Earnouts

January 13, 2021

What are Earnouts?

Earnouts are recorded when an acquirer negotiates with a business seller to delay some of the purchase price. The amount of the deferred consideration is often linked to key performance indicators of the business. The deferred payment is ‘earned out’ over time based on the business performance.

Earnouts are used to help reduce the risk to the purchaser and to help bridge the gap between the valuation expectations of the buyer and seller. There are many different forms of earnout which will impact the accounting for them.

Key Learning Points

- Earnouts are deferred consideration in an acquisition

- Future earnout payments are often linked to performance of the underlying business

- Future earnout payments are recorded on the balance sheet either as equity or as a liability

- If the earnout is for a fixed dollar value, then the present value is recorded as a liability and measured at fair value going forward

- Changes to the estimated contingent consideration liability are matched by gains and losses recorded on the income statement

- If the earnout is for a fixed amount of shares it is recorded as equity and not measured at fair value so there are no future gains and losses on the income statement

- Rating agencies often treat earnout liabilities as debt equivalents

Accounting for Earnouts

Historically earnout liabilities were linked to goodwill. The accounting has now changed and the earnout liability is delinked from goodwill, so changes in the liability directly impact the income statement creating potential earnings volatility. The earnings volatility from changes in the earnout liability make them less popular way of structuring transactions.

The earnout is measured by present valuing the expected payment. The present value is recorded as either equity or as a liability. If the earnout is for a fixed dollar value, then the present value is recorded as a liability and measured at fair value going forward. If the earnout is for a fixed amount of shares it is recorded as equity and not measured at fair value going forward.

Creating the Earnout on the Balance Sheet

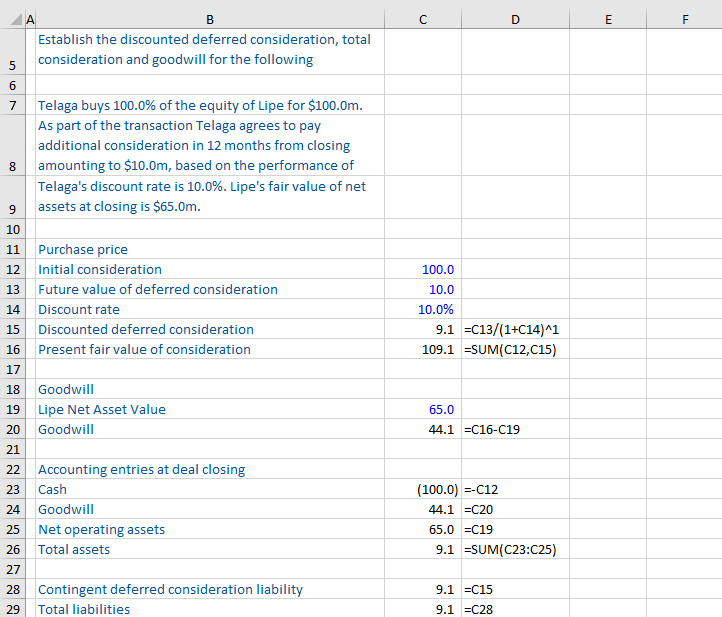

In the following example an acquirer agrees to pay $100m up front for 100% of a Telaga’s equity. In addition they agree to pay an additional $10m in 12 months time based on satisfactory performance of the business. The discount rate is 10% and the fair value of Telaga’s net assets is $65m.

As the consideration is for an agreed dollar amount the present value of the deferred consideration will be recorded as a liability on the acquirer’s balance sheet.

We need the total consideration including the present value of the earnout to calculate goodwill. Using the discount rate of 10% we can present value the $10m back one year 10/(1+10%)=$9.1m and add it to the initial consideration of $100m to calculate the total consideration: $100+$9.1=$109.1.

Next, we can calculate goodwill by taking the total consideration and deducting the fair value of the net assets: 109.1-65=$44.1. The consolidated balance sheet balances as the assets increase by $44.1 of goodwill and the $65m of net assets acquired, but then drop $100m due to the cash consideration leaving a net increase of $9.1m. The liabilities increase by the present value of the deferred consideration an increase of $9.1m.

Unwinding the Discount

At the deal date the deferred consideration if payable for a fixed $ amount rather than a fixed number of shares will be on the balance sheet as a liability and measured as a present value of the future expected payment. Over time the liability will need to grow to the future value. Accounting deals with unwinding the discount rate by calculating interest on the present value and then expensing this on the income statement.

In the above example the contingent deferred consideration liability is increased by the discount rate of 10%. So 9.1×10.0%=0.9, and 9.1+0.9=10.0 which is the ending balance of the contingent consideration liability just before it’s paid.

You can see from the accounting entries that the interest expense of 0.9 decreases retained earnings which is balanced by an increase in the deferred consideration liability of 0.9. Then the contingent consideration is paid off and cash falls by 10.

Estimating the Earnout

The deferred earnout consideration is recorded as the present value of the best estimate of future payments at the time of the acquisition. Revisions to the estimate can be made later, with a relevant gain or loss being recorded on the income statement matching the increase and decrease in the liability. The most common method of estimating the cash flow is to apply a probability weighting.

If there is a permanent reduction in the subsidiary’s value, then deal goodwill is reduced. Goodwill and the contingent consideration liability are treated and measured separately.

Changes to the Earnout Estimate

In addition to interest, if the expected earnout payment rises or falls the present value must be adjusted on the balance sheet and a gain or loss recorded on the income statement.

In the above example the deferred consideration (earnout) is adjusted upwards from the original 10m to 12m based on better performance of the business. The deferred consideration is increased by 2m and there is a corresponding charge to the income statement of 2m which reduces retained earnings. Finally, when the liability gets paid off cash falls by 12m and the deferred consideration falls by 12m.