Net Income

November 10, 2020

What is Net Income?

Net income is the profit after all expenses have been deducted for the period. It is the net of all revenues and expenses presented in the income statement and is often referred to as “the bottom line”. However, more than one version of net income can be provided and care must be taken to use the most appropriate version for the task in hand.

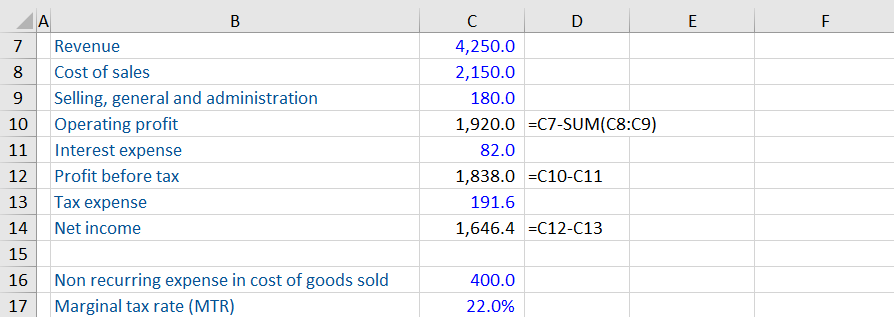

Extract from General Motors Income Statement 2018

In the example above, the net income is 8,005 for the latest year but this includes operations which will no longer be part of the performance of the business. Above this line is income from continuing operations, reported at 8,075. Therefore, the net income of most interest to analysts measuring the operational efficiency of the business is 8,075 since this has been generated by activities which are expected to continue into the future. All figures presented are in millions.

Key Learning Points

- Net income is the profit attributable to common shareholders after all expenses have been deducted for the period

- A non-controlling interest (NCI) represents a shareholder or shareholder group that owns a minority stake in a company that is controlled by another company

- Profits attributable to NCIs are reported in a consolidated income statement in a separate line

- Normalized net income removes the impact of non-recurring items

- The marginal tax rate (MTR) is used to tax adjust any non-recurring items when calculating the normalized net income

Non-Controlling Interests

A non-controlling interest (NCI), formerly known as a minority interest, represents a shareholder or shareholder group that owns a minority stake in a company that is controlled by another company. As the other owner has full control, it follows logically that the minority shareholders do not, hence the name non-controlling interest. The holding company with control but not 100% ownership must always produce consolidated financials for all subsidiaries.

Companies always need to report the earnings attributable to NCIs on their income statements. These NCIs are created through the partial acquisition or partial disposal of a subsidiary. The parent company will “over” consolidate their financial statements to include these, but will always state the proportion not owned by the group. It’s important to understand what this figure is and use the correct net income in analysis.

Extract from The Walt Disney Company Income Statement 2019

Above, the net income generated for the year is 11,054 but this must be shared between two distinct groups of shareholders. The shareholders of Walt Disney Company are entitled to 11,054 of the total 11,584 with 472 allocated to shareholders who have a non-controlling stake in a subsidiary (or subsidiaries) of the parent company. The proportion of net income attributable to the NCIs is deducted from the group’s accounts and presented separately.

Normalized Net Income

In order for ongoing net income to be understood, an analyst may “normalize” this number by cleaning out the impact of non-recurring items. This calculation is very similar to that of EBIT or EBITDA, however, when normalizing net income we do not adjust for non-core or non-controlled items. But, why is this the case?

The calculation for EBIT measures a company’s core operating profit. An analyst is not interested in any non-core items or non-controlled items (maybe income from a 25% shareholding in another company). However, normalized net income is measuring the continuing net income attributable to shareholders. This net income will include any income generated from non-core items.

Since net income is a post-tax number located at the bottom of the income statement, all non-recurring items must be removed on a post-tax basis. If the post-tax non-recurring items are not provided in the financial statements (which is common), then an estimated amount is calculated by assuming the tax impact is at the marginal rate. The net income impact is calculated as follows:

Non-recurring item * (1 – MTR)

Calculating Normalized Net Income

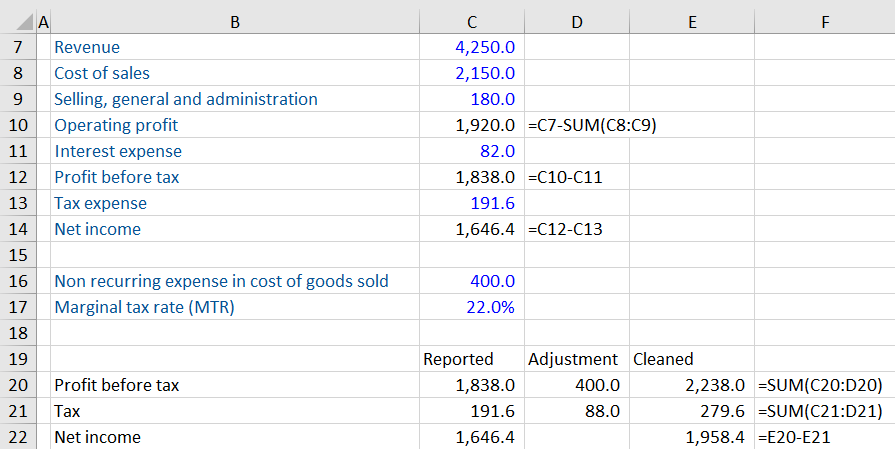

Income Statement

To calculate the normalized net income, we first start with the reported profit before tax at 1,838. The next step is to make adjustments for any non-recurring items and the notes provide us with an item of 400 embedded in the SG&A line. This 400 needs to be added back to the reported profit before tax to produce a cleaned profit before tax figure.

If profit before tax increases, then the tax expense must also increase. The profit has increased and we, therefore, need to apply the marginal tax rate to the amount the profit has increased by. We need to estimate the amount using the marginal tax rate because the post-tax non-recurring expense has not been provided. The adjusted tax amount is 88 (22% * 400) which can now be added to the original tax expense. The normalized net income is the cleaned profit before tax minus the cleaned tax expense, 1,958.4 (2,238 – 279.6).