Cov-lite Loans

May 19, 2021

What are Cov-lite Loans?

Covenant-lite loans or cov-lite, as they are more commonly known, are a type of term loan that has maximum flexibility and minimal constraints for the borrower, often resulting in only one or even no covenants. The result is a term loan that is structured more like a bond, which is much more advantageous to issuers who are looking to use cash for other purposes than repaying debt.

Key Learning Points

- Cov-lite loans are non-amortizing (or minimally amortizing) senior secured term loans that have only one or sometimes no financial maintenance covenants, similar to bonds

- They are created in the Term Loan B market, which is a common debt product in levered capital structures

- Investors are drawn to the floating rates offered by cov-lite loans, as opposed to the fixed coupon of high yield bonds

- Cov-lite loans can be structured as first lien/second lien, part of a unitranche facility, stand-alone, or with a revolver (pari passu or subordinated)

- While maintenance covenants are minimal, they do offer other covenants such as builder and grower baskets which give the issuer flexibility to make acquisitions and pay down expensive junior debt

The Use of Cov-lite Loans

As the pace of leverage transactions has increased, the arrangers of these, which are typically financial sponsors, have looked for increasing flexibility and decreasing constraints. This is primarily to allow for tuck-in or follow-on acquisitions to a platform deal. With traditional “A” and “B” term loans, financial maintenance covenants prevented adding additional debt at any level, thereby making these acquisitions a challenge. Most “A” tranche term loans also have significant amortization. Sponsors often prefer to reserve cash for other purposes. Furthermore, sponsors were looking for more creative ways to enhance returns and many distributions are restricted in traditional loans (if not by law).

Cov-lite loans are issued by financial institutions but then sold (as opposed to syndicated) to other investors who are attracted by the senior, secured nature of most term loans along with their floating rates. As demand from investors like CLOs has grown, borrowers have become more aggressive in seeking loan terms and lenders have had to keep up by agreeing to looser terms.

Cov-lite loans, which are essential “B” term loans, can be structured as standalone, first lien/second lien (which is sharing collateral with another senior loan), as well as alongside a revolver (split collateral or subordinated ). This is much more favorable than the “A” term loans that typically must always be senior and are never part of a unitranche facility.

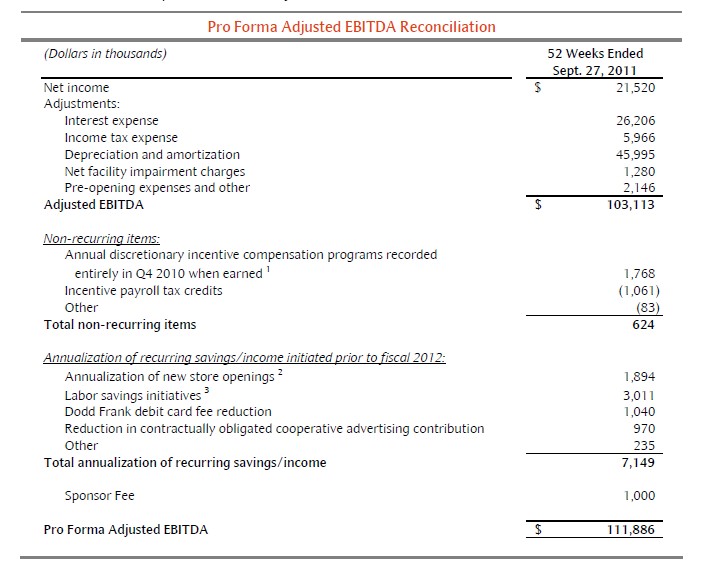

If there are any maintenance covenants in a cov-lite loan it is most likely a leverage ratio such as Net debt/EBITDA. Yet another feature of these loans are significant allowances, add-backs, and adjustments to EBITDA making them even more forgiving. These can even include pro-forma cost savings not yet achieved. Allowances for incremental EBITDA allow for more overall leverage as well.

Below is an example of using significant add-backs in calculating adjusted EBITDA in a cov-lite loan:

One area where covenants are used frequently with these loans are builder and grower baskets. These terms establish a permitted or allowable amount that can be used for an action otherwise restricted such as repaying junior debt. These are based on a financial test such as a leverage or coverage ratio.

Difficulty with Cov-lite Loans

Default rates have climbed much higher since the rise of cov-lite loans. This is not to imply that credit quality has lessened with these loans but rather, the lack of maintenance covenants does not give the lenders many tools or much time to step in and fix problems before they develop. By the time a borrower has defaulted on a payment, it is often too late. Equity cures, which give the sponsor time to add equity to relieve the situation, are becoming standard in these deals as means to remedy problems.

Conclusion

Cov-lite loans are senior secured term loans that give maximum flexibility to the issuer by limited use of maintenance covenants. They have become a backbone of the capital structure for highly levered companies due to their relatively low cost and high flexibility.