Shareholders

October 1, 2020

What are Shareholders?

Otherwise referred to as stockholders, shareholders are individuals, companies or institutions that own at least one share of a company’s stock and whose name the share certificate is issued. Public and private companies can issue shares to investors.

Typically, a shareholder’s influence in an organization depends on the percentage of shares owned. Shareholders who own more than half of a company’s shares control the company and are known as majority shareholders. Shareholders who own less than 50% of a company’s shares are known as minority shareholders and have limited to very little influence on a company’s daily operations. Their shareholding percentage also determines their right to vote on business matters and to be seated on the board of directors.

Since they are owners of a company, they reap financial rewards and bear risk. Their rewards stem from the increase in share price and profits distributed in the form of dividends. The risk that they bear is a drop in share price and the company making a loss, resulting in no dividend payments. If a company goes bankrupt, shareholders will be paid out last and can lose their entire investment.

Key Learning Points

- All companies have common equity or ordinary share investors

- Shareholders receive returns via dividends (distribution of company’s profits) or via stock price appreciation (hope to make capital gains when they sell the shares on)

- Preferred equity or preference shares have preferential rights when compared to common equity

- All classes of shares in issue are shown in equity

Different Types of Shareholders

Most companies have two types:

Common

The vast majority of individuals or organizations that own shares in a company are common shareholders.

Common shareholders usually have the right to vote on certain company decisions, to receive common dividends declared and will receive the residual value of the assets. In the event of a bankruptcy, common shareholders are the last to benefit from liquidation. Companies will first pay creditors (liabilities), then preferred shareholders before common shareholders.

They also often enjoy pre-emptive rights (dependent on the relevant country’s legal system), allowing them to buy a specific number of new shares that the company has offered before they become available to new investors. Pre-emptive rights are attractive to common shareholders since a company usually offers it at a subscribed price on a per-share basis.

Preferred

Preferred shareholders enjoy more rights than common shareholders. They receive dividends before common holders, and in bankruptcy they have first claims on assets after creditors but before common. Preferred shareholders often receive dividend payments at regular intervals.

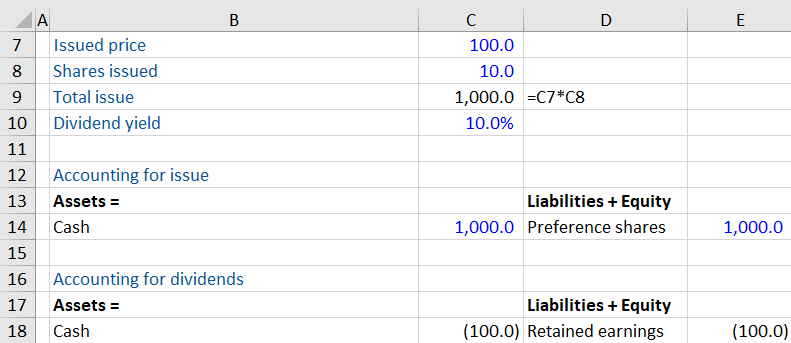

Usually, preferred stock is issued at par value and its dividend is calculated as a percentage of value. Preferred holders claim against the assets is limited to the issue price of the shares, so their prices don’t fluctuate as much as common stock.

Preferred stock trades in a similar way to bonds. The value of the preferred stock falls when the yield rises and vice versa. Preferred can sometimes convert their stock to a fixed number of common shares. These preferred shares are known as convertible preferred shares.

Example

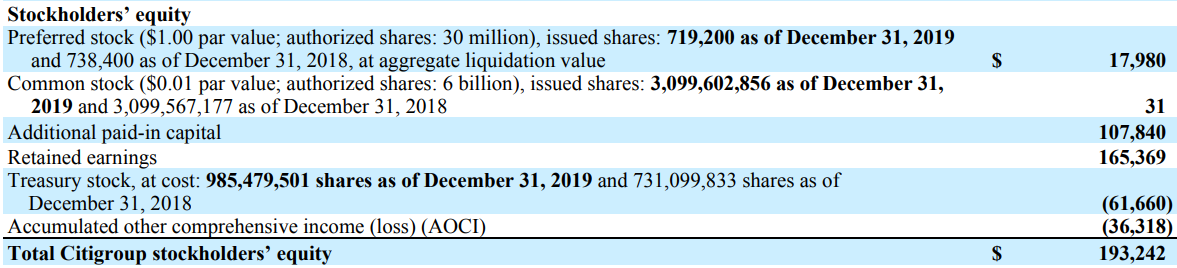

Below is an extract from Citigroup’s Consolidated Balance Sheet at September 30, 2019:

Citi Group – Extract from Balance Sheet

Shareholders Vs. Stakeholders

Shareholders have to own at least one share in a company, whereas stakeholders have an interest in the performance of a company but do not necessarily own shares in it. A stakeholder’s interest in a company may or may not be monetary.

Shareholders are stakeholders in a company, but stakeholders are not necessarily shareholders. Some examples of stakeholders include a company’s employees and customers.