Unaffected Share Price

October 9, 2020

What is Unaffected Share Price?

The unaffected share price is the share price of a target company prior to any official announcement of an M&A transaction. It is compared to the price paid in an M&A transaction to understand the size of the premium buyers are willing to pay to acquire a controlling stake in a business. Also known as transaction comparables or deal comps, this is a relative valuation method very similar to trading comparables and is an important part of the M&A process.

Usually there is a significant difference between the unaffected share price and the actual price paid for the deal. For example, in 2015, Hewlett-Packard Company (HP) acquired Aruba Networks, Inc. The target company’s unaffected share price before the deal announcement was $17.13 per share. However, the deal closed at $24.67 per share, a 44% increase from the unaffected share price.

Key Learning Points

- The unaffected share price is the trading price of a target company prior to any knowledge on an M&A transaction (analysts typically look at the closing price 1 day prior)

- Transaction comps is a relative valuation technique which values a company based on a peer group of transactions

- When analyzing a deal, it is important to review information only available to the bidder at the date of the offer rather than the completion date of the transaction

- It is important to review the volume of shares traded as well as the change in share price to determine the unaffected share price

Unaffected Share Price Explained

It is important to focus on the price on the offer date and not the completion date when analyzing an M&A transaction. This helps to focus on the financial and operational information that was available to the bidder at the time they decided to launch their acquisition. This is the same situation bidders will be in when they are thinking about making an offer for another asset in the same sector.

Typically, analysts use the closing price from the day prior to the deal announcement. However, sometimes rumors circulate before the announcement, which impacts the target share price. These rumors are likely to drive the share price up and understate the premium associated with the deal. Consequently, it is common to calculate the premium based on a range of prices, such as:

- 1 day prior

- 1 week prior

- 1 month prior

- 90-day moving average

- A volume weighted average share price known as VWAP

Analysts should also examine the volume of trading prior to the announcement. An uptick in volume traded will suggest the market is anticipating a deal and pricing in some of the premium. The unaffected share price is the price prior to the volume ramp up.

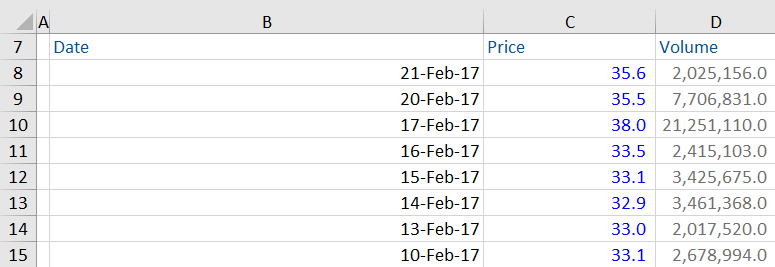

For example, on February 17th, 2017, Kraft-Heinz had launched a bid for Unilever, which it had subsequently withdrawn. Following is the price volume data for Unilever around the announcement date.

Here, we can clearly see that there is a large spike in trading volumes on the announcement date. From the above, the unaffected share price will be the 1-day prior price (33.48).

Determining Unaffected Share Price:

Below is the 10-day share price history of a business. A bid was announced sometime in February, within these 10 days. From this information, what is likely to be the unaffected share price?

Indicator 1: Share Price

If you look at the share prices between February 2nd and 4th, they are around $63 per share. However, on February 5th, the share price jumps to $87.43.

Indicator 2: Volume of Shares Traded

If you look at the volume of shares traded, till February 4th, they are at around 1 million. However, on February 5th, the volumes surge to 41 million. After that, the volumes start going down.

Based on the information above, we can reasonably assume that the announcement date was February 5th. Therefore, the unaffected share price will be the 1-day prior (February 4th) closing price of 64.80.

In practice, analysts need to look broader than the period given here. They need to look at 1-day before, 1 month before, and even 90 days before or 90-day average. It is important to look back further than just one day because there is a possibility of rumors circulating in the market about the deal. Ideally, you want the real underlying share price prior to the rumor.