Working Capital

November 19, 2020

What is Working Capital?

Working capital is calculated as current assets less current liabilities. It measures the short-term liquidity of a business and determines how well a company is able to cover the payment of its forthcoming liabilities. It only focuses on current items and does not include any of the long-term assets, long-term liabilities, or equity.

Working Capital Formula

Working Capital = Current Assets – Current Liabilities

Key Learning Points

- Working capital helps assess the short-term liquidity of a business and determine how well the business is able to cover the payment of its forthcoming liabilities

- Working capital is calculated as current assets less current liabilities

- Current assets are resources controlled by the entity and are expected to provide future economic benefits to the business in less than 12 months

- Current liabilities are a future obligation of the business due within 12 months

- The working capital cycle is the length of time that funds are either required by or provided to the business

- Operating working capital is defined as operating current assets less operating current liabilities. Cash and other financial assets are typically excluded from operating current assets and debt is normally excluded from operating current liabilities

Understanding the Formula

Both current assets and current liabilities can be found in the balance sheet. Both have an expected life of less than 1 year.

Current Assets

Current assets are expected to provide future economic benefit to the business in less than 12 months. Here are some examples of current assets:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Prepaid expenses

- Marketable securities

- Assets held for sale

- Notes receivable

- Short-term investments

Current Liabilities

Current liabilities are future obligations of the business due within 12 months. Some examples of current liabilities are:

- Short-term debt

- Accounts payable

- Accrued expenses

- Dividends payable

- Taxes payable

Example: Calculating Working Capital

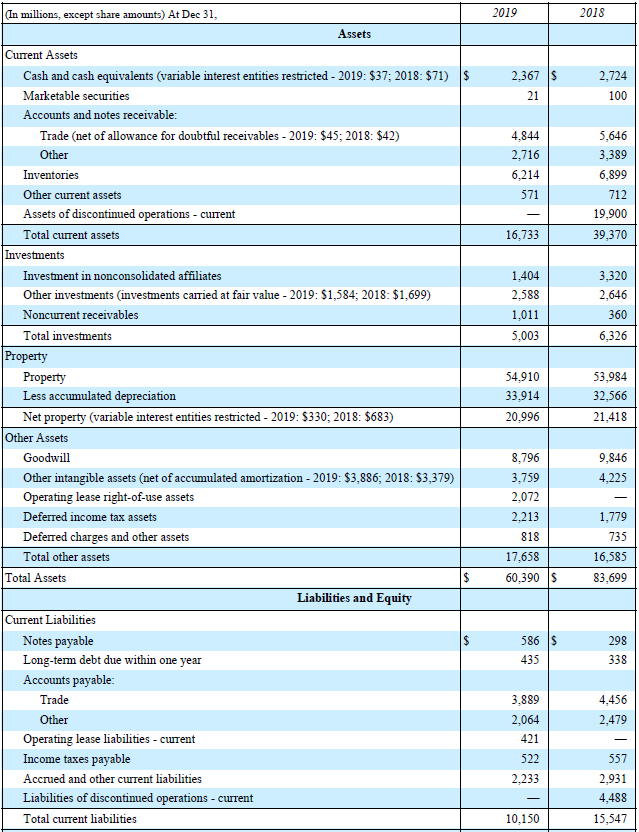

Calculate the working capital using the following information:

The calculation is presented as follows:

The current assets number is found under the “total current assets” line item. This is the sum of all the current assets for the reported year.

Current liabilities is found under the liabilities section of the balance sheet under “total current liabilities”. The working capital is 23,823 and 6,583 for each year respectively.

This shows the company has adequate assets to pay off its upcoming liabilities.

Working Capital Cycle

When looking at working capital it’s common to see balances compared to other parts of the business. For example, a modeler may observe that receivables have historically been 5% of revenue and then use that in forecasts. The relationship shows working capital is needed to support trade, and will grow or shrink along with the business. You may see this relationship expressed as days instead. It’s the same idea given as the time on average items tie up cash.

This is helpful to relate to how an industry works. If you saw a car manufacturer with inventory days of 20, you may not be surprised. However, if you saw a baker with inventory days of 20, you may worry about the quality of their product. Their loaves are sitting unsold for 20 days after production. The overall working capital cycle expressed as days may be made up of several balances, depending on the company. The commonly seen elements are:

Inventory days

Inventory days: the number of days a company holds its inventory before selling it.

Receivable days

Receivable days: the number of days it takes a company to collect the cash due from customers. This is the time when cash flows into the business.

Payable days

Payable days: the number of days it takes for a company to pay its suppliers. This is the time when cash flows out of the business.

Example: Working capital cycle

Let us understand the working capital cycle based on information from two companies:

Company A has a working capital cycle of negative 8.5 days. The business receives inventory on day 1 and sells it on day 7.5. It receives cash on day 44.5 (37+7.5). However, no cash leaves the company until day 53 when the suppliers are paid. This is beneficial as cash is held in the business and provides funding for 8.5 days.

Company B has a working capital cycle of 59.2 days. The business gets inventory on day 1. On day 16.8, the business pays its suppliers. The inventory is not sold until day 69. The business gets cash only on day 76 (69+7). This is not an ideal situation as the business requires funding for 59.2 days.

Practice calculating working capital using the workout files in the free download section.

Working Capital and Operating Working Capital

Operating working capital (OWC) is defined as operating current assets less operating current liabilities. The term “operating” identifies assets or liabilities that are used in the day-to-day operations of the business or that are not interest-earning or bearing (financial). Cash and other financial assets are typically excluded from operating current assets and debt is normally excluded from operating current liabilities as it is difficult to identify how much of cash and short term debt are purely working capital related.

A business with positive OWC, where short-term operating assets are greater than short-term operating liabilities, require short-term funding. Cash is “tied up” in the business creating the funding requirement. Businesses with negative OWC, where short-term operating liabilities are greater than short-term operating assets, effectively are funded by their suppliers.

Whilst both working capital and OWC are measures of short-term liquidity, there is a key difference between the two. Working capital measures the overall short-term liquidity position and OWC is an operational measure. OWC distinguishes between interest-bearing financial items and non-interest-bearing operational items.