Employee Stock Options

What are Employee Stock Options?

Companies can offer employee stock options to their employees and executives as a form of compensation. Stock options are contracts granted by the company to employees where they are given an option to buy shares at a fixed price which is known as the strike or exercise price. When the options are issued (known as the grant date) the strike price is normally set at the current share price. The option holders must usually wait three years (known as the vesting period) before they can exercise the option. After the vesting period the option holders are free to exercise the option and if the share price has risen they will be sitting on a profit (the options are known as ‘in the money’ if they are profitable to convert). Typically, options have both a vesting date and an expiration date. Option owners cannot exercise their options either before the vesting date or after the expiration date.

Many option holders will not exercise their options on the vesting date even if they are in the money. Usually, as soon as the options are exercised the holders will have a taxable gain, so a chunk of the holder’s capital will be paid to the government in tax. If the option holders think the company’s share price will rise after the vesting date, and they don’t immediately need the money, they will hold onto the options rather than convert them to postpone any taxes payable.

Key Learning Points

- Employee stock options are a type of derivative contract offered to employees as a form of compensation

- Option holders have the right (but are not required) to exercise their options after the vesting period

- If the strike (also known as exercise) price is higher than the current share price then the options are said to be “in the money”

- For valuation purposes, all dilutive contracts including options and convertible debts are assumed to be fully exercised

- The treasury method is a shortcut calculation which uses the =MAX excel function to calculate the additional shares issued as the result of stock options being exercised

Employee Stock Options in Valuation

A company’s equity value is calculated by multiplying the diluted number of shares outstanding by the current share price. The current share price factors the dilutive effect of options as this is publicly available information reported in the annual reports. The diluted number of shares must therefore include any new shares available from options. If the options are “in the money” and exercised, they increase a company’s equity value because of a resulting increase in the number of shares outstanding. One important assumption to be aware of is that all options are assumed to be exercised when they are in the money.

A common question is whether to use the exercisable options (which are past the vesting date) or outstanding options (which include options which are both before and after the vesting date). An example of the disclosure is below:

PPG 2019 10-K – Notes to the Consolidated Financial Statements

The information above is from PPG Inc’s 2019 10-K filing. The first five lines breakdown the changes to the options outstanding during the year – new options granted, options exercised, and lastly options which are forfeited (if people leave the firm) or expire without being exercised (if they aren’t in the money). Below the outstanding number at year-end are two lines, first, the amount vested or expected to vest and second the ones currently able to be exercised.

Nearly all Wall Street firms use the outstanding options for both trading comparable and transaction comparable valuation. The reason for using the outstanding options is that even if they cannot be exercised if they are in the money, there is a strong incentive for the holders to stay with the business until they can exercise them. So analysts reasonably assume the stock market prices in the dilution of the full outstanding number if they are in the money. The disclosure of ‘expected to vest options’ is relatively new. You can see from the above disclosure the number of options expected to vest is much closer to the outstanding options than the exercisable options – supporting the choice of using the outstanding options. You might reasonably think it would be best to use the expected to vest number for valuation purposes, it is, if the disclosure is consistent across all the peer group companies. In an acquisition, it is normal for the unvested options to immediately vest (other shareholders don’t want the key executives to have a disincentive to accept an acquisition premium).

The Dilutive Effect of Options Explained

Let us understand how options dilute or change the number of shares outstanding with an example.

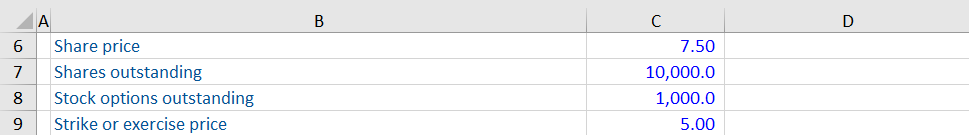

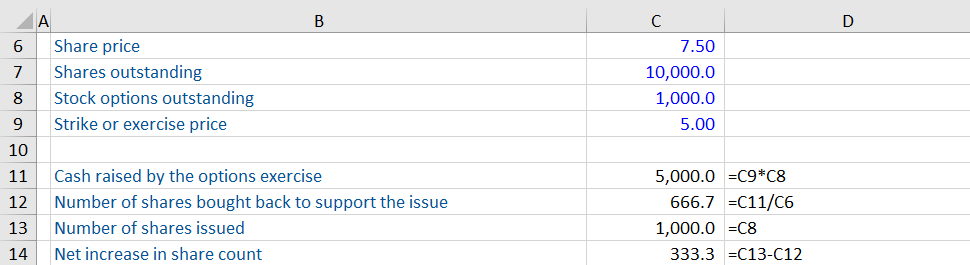

In the example, the company has 10,000 shares and 1,000 outstanding stock options. The exercise price is 5, which indicates that employees need to pay $5 to own one share worth of $7.5.

The cash raised by the exercise of the options is $5,000. In other words, when the employees exercise their options, they need to hand over $5 for every outstanding stock option they own. The company uses the $5,000 to purchase shares from the market. Given the share price of $7.5, it is only possible to purchase 666.7 shares from the market. However, the employees are expecting 1,000 shares and the company needs additional shares in order to meet this requirement. They therefore will have to create an additional 333.3 shares. The creation of additional shares is described as the dilutive effect of the stock options.

There are now 333.3 additional shares to be added to the outstanding number of shares. Below highlights how these affect the equity value.

After this dilution, the number of shares outstanding increases to 10,333. And as a result, the diluted equity value increases to 77,500.

The Treasury Method of Calculating Diluted Equity Value

The treasury method is a faster way of calculating the diluted equity value. The formula is:

Net Dilution = Number of shares outstanding * Max [0, Share price – Strike price/Share price]

Note that we have used a maximum of 0 here to get a positive number. If the share price is lower than the strike price, this will give a negative number, and this would not happen. If the share price were below the strike price, the options would not be exercised.

Let us understand this with the same example above:

Net Dilution = Number of shares outstanding * Max [0, Share price – Strike price/Share price]

Once employees exercise their right to vest the options, the 1,000 outstanding stock options get converted into 333 shares. Subsequently, this increases the equity value.

The Use of Stock Options by Startups Versus Mature Companies

Stock options are widely used by startups, among other companies. Options serve as a reward to early employees who take on risk by joining an unknown company. Stock options give a direct incentive to executives to maximize performance and growth which ultimately contribute to increasing the company’s stock price. If the stock price increases, they expect to be rewarded by the capital appreciation of their share ownership. Where options form a very significant portion of the capital structure, bankers might opt to value the options using the Black Scholes or Binomial models rather than simply taking the intrinsic value as we do in the above calculations.

Mature companies may also use stock options as a tool for retention. If the employees leave the company during the vesting period, then they must surrender their right to the option. They effectively get canceled, resulting in a loss to the employee.