Free Cash Flows (FCF) – Unlevered vs Levered

November 19, 2020

What is Free Cash Flow?

Let’s start with the word free – it generally means the amount freely available to pay to capital owners in a business.

Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt and equity holders. Unlevered free cash flow is generated by the enterprise so its present value, like an EBITDA multiple, will give you the Enterprise value.

Key Learning Points

- Free Cash Flow (FCF) is the amount of cash freely available to all capital providers

- Unlevered free cash flow is used in both DCF valuations and debt capacity analysis and represents the total cash generated for both debt and equity holders

- Levered cash flow is the amount of free cash available to pay dividends (the amount of cash available to equity holders after paying debt)

- In some models analysts will use leveraged free cash flows as only excluding interest rather than debt repayments so they can use the number to estimate the cash available for debt repayment only

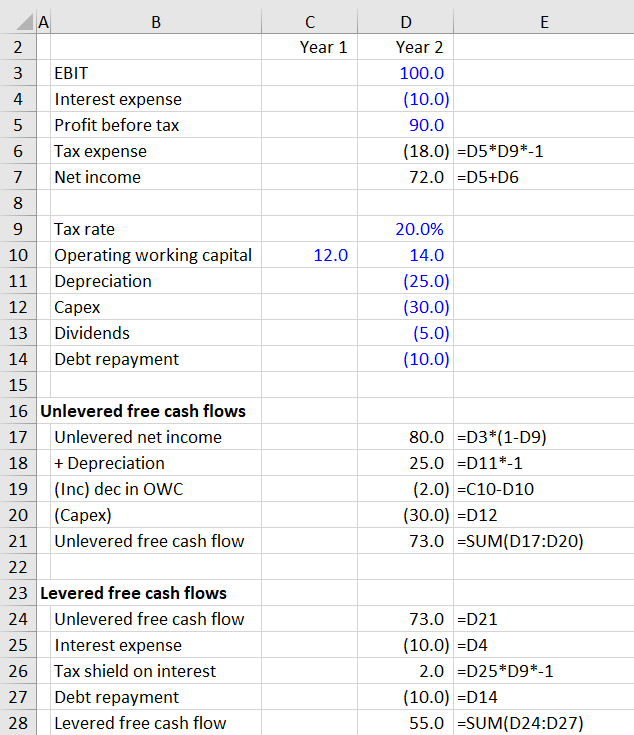

Free Cash Flow Calculation

When we calculate free cash flows we restate the cash flow statement only including items the business needs to operate:

In comparison levered free cash flows measure the amount of cash the business generates to pay dividends – after all payments to debt holders. Sometimes people call levered free cash flows, ‘cash flows available to equity holders’. You could value a firm using levered free cash flows by discounting them by the cost of equity rather than the Weighted Average Cost of Capital. Levered free cash flow is only available to equity holders, so discounting it, like a net income multiple, will give you an equity value.

Confusingly there are variants to the above calculations, for example in some models analysts will use leveraged free cash flows as only excluding interest rather than debt repayments so they can use the number to estimate the cash available for debt repayment only.

In other cases, analysts will calculate a number called CFADS or Cash Flow Available for Debt Servicing. In this calculation, they might also deduct dividends if they are planned to be made and the company is publicly traded, so cutting dividends would limit the business’s ability to raise equity capital in the future. Note that the definition of these numbers will be documented in the loan agreement, so it can depend on negotiations, and there isn’t a formal definition, just industry norms.