Unitranche Debt

May 21, 2021

What is Unitranche Debt?

Unitranche is a form of financing that combines first lien/second lien and/or senior/junior levels of debt into a single term loan. This presents the borrower with one financing instrument with one interest payment and one set of loan documents instead of several. While the loan appears to be singular to the borrower, from the issuer’s perspective there are often several components to the loan and many different investor groups.

Key Learning Points

- Unitranche combines several different tranches of debt (typically seen in leveraged finance) into a single loan to the borrower

- While this is still primarily a middle-market product, the size of unitranche is growing and it is appearing more frequently in large-cap deals

- These loans have grown in popularity driven by private equity sponsored deals

- Sponsors favor the shorter funding times and contractual simplicity of presenting one loan and one set of documents to a borrower

- Sponsor and unitranche providers often work together frequently making the deals close even faster

- Unitranche loans are often invested in by a range of investors seeking different yields: as such, the loans are often broken down into bifurcated structures representing “First Out” payments, which carry less risk and offer a lower yield, and “Last Out” payments with elevated risk and higher yield

- Unitranche is not a bank provided product and many consider the lack of intercreditor agreements problematic – the agreement among lenders, or AAL, has not been tested in bankruptcy court to the extent ICAs have

How Unitranche Debt Works

Traditional leveraged finance capital structures have some combination of first lien/second lien and senior/junior debt which spreads the lending risk among different investors. In the case of a levered transaction such as an LBO, that requires separate negotiation with banks, bond issuers, and perhaps mezzanine, each requiring their own terms, covenants, fees, interest payments, etc.

Unitranche rolls the entire debt funding into one loan for the borrower. The lender, or agent, is the arranger of the loan and is typically a private debt, private equity or hedge fund. The issuer then seeks investors looking to take on different portions of the loan, which it will carve out and price according to the risk level. In a bifurcated structure, a First Out, Last Out structure synthetically creates either a first lien/second lien structure (lien subordination) or a senior/junior structure (payment subordination). The AAL establishes a waterfall payment schedule that sorts out the interest payments to the various subsets of investors (amortization is rarely a feature of these loans) as well as the remedies in cases of default. The process of taking some of the interest from the overall blended cost payment and apportioning it to one of the investors in the higher-yielding carveout is called the “skim”.

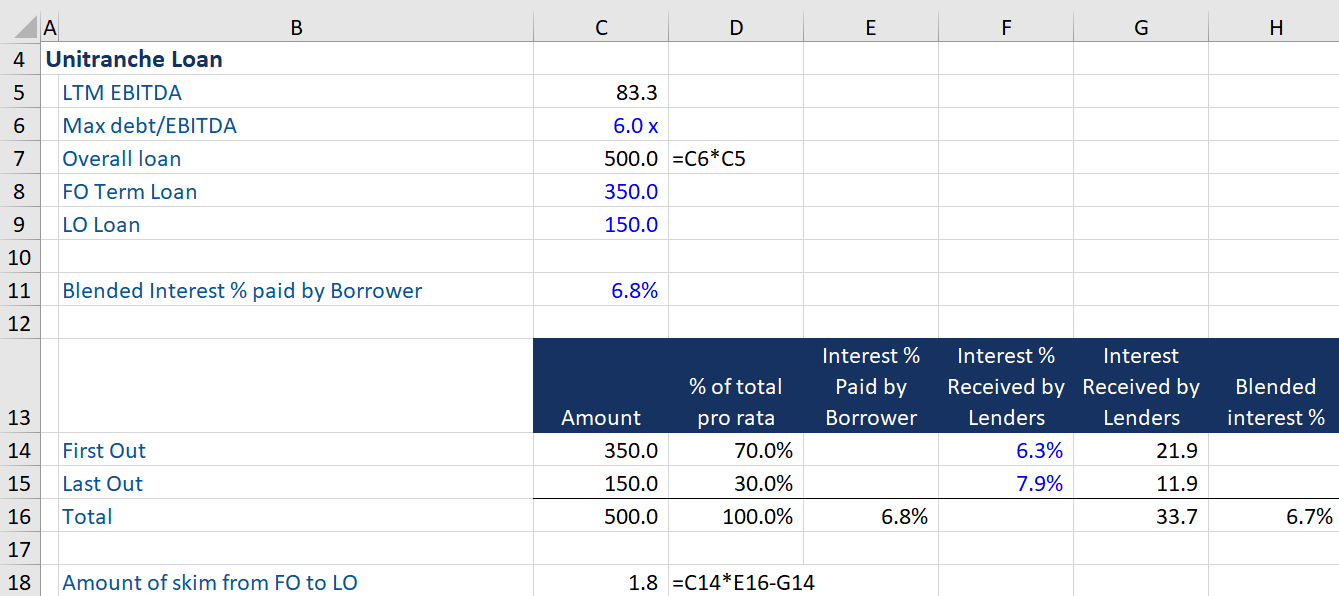

The Blended Interest Cost for Unitranche

In the example above, we can see the calculation of the blended interest cost and skim on a typical bifurcated unitranche deal (excluding fees, etc). The borrower is only responsible to pay the 6.75%, which is the AIC of the loan. However, the loan has a First Out carveout which offers a 6.25% yield and Last Out carveout offering 7.92%. The issuer, represented here in the First Out carveout, will receive all of the interest and needs to skim some of the First Out payment to pass along to the Last Out investors to increase their yield.

Most issuers are comfortable with the higher yield given the following factors: 1) the rate can be agreed to well in advance of the funding and there is no risk of price movement as there is with flex pricing on syndicated loans 2) the funding happens more efficiently in terms of time and documentation since the deal involves one lender and one set of loan documents.

Caveats for Unitranche

Unitranche is unlike traditional finance in many ways. One critical difference is that the borrower is not aware of anything happening behind the scenes of the single-term loan. This means that side deals are being made among investors regarding the borrower’s collateral, for example, and the remedy process in case of default, to which the borrower is not a party. Many borrowers are not comfortable with this.

Most unitranche providers are not banks and do not provide tailored products like revolving credit facilities. While it is possible to have an RCF in a unitranche deal, that facility will most likely have its own intercreditor agreement or ICA. Lastly, the agreements among lenders (AAL) have not been tested in bankruptcy court to the extent of ICAs and could leave lenders under-secured. Lastly, it can be more complicated to unwind a unitranche deal given standard call protection and more expensive to add incremental loans to a deal, given the higher average cost of borrowing.

Conclusion

Unitranche has become a sought-after financing solution for middle market, private equity sponsored transactions. By combining first lien/second lien and/or senior/junior levels of debt into a singular loan, the need to negotiate different tranches of debt with different parties can now be done with a single lender and a single set of loans documents.