Earnings Per Share (Basic EPS)

What is “Earnings per Share”?

Earnings per share (EPS) shows the earnings of a company for the period on a per-share basis and allows for comparison between businesses of different sizes. It is used in many situations, including the calculation of price-earnings (P/E) and EPS accretion/dilution in M&A situations. The basic formula for EPS is the following:

Earnings per Share Formula

EPS = Earnings / Number of Shares

The metric measures the total earnings which could be allocated to each shareholder. However, it is challenging to distil the performance of an entire business into one single metric. EPS is best used in conjunction with other performance indicators and, therefore, its application is limited and it should be used with care.

Key Learning Points

- Basic EPS is a widely used financial metric that shows the profits available to common shareholders of a company for the period on a per-share basis

- It does not take into account the potential dilutive effect of stock options and other instruments (Diluted EPS).

- The earnings figure is the profit attributable to common shareholders and must be adjusted after any preferred dividend and any allocation of profits to non-controlling shareholders

- WASO is the Weighted Average Shares Outstanding and shows the average share count for the period

- EPS is used in the calculation of price-earnings (P/E) and EPS accretion/dilution in M&A situations

Basic EPS Calculation

The basic earnings per share measure is calculated as follows:

EPS = Basic Adjusted Earnings / Basic WASO

Basic EPS is a common or ordinary share calculation and is after profit allocation to both preferred shareholders and any non-controlling shareholdings in subsidiaries. The shares outstanding is time-weighted for any changes in the share count during the period in question and is called weighted average shares outstanding (WASO).

Adjusted Basic Earnings

The net income used is that available to common ordinary shareholders. It should be after any preferred dividend and any allocation of profits to non-controlling shareholders. However, the preferred shares’ dividend must only be deducted if treated as equity. IFRS rules sometimes recognize preference shares as debt items instead of equity. Therefore, the dividends paid are treated as interest expense, meaning the expense will already have been taken out in the original reported net income.

Weighted Average Shares Outstanding (WASO)

Next is to calculate the weighted average shares outstanding (WASO). We first start with the basic number of shares at the beginning of the year, calculated as the issued number of shares minus any treasury shares. This figure then needs to be adjusted for any shares issued or repurchased during the year, adjusted for timing. If shares have been issued halfway through the financial year, then only 6 months impact is included in the weighted average share count. We can understand this better with a simple example.

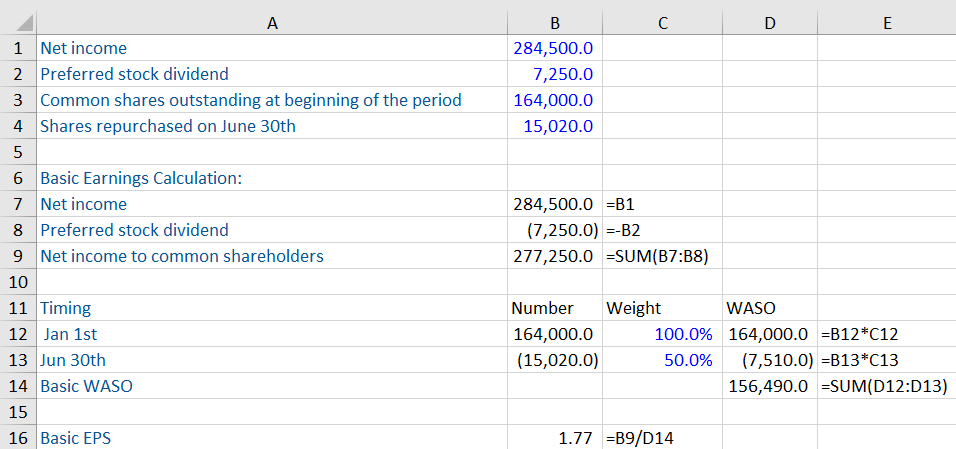

The first step is to calculate the earnings available to ordinary shareholders. In this case, the preferred stock dividend must be deducted to get the net income used for the basic EPS calculation. In this example preferred stock dividends is treated as equity, so we must remove this in the adjusted earnings calculation. You should always check the financial statement footnotes for additional information. The earning calculation thus becomes:

Next, we need to calculate the weighted average shares outstanding. The only change to the share count during the year was a buy back that happened after 6 months, therefore, only 6 months impact is included in the weighted average share count. The calculation is as follows:

The basic EPS can now be calculated as 1.77.

It is important to note that basic EPS does not take into account the potential dilutive effect of stock options and other instruments. Practice calculating basic EPS using two examples by accessing the free download.