Marketable Securities

May 20, 2025

What are Marketable Securities?

Marketable securities are highly liquid assets, meaning they can be easily converted to cash at no loss of value. They are not typically part of a business’s operations and are defined as a current asset, meaning they are expected to be converted into cash in less than 12 months. Marketable securities are purchased and sold in Capital Markets, such as the stock or bond exchanges. Due to their high liquidity, they are often reported as cash and cash equivalents in Company Financials and are included in many liquidity ratios.

Key Learning Points

- Marketable Securities are investments with short maturities of less than 1 year

- They are reported as Current Assets on the company’s balance sheet

- Marketable securities are a highly liquid asset class and hence used in many accounting metrics, including the calculation of net debt and liquidity ratios

- Marketable securities provide companies with the opportunity to earn additional returns on cash balances

Why do Companies Invest in Marketable Securities?

A company may maintain cash reserves for several reasons. Cash reserves help deal with unforeseen challenges, act quickly on attractive acquisition opportunities, or settle financial obligations. However, idle cash does not generate returns and could instead be used to generate other forms of income. Marketable securities allow companies to earn returns on their cash balances. In case of a sudden need for cash, businesses can easily liquidate marketable securities to meet this demand.

Marketable Securities & Liquidity Ratios

Liquidity ratios assess a company’s ability to meet its short-term financial obligations. Marketable securities are included in all these ratios as they are seen as “spare cash”. There are three key ratios to calculate when examining liquidity:

- Current Ratio = (Current Assets / Current Liabilities)

- Quick Ratio = (Cash + Marketable Securities + Receivables) / Current Liabilities

- Cash ratio (The market value of Cash and Marketable Securities / Current Liabilities)

Current Ratio

The Current Ratio shows if there are sufficient current assets to meet short-term financing obligations. It is important to understand the industry of the company in question as an acceptable ratio may be dependent on the industry.

Download a free Financial Edge template to help calculate the Current Ratio.

Quick Ratio

The Quick ratio removes inventories from current assets. Inventory needs to be sold in order to generate cash, and in some cases, inventory can be difficult to sell.

Cash Ratio

The Cash Ratio focuses on the cash and cash equivalents compared to current liabilities. It provides a worst-case scenario if other current assets are difficult to sell (due to market conditions) and the company must rely on its cash balances.

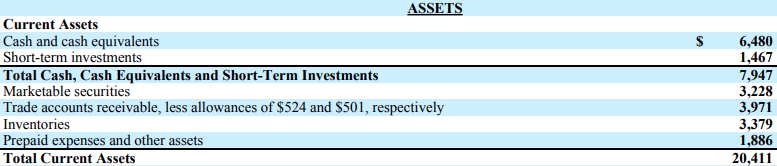

Where to Find Marketable Securities in Financial Statements?

Marketable securities can be found in the Balance Sheet section of the company’s annual report. Here is a snapshot from the 2017 Annual Report of The Coca Cola Company.

The company has reported its Marketable Securities for 2017 and 2016 under current assets.

Features of Marketable Securities

Marketable securities have several key features that make them attractive to investors and companies:

- High Liquidity: They can be easily converted to cash without significant loss of value

- Short Maturities: Typically, they have maturities of less than one year

- Current Assets: They are reported as current assets on a company’s balance sheet

- Additional Returns: They provide companies with the opportunity to earn returns on idle cash balances

- Use in Accounting Metrics: They are used in various accounting metrics, including the calculation of net debt and liquidity ratios

Types of Marketable Securities

Marketable securities are highly liquid assets that can be easily converted to cash. Here are some common types:

- Stocks: shares of publicly traded companies that can be bought and sold on stock exchanges are considered marketable securities

- Bonds: Bonds are debt securities issued by corporations or governments, which can be traded in bond markets

- Treasury Bills (T Bills): Short-term government securities with maturities of less than one year also fall under the umbrella of Marketable Securities

- Exchange-traded funds (ETFs): Exchange-traded funds (or ETFs) are pooled investment vehicles for which the shares of the fund are available for trading over an exchange

- Commercial Paper: Commercial Paper are short-term debt instrument issued by corporations to meet their immediate financing needs

- Certificates of Deposit (CDs): Time deposits offered by banks with fixed interest rates and maturity dates

- Futures: Futures contracts are popular derivatives used to exchange physical assets, speculate, and hedge prices

- Options: Options are derivative financial instruments in which two parties contractually agree to transact an asset at the strike price before or on an expiration date

Advantages and Disadvantages of Marketable Securities

Let’s have a closer look at the advantages and disadvantages of Marketable Securities.

Advantages:

- Liquidity: They can be quickly converted to cash, providing flexibility in managing financial obligations

- Income Generation: they allow companies to earn returns on their cash reserves which is particularly useful in low-interest rate environments

- Risk Management: They can be used to manage short-term financial risks and meet unexpected cash needs

Disadvantages:

- Market Risk: The value of marketable securities can fluctuate based on market conditions

- Limited Returns: While they provide returns, these may be lower compared to other long-term investments

- Short-Term Focus: They are not suitable for long-term investment strategies due to their short maturities

Conclusion

Marketable securities are highly liquid assets that can be easily converted to cash without significant loss of value. They are typically categorized as current assets and are typically converted into cash within 12 months. These securities include stocks, bonds, treasury bills, commercial paper, and certificates of deposit. They offer several advantages such as high liquidity, income generation, and risk management. However, they also come with disadvantages like market risk, limited returns, and a short-term focus.

They are useful for companies that find themselves with excess cash or a period when cash has built up on the balance sheet. The advantage is that it can generate a return which exceeds cash. The securities can then revert to cash and be used for longer-term plans.