Investing in Real Estate

July 13, 2021

What is “Investing in Real Estate”?

Real estate investing involves the purchase, ownership, management, rental and/or sale of real estate for profit. Unlike stock and bond investors, investing in real estate can be done through significant leverage, by paying part of the total cost upfront, then paying off the balance plus interest over time. Investing in Real Estate is generally divided into direct and indirect investing.

Real estate is commonly considered an attractive “real asset” class for the following reasons: protection against inflation, attractive yields, asset appreciation, stable income and asset diversification. On the flip side, real estate is a capital-intensive asset class with limited liquidity. If these factors are not well understood and managed by the investor, real estate can become a risky investment.

Key Learning Points

- Investing in real estate is an investment strategy, wherein one can make profit by investing in, buying and owning or “flipping” properties;

- Most real estate investment deals are highly leveraged, often with LTV’s (Loan to Value) up to 90%;

- Direct investments in real estate include investments in Residential or Commercial Real estate while indirect investments include REITS; and

- The key valuation metric for direct property investments are Cap rates (yield equivalent) and net operating income. The cap rate equals Net Operating Income/ Real Estate Value

Investing in Real Estate Explained

Real estate investments are generally divided into direct and indirect investments. Direct investments can be made via the purchase of residential or commercial buildings or the purchase of land (farmland, timberland, and development land). Indirect investment can be realized via the purchase of REITS, REIGS or mortgage-backed securities.

Key Investment strategies in real estate

Direct investing – Residential or Commercial Rental Properties

The idea behind rental properties is to buy a property and to rent it out, providing a steady income for the investor. This investment strategy is considered very simple, however, it requires substantial capital to finance sudden maintenance costs and cover vacant periods. On top of that, capital is required to buy the property in the first place. Given the high leverage, the risk to end up in negative equity should not be underestimated.

Flipping

Real estate flippers buy reasonably priced or undervalued properties, renovate them and then look to sell them profitably as soon as possible. This also requires capital, as well as a deeper market knowledge, however, it offers faster returns. Investors following this investment strategy often consider IRR (internal rate of return) as their preferred return metric.

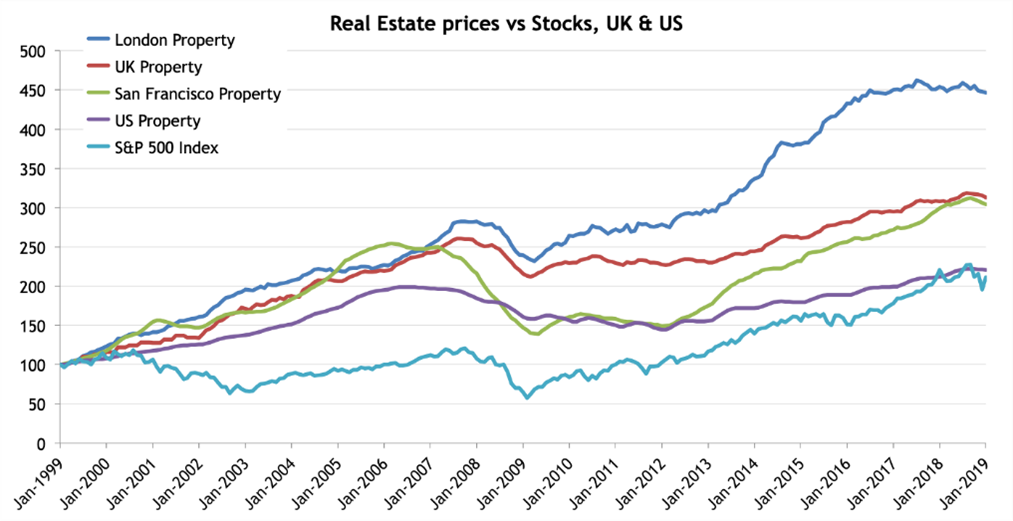

Appreciation

Appreciation works through investing in a property, holding onto it and selling it when the value of the property has risen over time. It can also go hand in hand with rental properties if played well, however, it requires an understanding of the markets, as one needs to make estimations of the value of the property in the future. Appreciation strategies are highly dependent on location and market knowledge. Investors often consider the multiple of Invested Capital (MOIC, MM) or IRR as their preferred return metric.

Indirect Investing- Real Estate Investment Trusts (REITs)

REITs are publicly traded instruments, brought into existence through corporations or trusts using investors’ money to purchase and operate properties. They can be bought and sold on major exchanges, like any other stock. To maintain their tax-friendly status, REITs must payout 90% of their taxable profits in the form of dividends, thus avoiding paying corporate income tax. REITs can also give investors access to nonresidential investments, such as malls or office buildings, typically difficult to buy directly. On top of that, REITs are more liquid than direct real estate investments as they are exchange-traded.

Real Estate Cap Rates vis a vis Other Valuation Metrics

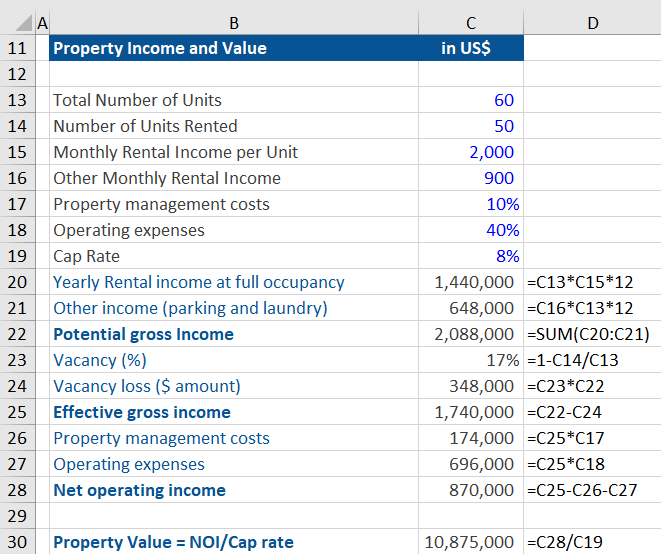

CAP RATE = NOI / Real Estate Value

Key valuation metrics, used particularly in commercial real estate, are Net Operating Income (NOI) and CAP rates. The capitalization rate (cap rate) is used to indicate the rate of return that is expected to be generated on a real estate investment property. The lower the cap rate, the higher the property value if the NOI remains equal.

Example

A 60-unit apartment building rents for $2,000 per unit per month. Operating expenses, including property taxes, insurance, maintenance, and advertising, are typically, 40% of effective gross income. Other income from parking and laundry is expected to average $900 per rented unit per year. The Cap rate is 8% and the property manager is paid 10% of effective gross income. From these inputs, we obtain a property value of $10,875,000 which you can see below.