Save 40% on all online finance courses

Earnings Before Interest and Taxes (EBIT) Template

October 16, 2025

What is Earnings Before Interest & Taxes (EBIT)?

EBIT stands for Earnings Before Interest and Taxes. It measures a company’s profitability from its core operations, excluding the effects of capital structure (interest) and the tax environment. It’s a useful metric for comparing companies across industries and geographies, as it focuses purely on operational performance.

EBIT is often equal to operating profit, but not always. Adjustments may be needed for non-recurring, non-core, or non-controlled items.

Download the Free EBIT Template

You can download the EBIT Workout Excel template directly from the Financial Edge blog. It includes:

- A sample income statement

- Footnotes for adjustments

- A bonus EBITDA workout

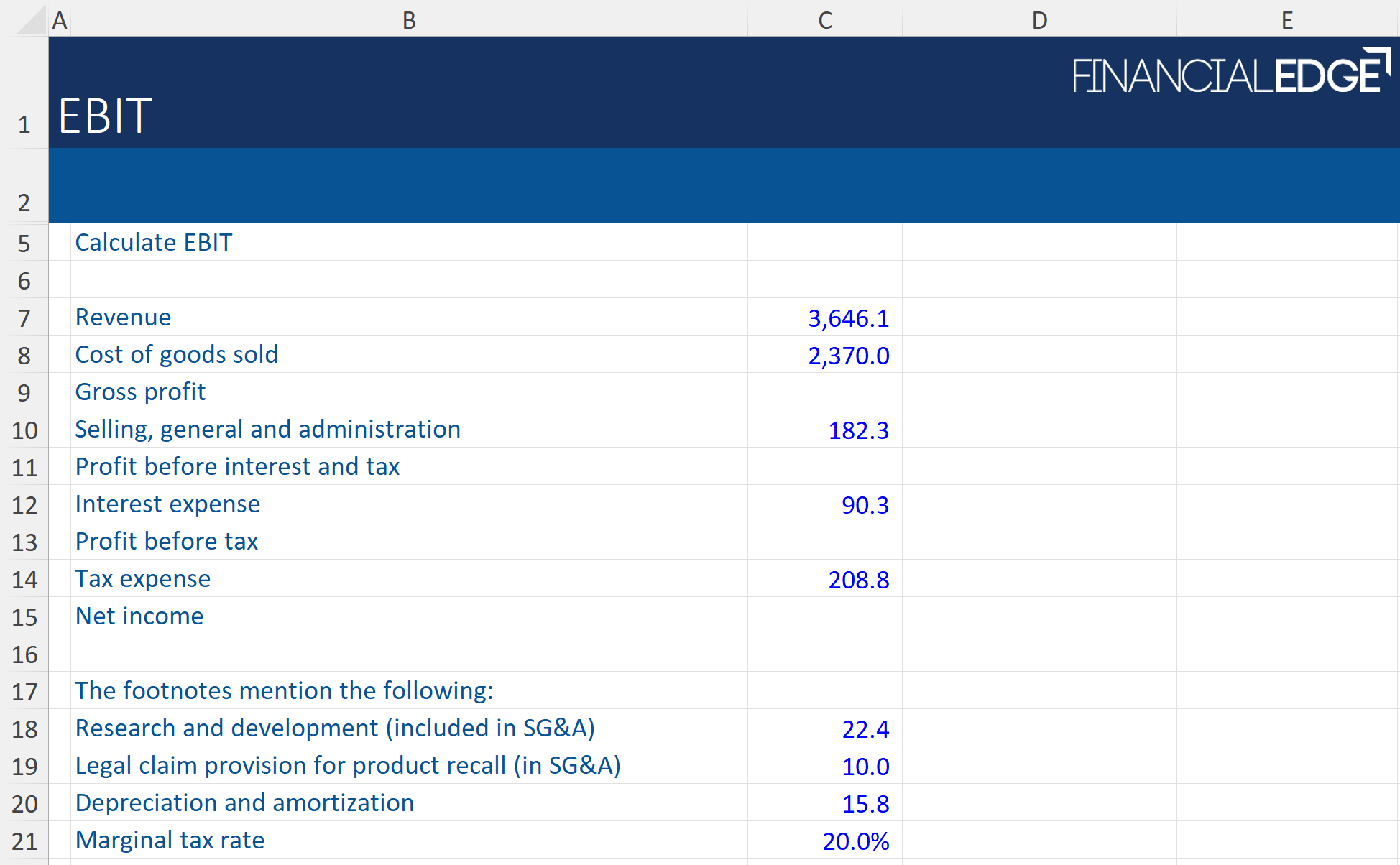

The first template will show how to calculate EBIT from a simple income statement which also contains footnotes with unusual items.

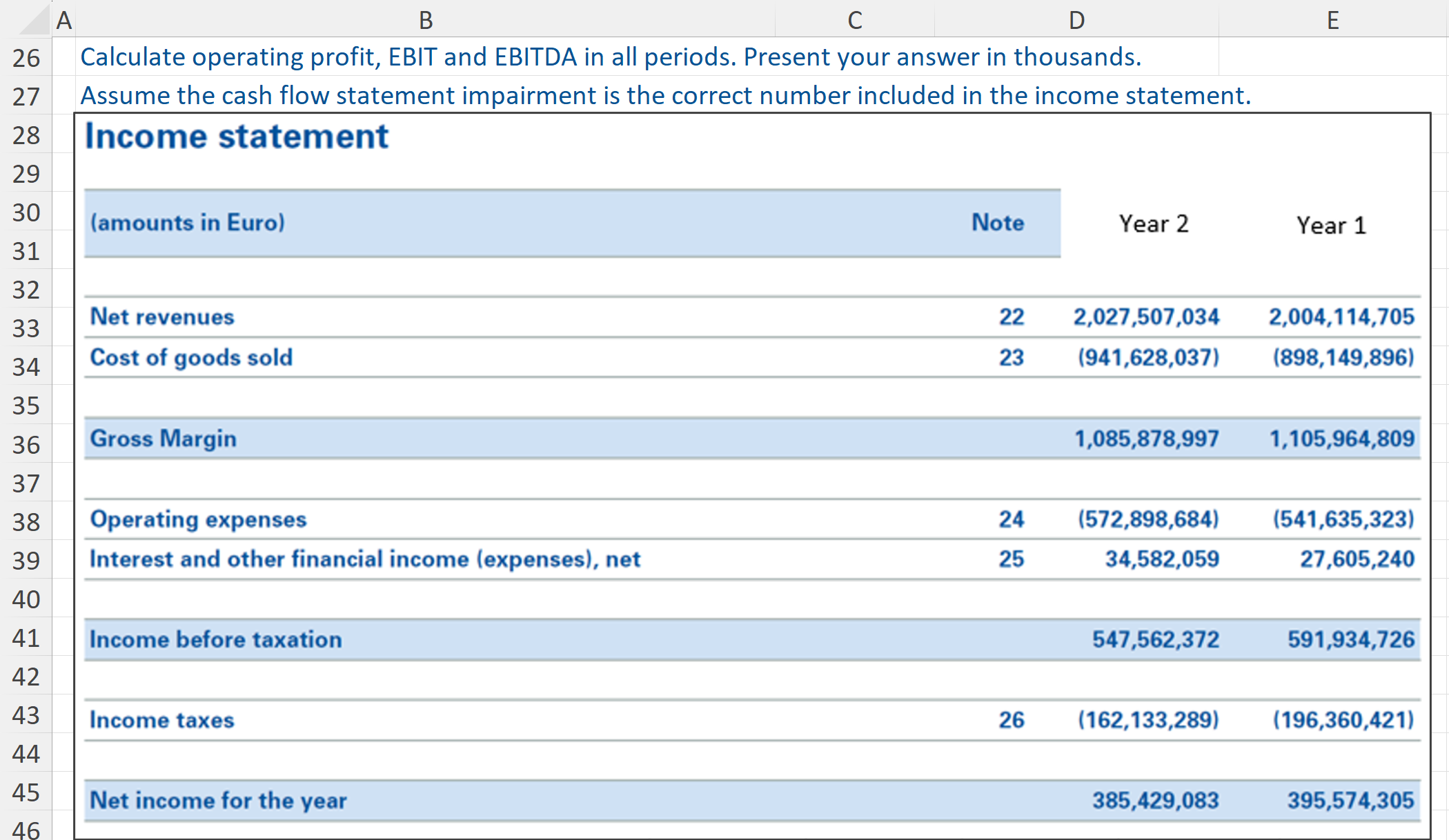

The second template looks at a published income statement from a listed company and looks at how to calculate both operating profit and EBIT from the information provided by the company.

How to Calculate EBIT

There are two main approaches to calculating EBIT, the first can be done from the operating profit figure. Alternatively, depending on the information provided, EBIT can also be calculated from the net income figure.

Steps to follow when calculating EBIT in the template

Operating profit and EBIT are usually similar, as both tend to strip out any interest and tax charges from the operating performance. However, EBIT also removes any non-recurring, non-core, or non-controlling items from the performance. These can be charges (such as non-recurring restructuring charges) or gains (such as a non-core gain from a subsidiary).

These are the steps to follow when calculating EBIT from operating profit:

- Start with the operating profit from the income statement

- Review items above and below the operating profit for adjustments

- Add back any non-recurring or non-core expenses (e.g., legal claims, restructuring charges)

- Exclude non-controlled income (e.g., share of net income from minority investments)

- Check footnotes and MD&A for embedded non-recurring items

- Net off all these items to get EBIT

From Net Income

If insufficient operating information is available, EBIT can be calculated using net income. This requires adding back tax and interest charges (or gains) to move ‘up’ the income statement. Then, similar adjustments are required to strip out non-recurring, non-core, and non-controlling interests where applicable.

These are the steps to follow when calculating EBIT from Net Income:

- Start with net income, again from the income statement

- Add back interest and tax expenses

- Adjust for any one-off items to reflect recurring operational earnings

- Check footnotes and MD&A for embedded non-recurring items

- The resulting calculation is EBIT

EBIT Formula

EBIT = Operating Profit + Non-recurring + Non-core + Non-controlled

Alternatively, if operating profit isn’t available:

EBIT = Revenue – COGS – Operating Expenses

Or:

EBIT = Net Income + Interest + Taxes

When doing calculations, please check to use correct signs (+/-) for adjustments. Be sure that items you are adjusting for are gains or losses and treat them accordingly. Also remember to exclude any income or expenses not related to core operations.

EBIT is a ‘clean’ version of operating profit. Its purpose is to allow investors to look closer at a company’s core operations without having to factor in non-core items and the financing of the company.

It is a core metric when looking at the year-over-year performance of a company. It is used in core equity valuation metrics such as EV/EBIT and EBIT margin.

Conclusion

EBIT is a core financial metric when analyzing a company’s income statement. Use this free template and follow the steps provided to ensure that calculations and adjustments are always correct.