Index Investing

February 15, 2022

What is “Index Investing”?

Index investing is an investment management approach that aims to replicate the performance of a particular market index. It is also referred to as passive investing as it eliminates the risk of taking active positions and stock picking. In terms of asset class, passive strategies could be built around a number of equity or fixed income-related indices and some alternative areas such as property or private markets. Exchange-traded funds (ETFs) are the most popular index investing structure, but there are also others such as the index trackers, which are priced once a day compared to the intraday trading feature of ETFs.

Key Learning Points

- Index investing aims to replicate the performance of a specific market index or a benchmark

- Index investing is a passive approach, which removes the risk of active decision-making and offers broader exposure to the entire market

- Index investing is most successful when executed in efficient well-established markets such as large-cap equities in developed economies

- Historical data shows that passive investment strategies outperform active managers

How Does it work?

Index investing offers exposure to the performance of the market as a whole, rather than trying to select those stocks that have the strongest potential to outperform. However, it is also worth noting that although investors benefit from rising markets, they also risk the possibility of financial loss during a market decline. Since no active decision-making is involved, index investing is usually run by an automated model instead of a portfolio manager. Therefore, the costs of index investing are much lower when compared to active funds.

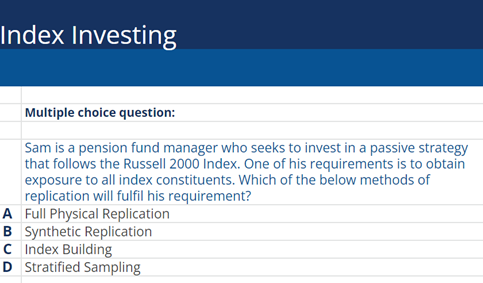

Methods of Replication

Generally, there are three methods used to replicate an index. The most popular is full replication, in which the fund buys all the stocks in the index, and each holding has the same portfolio weight as it has in the index. Stratified sampling is another method that would hold the largest index constituents and use a sampling technique to match the remaining constituents (this can vary, but for example, it could sample 20% of the lower end of an index). The third method of replication is synthetic replication – as the name suggests, it tries to replicate the performance of an index by holding synthetic instruments such as derivatives. It is worth noting that the fees for the replication method can be higher than the first two methods.

Advantages and Disadvantages

Academic research suggests that it is impossible to beat the market over the long term. Therefore, the proponents of index investing believe that getting exposure to all market constituents instead of a smaller basket of stocks would be the best approach. While it is impossible to remove the systematic risk, index investing eliminates specific risk. It is also argued that this approach works best inefficient markets where all the information is publicly available and arguably already reflected in the company’s share price. A good example of such an index is the S&P 500.

On the other hand, the theory does not hold well against active managers in less efficient market segments, such as smaller companies and emerging markets. In addition, since the active risk element is removed, passive strategies may be exposed to more significant drawdowns during periods of market turbulence or recession.