Chat GPT Replacing Financial Analyst Jobs?

February 20, 2023

The debate on whether artificial intelligence (and platforms like ChatGPT) will replace jobs of financial analysts continues to gain traction. Our Founder and Managing Director, Alastair Matchett, recently shared his perspective on this topic on LinkedIn. After asking an AI blog writer to produce a piece of content on Kellogg’s 2022 performance, the results were underwhelming: a seven-page report with limited commentary and analysis.

When comparing the AI-generated report to a comprehensive equity research report produced by a reputable financial analyst, the difference is clear. The AI report is deficient in terms of content, structure, infographics, clarity, and analysis. The information provided is general and obtained from web sources rather than from the company’s 10-K filing, which would provide independent analysis.

For instance, while the AI report mentions the performance of Kellogg’s various business segments, it fails to provide any in-depth explanation. The statement “this was mainly due to higher costs associated with production and marketing expenses” when referring to the decline in net sales year-on-year, does not elaborate on the reasons, which could be higher inflation, supply chain issues, or competition.

A financial analyst in equity research, on the other hand, would typically provide a company rating, a share price target and their own assumptions for the company’s outlook. While AI may offer a management or industry consensus view of the company, it would struggle to offer independent analysis due to its limited access to reliable data and lack of commercial awareness.

The ‘Outlook for 2023 and Beyond’ section in the AI-generated report is short and not particularly insightful, largely drawing on broader market trends and forecasts. Although it mentions Kellogg’s recent acquisitions and strategic initiatives when commenting on how the company is placed to capitalize on market conditions, it does not quantify nor comment on the extent to which the company is set to grow.

Another example of AI’s limitations is its response to a frequently asked question about Kellogg’s biggest competitor, which it cites as General Mills without any context. A reader would expect to see whether this is based on annual revenue, number of employees, product portfolio, or number of brands owned.

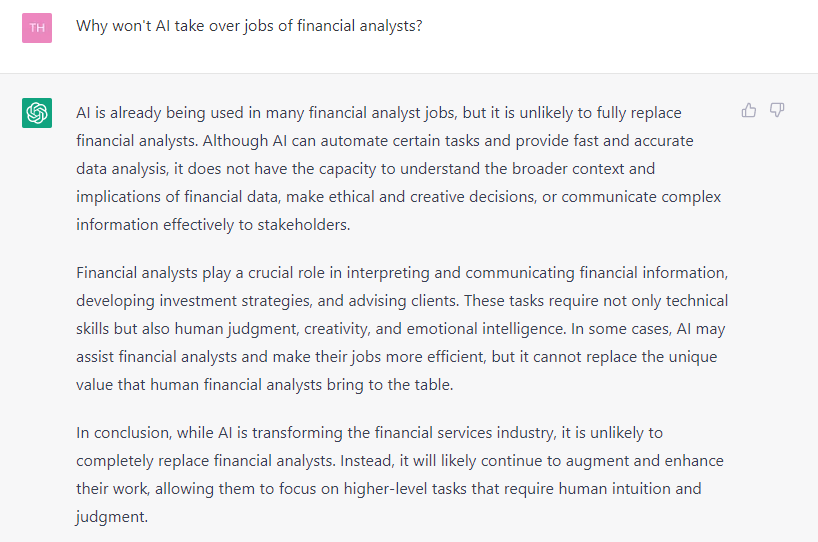

I consulted with ChatGPT directly to understand why AI is unlikely to replace the jobs of financial analysts. It offered the following explanation:

The key takeaway is that AI does not have a ‘big picture’ of the financial industry when it comes to combining technical and commercial understanding. A financial analyst in equity research may have been working for several years in the industry, having developed a deep and thorough understanding of a specific sector that offers them a unique perspective into the industry. Having developed relationships with key stakeholders within the companies they cover as part of their research, they also have access to an ‘inside’ view of such developments.

AI does not have the capacity to direct complex financial information, such as advanced debt restructurings or acquisition financing structures. It also lacks emotional intelligence, which is crucial in building relationships with clients and stakeholders. A financial analyst who has a deep understanding of a client’s personal needs, goals, and challenges is better equipped to provide tailored research.

Financial analysts also play a vital role in managing risk and making ethical decisions. They must have a thorough understanding of market regulations and ethical standards, applying and abiding by these standards when publishing research. AI, however, is limited by the data it has been trained on and the algorithms it uses, and may not be able to make ethical decisions in complex and unpredictable situations.

In conclusion, the combination of technical knowledge, commercial understanding, relationship management, emotional intelligence, ethical judgment, and effective communication skills makes financial analysts an indispensable part of the financial industry. While AI has the potential to automate certain tasks and provide fast and accurate data analysis, it cannot compete with financial analysts.

Now you’re sure your future career as a financial analyst is safe for now, why not get a head start by taking one of our Wall street-recognized Micro Degrees.