What is the WACC for a Private Company?

July 28, 2025

The WACC, or Weighted Average Cost of Capital, represents the average rate a company is expected to pay to finance its assets, combining both debt and equity costs. For a private company, it reflects the total cost of capital from all investors and is used to discount future cash flows.

Getting the data to calculate an accurate WACC for private companies can be tricky: it may require gathering information from similar companies and applying it to the company. Private companies lack publicly traded shares, so analysts and investors may need to estimate metrics like cost of equity and requiring proxy data from similar public firms.

A higher WACC indicates higher perceived risk and results in a lower valuation.

Key Learning Points

- Calculating a WACC for a private company may be tricky as it requires gathering information, possibly from other sources to form the calculation

- Use borrowing costs of similar companies with comparable risk profiles and leverage

- Apply the Capital Asset Pricing Model (CAPM) using beta values from peer companies

- Estimate the proportion of debt and equity in the company’s financing

- Use proxy data from similar public companies to estimate the cost of equity

- Use the formula to calculate the Weighted Average Cost of Capital (WACC) for private companies, which is crucial for evaluating investment opportunities and making informed financial decisions

How to Value a Private Company

Valuing a private company often involves using comparable public companies as benchmarks. Since private firms lack market-traded equity, analysts typically rely on valuation multiples (like EV/EBITDA) from similar public peers. These multiples are adjusted for differences in size, risk, and capital structure to estimate the private company’s value.

Private Vs. Public Companies: What is the Difference?

The key difference between private and public companies is market accessibility and transparency. Public companies are listed on stock exchanges and have readily available market data, including share prices and beta values. Private companies, on the other hand, do not have publicly traded shares, making it harder to estimate metrics like cost of equity and requiring proxy data from similar public firms.

How to Calculate WACC for Private Company

Follow these steps to calculate WACC for a private company:

- Estimate Cost of Debt: use borrowing costs of similar companies with comparable risk profiles and leverage.

- Estimate Cost of Equity: apply the Capital Asset Pricing Model (CAPM) using beta values from peer companies.

- Determine Capital Structure: estimate the proportion of debt and equity in the company’s financing.

- Apply the WACC Formula: combine the weighted costs of debt and equity based on the capital structure.

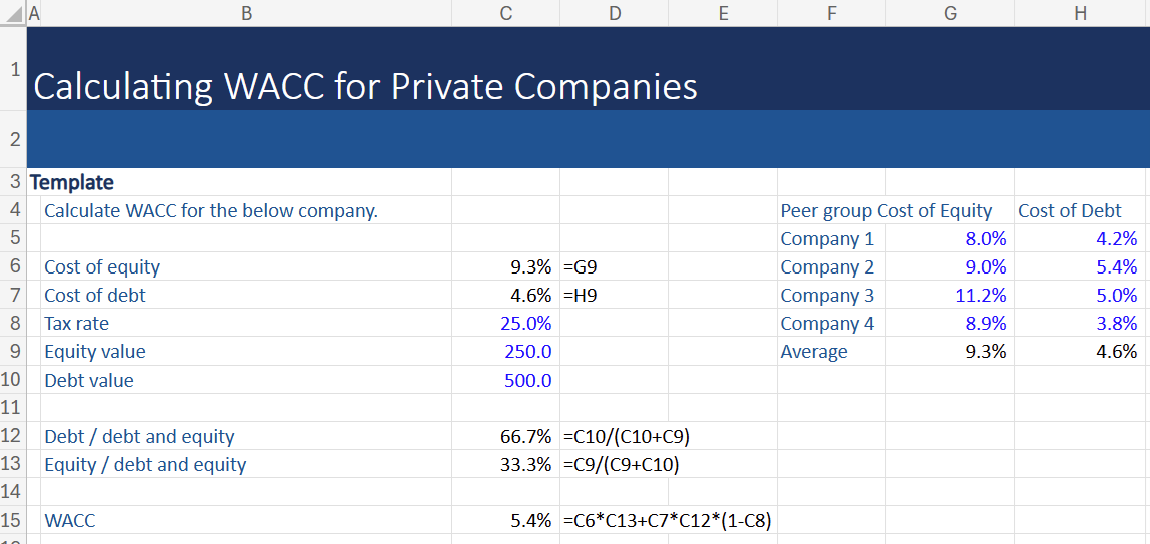

Download a free Financial Edge template with an example of how to calculate WACC for a private company.

In the example, we have been provided with a peer group of companies with similar leverage and are a similar size and sector to the private company. When building a WACC it is possible to rely on a peer group company, or we can take an average of the group. This example does the latter so we can use the average peer group cost of equity and debt for the private company.

The company has disclosed its equity and debt positions (of 250 and 500, respectively) so we do not need to make assumptions here. We have also been provided with a tax rate.

With this information, we are able to calculate a weighted average cost of capital of 5.4% for the company.

WACC Formula for Private Company

The standard WACC formula applies for private companies:

WACC = (ED + E x×re) + (DD + E x×rd x (1−T))

Where:

- E = Market value of equity (estimated)

- D = Market value of debt

- re = Cost of equity (from CAPM using peer beta)

- rd = Cost of debt (from similar companies)

- T = Corporate tax rate

Why Might an Interviewer Ask How to Calculate WACC for a Private Company in an Interview?

This question of how you would calculate WACC for a private company might be asked in an investment banking interview to gauge the depth and boundaries of a candidate’s financial knowledge.

When handling complex finance questions in interviews, candidates should confidently share what they know, even if they can’t provide a complete technical answer, and avoid overreaching into areas they don’t fully understand.

In essence, calculating a WACC for a private company is the same calculation as for a public company, but it will require a series of assumptions where information isn’t available. If a candidate can highlight these areas and offer proxy solutions for gathering the information, this should fully answer the question.

Conclusion

Calculating the Weighted Average Cost of Capital (WACC) for private companies presents unique challenges due to the lack of publicly available market data. However, by leveraging proxy data from similar public firms and applying standard financial models like the Capital Asset Pricing Model (CAPM), it is possible to estimate the cost of equity and debt. This approach allows private companies to determine their WACC, which is crucial for evaluating investment opportunities and making informed financial decisions.

Understanding and accurately calculating WACC can provide valuable insights into a company’s financial health and its ability to generate returns for investors.