Linking Three Financial Statements

January 11, 2022

How are the three Financial Statements Linked?

The three financial statements are the Income Statement (IS), Balance Sheet (BS), and Cash Flow Statement (CFS). Understanding the links between them is important for building models, and is a classic interview question in financial services.

So how to understand the links? Firstly, the IS lists sales for a period. But not all of them are cash sales. So the CFS takes the IS non-cash flows and converts them into cash flows. This difference in preparation – the IS is not prepared on a cash basis, but the CFS is – creates many links between the 2 statements.

Secondly, the BS tells us the company’s assets, liabilities, and equity, and again is prepared using differing accounting principles to the IS and CFS. In its most simple form, the CFS goes looking for cash flow changes in the BS, and the IS explains some of the changes in the BS. To go through every link would fill a library of books (we’d love to do this), but here we shortlist the major links.

Key Learning Points

The major links in the three financial statements are:

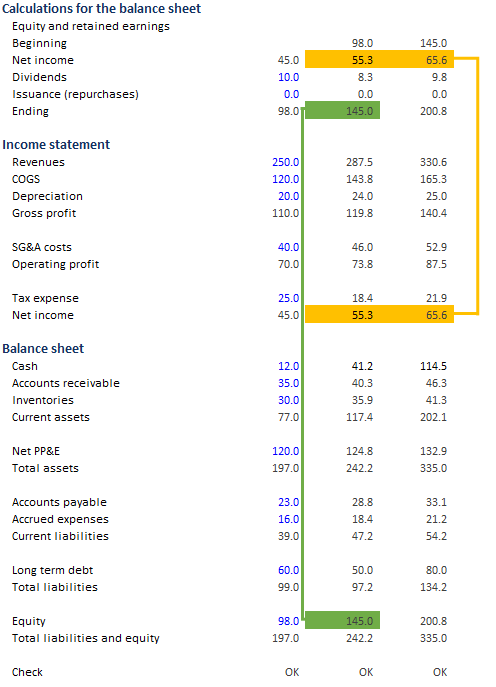

- Net income from the IS links to the BS (retained earnings) and the CFS operating section

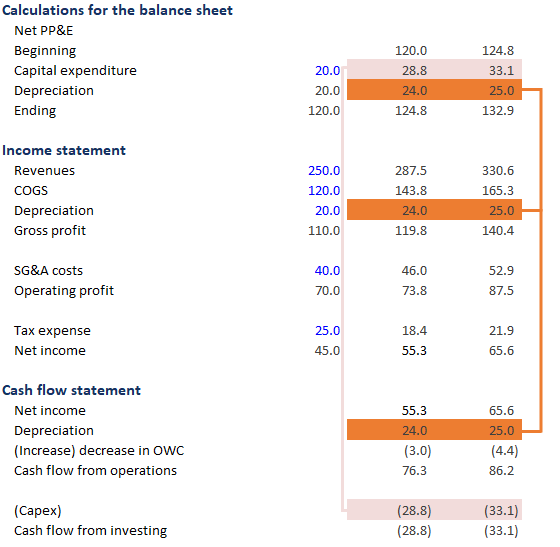

- Property, plant and equipment in the BS creates depreciation in the IS and the CFS operating section, and also creates capital expenditure in the CFS investing section

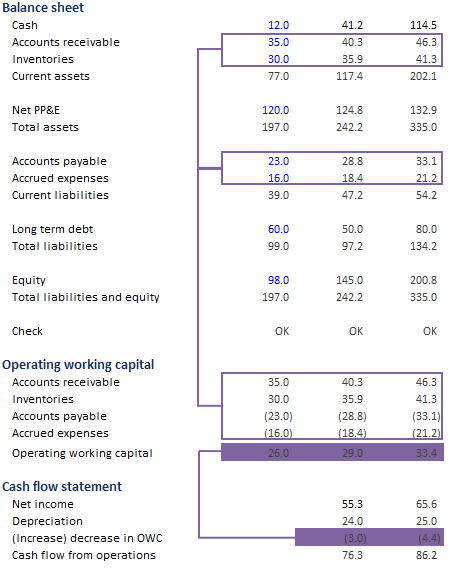

- Changes in current assets and liabilities from the BS are aggregated to calculate Operating Working Capital (OWC) in the CFS operating section.

- Debt in the BS leads to interest expense in the IS, and debt issuance/repayment in the CFS financing section

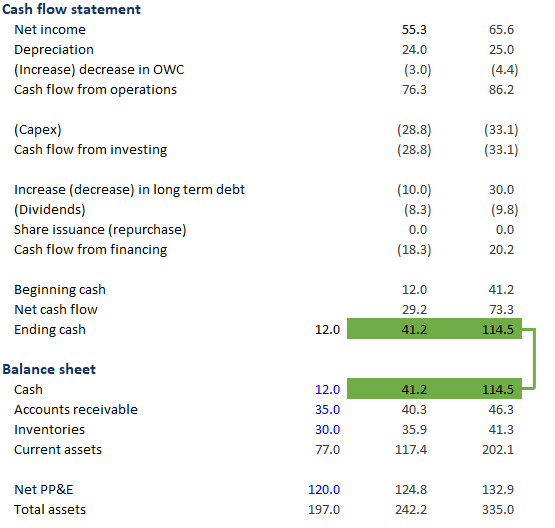

- Ending cash in the CFS is what drives cash in the BS

Why Analyze Financial Statements

Net Income and Depreciation

The IS reports all sales and costs for the period, but not all of them are cash flows. So the first line in a CFS is net income from the IS, and then the CFS adjusts it to create cash flows. The best example of this adjustment is depreciation. Depreciation is a cost in the IS, but it is not a real cash flow, so the CFS adds it back to net income to pretend it didn’t happen.

Net Income and Retained Earnings

Net income can be paid out as dividends to shareholders, but can also be retained and kept by company. This retained net income is still owed to equity shareholders (“hey, where did my dividends go?”), so it goes in retained earnings in the equity section of the BS.

PP&E, capex and depreciation

PP&E (property, plant and equipment) is an asset in the BS, but as it is used up during the period it depreciates, and that depreciation cost goes in the IS.

Also, as PP&E goes up on the BS due to capex (capital expenditure), that capex is also a cash flow, which appears in the CFS.

Operating Working Capital

The CFS goes looking for any cash flows it can find in the IS and BS. Changes in OWC in the BS are one of those cash flows. If inventory goes up on the BS, cash goes out on the CFS. If accounts receivable goes down on the BS, cash comes in from customers on the CFS. These are summed up as “Changes in OWC” on the CFS.

Debt

Debt is on the BS, and companies have to pay interest on that debt. This interest cost goes on the IS.

Also, as debt is issued or repaid, the cash in or out flow appears in the CFS.

Cash

The CFS sums up all cash in and out flows for the year, and calculates the ending cash figure. This then goes in the assets section of the BS.

Free Download

The free download shows a three-statement financial model with the links between the statements color-coded for ease of reference.