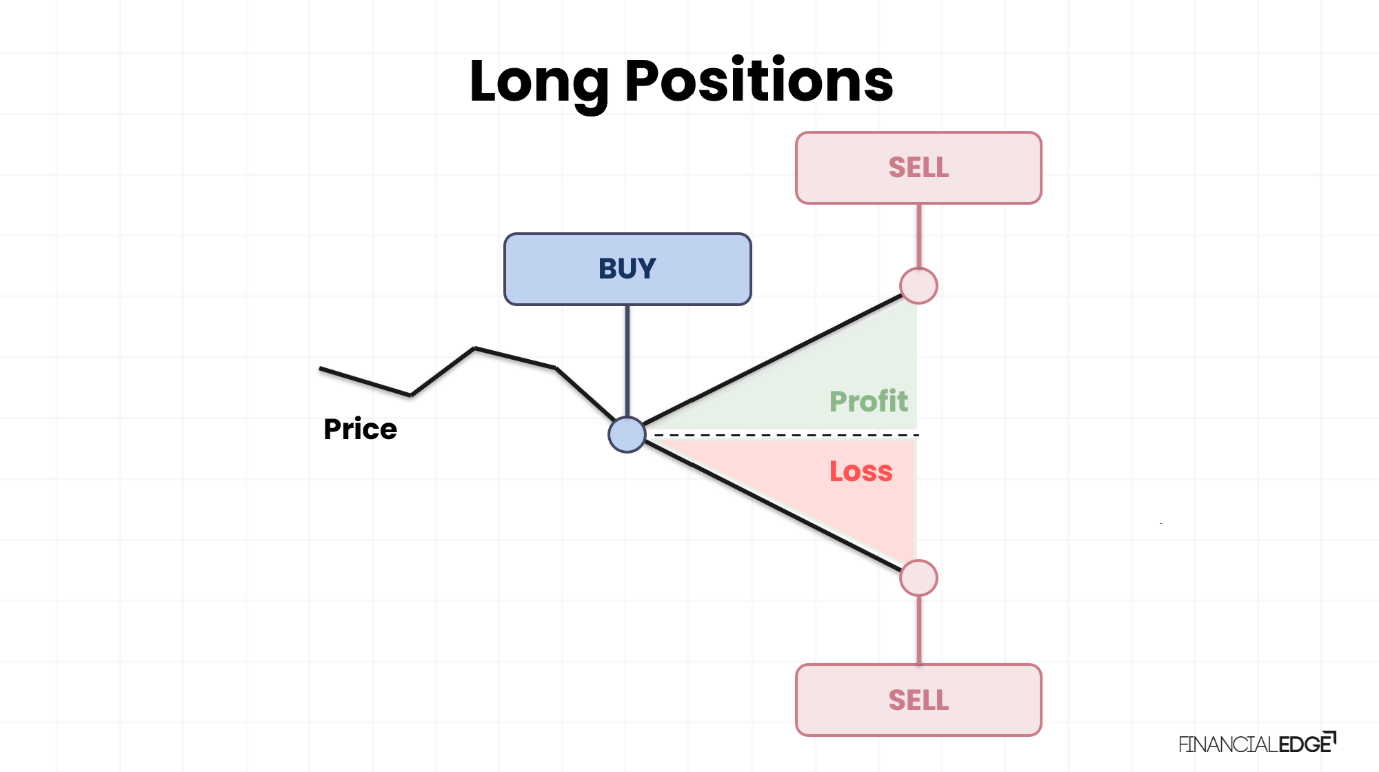

Taking a long position is essentially expressing a distinct view on a security in which the investor buys it on the back of an expectation that its price could increase in the future. Should that materialize, the security could then be sold at a higher price, and the difference will be the investor’s profit from the trade. However, if the price goes down post purchase and the investor decides to sell, that will result in a financial loss. The potential loss is capped as the price cannot drop below 0.

Among the benefits of “going long” is having ownership. In assets such as equities, this could entitle shareholders to voting rights, dividend payments and in some cases privileged access in subsequent shares issuances.

Long Position Profits

By entering a long position, in theory the profit that the investor can make is unlimited. This is because the price of the security could keep rising and unless the investor’s conviction has changed and the security is sold, the potential profits can keep increasing. However, in the real world this requires a very long-term holding period and would rarely hold up. As shown on the chart below, the potential risk post purchase is making a loss that is capped to the initial (and any subsequent) amount invested.

Example of a Long Position

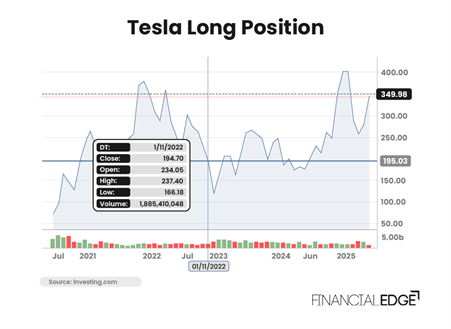

Let’s suppose that an investor believes that Tesla’s outlook is good due to future higher demand for electric vehicles. However, the current share price looked high, and the investor had to wait until it dropped to the desired level. Then, on the 1st of November 2022 following a price decline, he purchases 100 shares at $235 each as per the chart below.

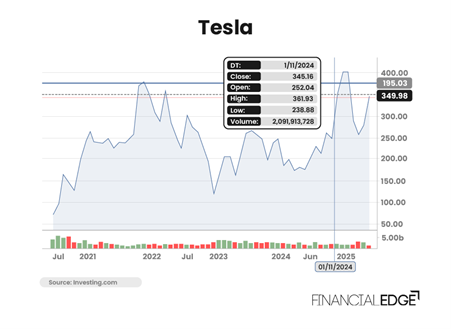

The stock had been volatile, and its price kept fluctuating, but the investor held the stock for exactly two years and decided to sell on the 1st of November 2024 (as shown below) at $350 per share.

Overall, this trade would have resulted in a profit of:

$350 x 100 = $35,000 (sold)

$250 x 100 = $25,00 (purchased)

Profit* = $35,000 – $25,000 = $10,000

*Please note this is just an illustrative example and the figures do not account for any transaction or maintenance costs, additional purchases or sales, dividends received, or taxes.

Short Positions

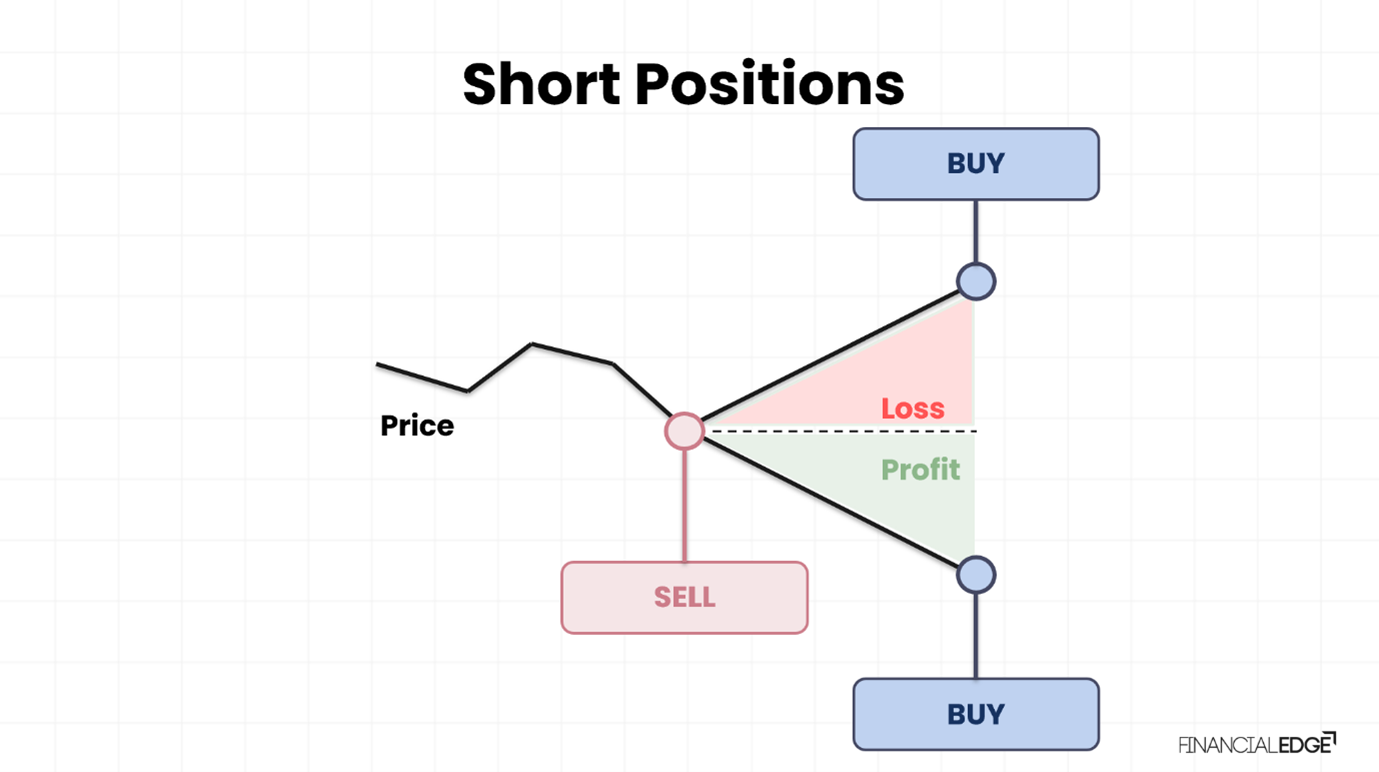

Conversely to long positions, by “going short” an investor is essentially expressing a negative view (being “bearish”) on the future prospects of an asset and is betting on a decline of its price. As short positions involve selling an asset that the investor does not own, the trade is a bit more complex. It requires borrowing the asset, for example borrowing a stock from a broker, and immediately selling it on the market with the intention of buying it back later at a lower price. If the price declines, the investor could repurchase and return it to the lender. This would result in making a profit by keeping the difference.

However, there are also significant risks associated with this type of trade. If the price of the asset increases, the investor may need to repurchase it at a higher price, which would result in making a loss. Unlike long positions, shorting’s potential profit is capped as the price of the asset cannot go below 0, but the downside is unlimited should the price keep going up. This is illustrated in the chart below.

How to Set Up a Short Position

The process of setting up a short position is rather technical and involves a couple of steps that we outline below:

- The process begins with identifying a security, for example, a stock that is likely to experience a decline in its market price. This is likely to be an outcome of fundamental or technical analysis

- Then the investor needs to open a margin account. This is usually done with a broker and allows investors to borrow securities. We provide more detail on this in the next section.

- Next is borrowing the security – the broker sources the security from other investors acting on behalf of the investor that wants to borrow them

- After this is done, the borrowed securities are sold. The trade is executed at the current market price, initiating the short position.

- The position is set – it is now time for the investor to monitor the performance of the security. A decline would work in favour of the trade whereas a price increase would lead to a loss

- The final step is buying back the security. Should the price reach the target level, the investor repurchases the security and returns it to the lender

What Is Margin?

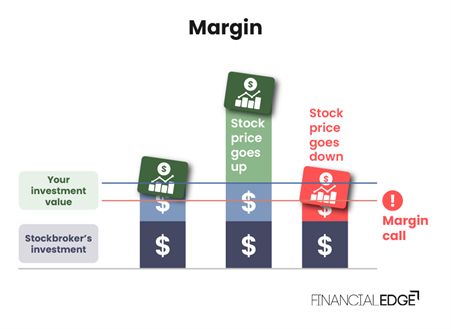

Margin is the use of borrowed funds from a broker to buy securities, which allows investors to increase their purchasing power. It requires putting up a portion of the total value of the investment (also known as initial margin) and borrowing the rest. The investor’s own money acts as collateral.

While using a margin can amplify returns/profits if the price goes in the desired direction (up for long positions and down for shorts), it could also magnify losses if the opposite occurs. Should the latter happen, and the value of the investment drop substantially, the investor would typically receive a “margin call” that requires them to deposit additional funds to maintain the desired margin level. The process is demonstrated in the chart below.

Example of a Short Position

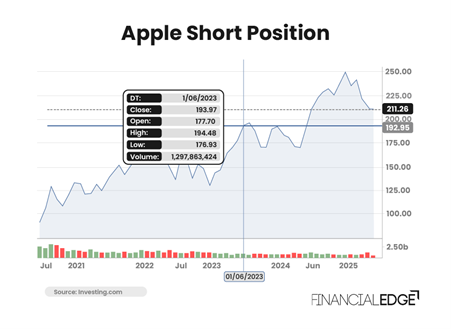

Following Apple’s remarkable share price growth, an investor conducts some fundamental research and concludes that its share price is above its fair value. He thinks that a correction is immediate and on the 1st of June 2023 initiates short position on the stock by selling 100 shares at $190 per share. The trade is illustrated below.

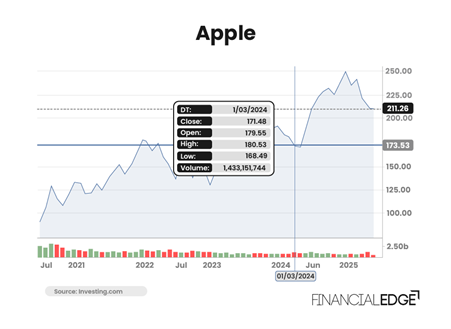

Three months later, the price drops down to $175, but the investor believes it could go further down. This was not the case, the stock recovered to the $190 level and even went up to $199 at which point the investor was making a loss. However, on the 1st of March 2024, the share price reached the investor’s desired level, and the short position was closed at $170 per share (as per the chart below).

To find out what the profit made from this trade we need to calculate:

$190 x 100 = $19,000 (asset borrowed and then sold)

$170 x 100 = $17,000 (asset bought back and returned to lender)

Profit* = $19,000 – $17,000 = $2,000

*Please note this is just an illustrative example and the figures do not account for any borrowing, transaction or maintenance costs, additional purchases or sales, dividends received, or taxes.

Pros and Cons of Short Positions

Some of the notable pros and cons of short positions are summarized in the table below.

| Pros | Cons |

| Allows investors to benefit when asset prices fall, offering opportunities in declining (also known as “bear”) markets | Potential losses are uncapped as asset prices could in theory rise indefinitely |

| Could help investors manage risk by hedging against potential losses from long positions | Investors would have to pay fees for borrowing the asset they short sell, which reduces potential profits |

| The use of margin can amplify potential returns (although this can also increase the risk) | A margin call could be triggered if margin requirements are not fulfilled |

Long and Short Trading Strategies

There are various investment strategies that involve long and short positions, or both. Below are some examples:

Long Strategies

- Buy and Hold – this is when the investor buys an asset and holds it for the long-term anticipating its piece to increase. Typical examples are concentrated active equity funds

- Index investing – if the investor has a positive view on a particular market and its future prospects, investing in an Exchange Traded Fund (ETF) that mirrors the performance of that market is a good passive option

Short Strategies

- Shorting an overvalued asset – this requires identifying securities that are trading above their intrinsic value and betting on their price going down. Hedge funds are a typical example of this strategy

- Pairs Trading – this strategy requires taking a long position on one asset while at the same time shorting a correlated asset. The potential profits will depend on the assets’ relative performance. Market neutral funds often use this approach

Conclusion

Overall, both long and short positions offer a way to profit from asset price movements, but nevertheless the approaches are opposing to one another. Long positions are easier to comprehend and involve relatively lower risk since the maximum loss is capped, while on the other hand short positions are technically more complex and offer limited upside and uncapped potential losses. The approaches can be used independently or combined, for example in equity long-short strategies that aim to reduce market risk while exploiting individual stock movements.