Tesla Valuation Explained

May 19, 2025

Valuation Methods and Market Comparisons

We recently hosted a free Financial Edge webinar offering a comprehensive deep dive into Tesla’s valuation. The session explored two key valuation methods: trading comparables and a fundamental discounted cash flow (DCF) model to assess the company’s stock price. This analysis was all conducted using the Felix Platform, a powerful tool for financial modeling and data analysis. Tesla’s valuation is one of the hottest topics in investing today. With a market cap close to $1 trillion, many are asking: Is the company really worth that much, or are investors overpaying for its future potential? That’s exactly what we explored.

The webinar provides a 60-minute discussion on the valuation methodologies to look at Tesla and what to interpret from valuation analysis. Elevate your career prospects by taking our online finance course and earning a Wall Street-recognized certification.

Key Learning Points

- Tesla is a US automotive and clean energy company founded in 2003

- Tesla is essentially an automotive company, but also has operations such as solar energy and battery storage which require different valuations

- It is highly vertically integrated unlike other auto manufacturers

- Currently listed on the NASDAQ and S&P 100, its stock market valuation puts it as one of the largest companies in the world

- From 2021 its market cap has peaked at over 1 trillion dollars

- The fundamental issue is, does Tesla justify this high valuation, both relative to the markets and relative to peers

Understanding the Basics: Tesla’s Unique Position

Tesla defies traditional classification. While it is fundamentally an automotive company, its operations also span solar energy, battery storage, and autonomous driving technology. This diversification complicates the selection of comparable companies for valuation purposes.

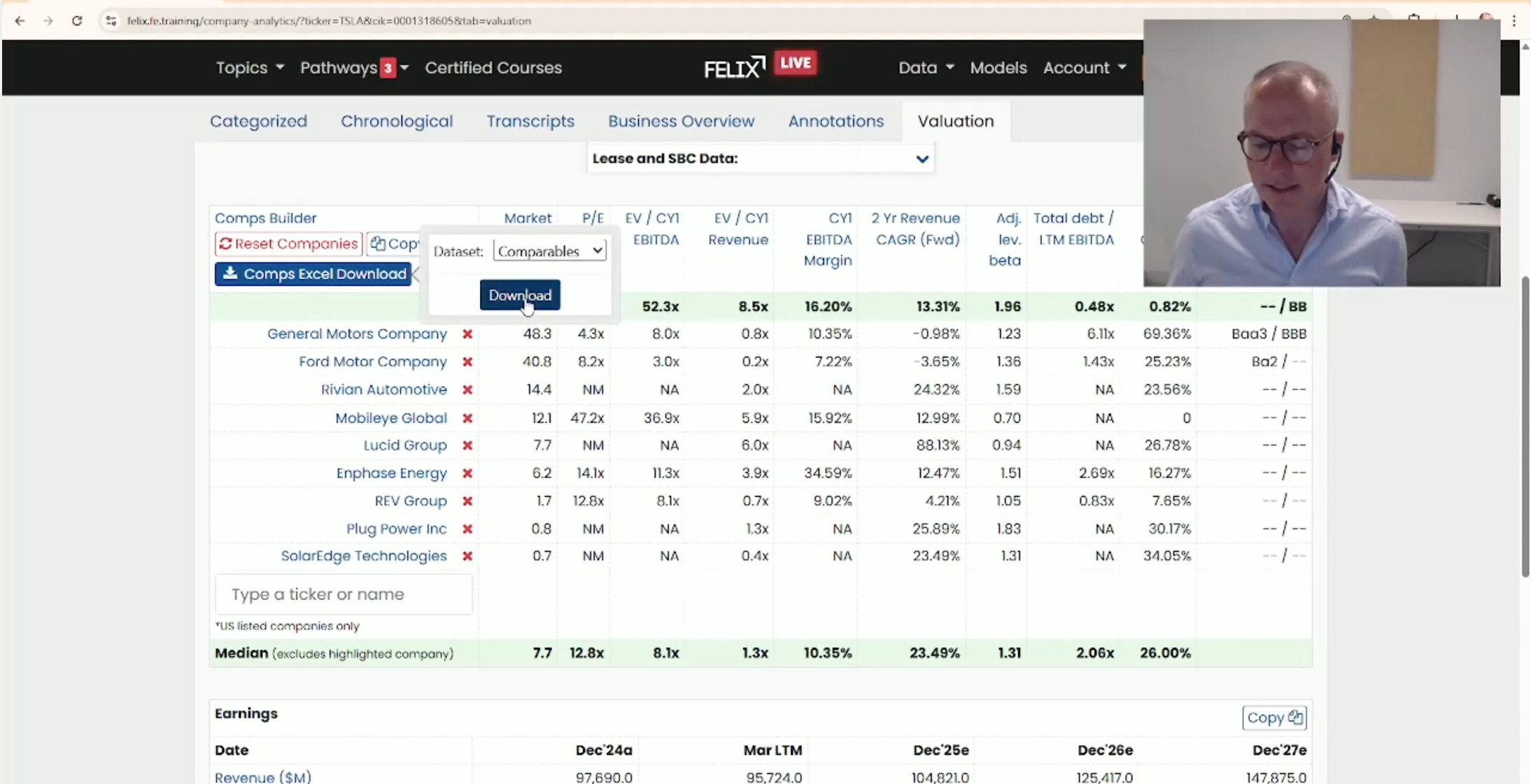

In the webinar, a mix of car manufacturers, energy companies, and autonomous tech firms were selected using the Felix platform to build a comparative valuation set. However, Tesla’s market cap is over $900 billion, dwarfs these peers, creating challenges in making direct comparisons.

How to Value Tesla: A Comprehensive Approach

Valuing Tesla requires more nuance than valuing a typical car manufacturer due to its unique position. This Financial Edge webinar uses a two-part approach:

- Relative valuation using trading comparables

- Intrinsic valuation via a Discounted Cash Flow (DCF) model

All the analysis was conducted using the Felix platform for data extraction, financial modeling, and peer comparisons. This provides comparison data for the peer group as well as in-depth financials, sourced from company filings, which can be downloaded straight into Excel.

Comparable Company Analysis (Relative Valuation)

Here are the steps to create a company analysis using relative valuation. This takes Tesla’s performance ratios and compares the relevant ones to the peer group. Using Felix, peer groups can be customized to suit the company, which is particularly useful for Tesla, which straddles industries beyond traditional automotive manufacturing.

Step 1: Choose Peer Companies Thoughtfully

Tesla operates across automotive, solar energy, and autonomous driving. As such, there’s no perfect comparable, but a blended group of peers is chosen:

- Traditional automakers (e.g., Ford)

- Energy/solar companies (e.g,. SolarEdge)

- Self-driving tech firms (e.g,. Mobileye)

These peers were selected and organized by market cap on Felix. This can be done by adding new names (and removing) to the pre-set peer group on Felix.

The data provided by Felix details the company’s market cap and a selection of valuation metrics such as P/E and EV/EBITDA.

Step 2: Analyze Valuation Multiples

The key metrics used in valuing Tesla include:

- EV/EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization)

- EV/Revenue

- P/E ratio

These ratios are useful when analyzing manufacturing companies, such as auto,s as they look to consider sales and earnings as the drivers of value. In this case, it is best to look at earnings ratios as drivers of value, which are typically EV/EBITDA and Price/Earnings ratio.

EBITDA looks at profitability before financing costs. This metric helps to ‘level the playing field’ between organically grown companies and those that have grown via acquisitions. Therefore, an EV/EBITDA ratio is very useful.

A PE ratio will focus on the net earnings of the company compared to the company’s market cap (or equity value), so again, it is a very useful comparison for peer group performance.

When looking at relative valuation, it is important to get the best time period for comparison purposes. Typically, this is 12-24 months into the future to best capture the earnings potential of a company.

Thus, when using Felix, analysts can click on the ‘download’ button on the comparison table, and this will provide more details than the initial calendar year (CY) data shown on the summary screen. This is current-year data, and analysts would like to evaluate the forward-looking data.

Download our free Financial Edge Tesla Valuation template with tabs and headings set up, ready to collate the Felix data.

What analysts can learn from the forward-looking data is that Tesla trades at significantly higher multiples than all peers:

- EV/EBITDA (2026): ~38x for Tesla vs. ~22x for closest peer (Mobileye)

- EV/Revenue (2026): 6.8x for Tesla vs. 4.4x for Mobileye

This information is shown on row 21 and row 17 of the valuation template.

This implies that Tesla is trading on a significant premium to its peer Mobileye when looking at both EV/EBITDA and EV/Revenue.

Step 3: Consider Growth and Margins

The next step is to consider why Tesla may be trading on a premium to its peer group. Again, all this information is available in the free Financial Edge Valuation Template.

High multiples may be justified by high growth. Tesla’s projected growth is:

- 32% EBITDA YoY growth between 2025–2026

- 17% EBITDA margin

But Mobileye shows higher growth (48%) and margins (20%), yet trades at lower multiples, implying Tesla may be overvalued relative to its peers.

Therefore, there needs to be another reason to justify Tesla’s high valuation – this may be linked to product, market share, growth potential or capital structure. It is an analyst’s role to determine what the ‘street’ sees in a stock price and to decide whether it is justified or not.

2. Discounted Cash Flow (DCF) Valuation (Intrinsic Valuation)

The second way to value a company is by using a DCF, which analyzes the future cash flow potential of a company. Here are the steps to follow to build a discounted cash flow model:

Step 1: Gather Historical and Forecasted Data

When building a DCF model, we can follow these steps and use Felix to create an Excel model using the most recent reported data and the latest consensus estimates for future growth.

- Pull Tesla’s last three years of financial statements (income, balance sheet, cash flow) and download into Excel using Felix.

- Added the consensus forecasts for revenue and EBITDA (including recent downward revisions) and downloaded them into Excel.

Step 2: Adjust for Accounting Differences

It is important to be aware of any potential accounting differences when looking at company data. Tesla’s EBITDA figures include stock-based compensation, which we can exclude, calling it a real economic cost. In the DCF, it is best to use consensus EBITDA estimates (excluding stock comp).

Step 3: Forecast Key Drivers

The DCF projects out to 2033, so an 8-year DCF with:

- Revenue growth tapering from 22.5% in 2027 down to 3% by 2033 (i.e., steady state)

- EBITDA margins compressing slightly (from ~16.3% to 15%)

- CapEx as % of revenue declining from ~11% to 3%, reflecting a maturing business

Step 4: Estimate Free Cash Flow

After creating the annual forecasts, cash flow is derived by subtracting:

- Depreciation (aligned to income statement, not inflated GAAP add-backs)

- Capital expenditure costs

- Changes in working capital (adjusted for Tesla’s negative cash cycle due to customer deposits)

Step 5: Discount Future Cash Flows

Future free cash flows are discounted using a chosen discount rate to arrive at a present value, giving an intrinsic valuation of Tesla’s equity.

Details of this are shown on the Tesla Valuation Template available in the free download section.

Trading Multiples: Where Tesla Stands

Using Felix’s pre-loaded comparables feature, the analysis revealed that Tesla’s 2026 EV/EBITDA multiple stands at 38x, significantly higher than any other peer. The closest was Mobileye at just under 22x.

Tesla also trades at 6.8x 2026 EV/revenue, again above peers, with Mobileye next in line at 4.4x. This suggests a strong market belief in Tesla’s future earnings, but is it warranted? This is what analysts will need to look at in more detail.

Growth and Margins: The Valuation Drivers

High valuation multiples are often justified by high growth expectations. Investors are willing to pay more for a stock today if they believe the company will likely grow at a high rate in the future.

Tesla is projected to grow EBITDA by 32% between 2025 and 2026. Its peer, Mobileye, however, is expected to grow by 48%, and with higher margins at 20% compared to Tesla’s 17%.

Why does this matter?

High growth combined with high margins indicates stronger competitive positioning and future profitability. Based on these metrics, Mobileye appears to offer better value relative to its trading multiple.

This suggests Tesla may be relatively overvalued. Investors would not want to pay for a stock trading on higher multiples than its peers if it is not forecast to grow at a higher rate than its peers.

Beyond Comparables: Discounted Cash Flow (DCF) Approach

To determine Tesla’s intrinsic value, we need to look closer at the fundamental DCF valuation. This method projects future cash flows of the company and discounts them back to present value using investor assumptions.

Using Felix, analysts can download historic data and consensus estimates for future performance. This makes the building of a DCF much quicker and does not require analysts to build their own forecasts. The DCF can be created using market expectations.

There are a couple of key elements included in the forecasts:

- Consensus Revenue Forecasts: This is adjusted for recent declines in analyst expectations

- EBITDA and Margin Assumptions: focused on excluding misleading metrics like stock-based compensation (which Tesla adds back in its non-GAAP reports)

- CapEx and Depreciation: declining CapEx trends post-2027 reflect a maturing business, with margin compression assumed due to increasing competition

The forecast growth rate is tapered from 22.5% in 2027 down to a steady 3% by 2033, a realistic assumption given industry size constraints.

Is Tesla Overvalued? The Verdict

The conclusion from this analysis is that Tesla appears relatively overvalued compared to peers like Mobileye. While Tesla’s growth and innovation potential are substantial, the market may be pricing in too much future success relative to current performance metrics.

That said, the analysis is relative, not absolute. Tesla’s valuation could still be justified if it continues to outperform expectations, expand into new markets, or significantly improve margins. But from a comparative standpoint, investors should be cautious given the information analyzed here.

Conclusion

Valuation is part art, part science. While trading multiples offer a snapshot, DCF models provide a longer-term lens, each with limitations. The skills required to analyze these factors in a constantly evolving marketplace are key to producing robust valuation work.

Tesla’s story is still being written, but as investors, it’s crucial to anchor enthusiasm with rigorous analysis. Based on this analysis, now might be the time for a second look at the numbers behind the narrative.

To hear more about the factors that may impact Tesla’s performance, watch the full webinar. It also provides easy-to-follow steps to use Felix tools to build a detailed and careful analysis of Tesla. To learn more about valuation check out our investment banking courses.