Floating Rate Funds

April 22, 2022

What is a Floating Rate Fund?

Floating rate funds are collective investments that deploy capital in a basket of debt securities that produce variable interest returns such as bonds and bank loans. These funds can be structured as either open or closed-ended vehicles and most offer a liquid solution for income investors, meaning that shares can be purchased or redeemed daily. However, there are funds that may allow daily purchases, but redemption during a specific period, for example monthly. There are various benefits that make floating rate funds attractive compared to fixed-rate ones. Some of these include potentially higher yields and some protection against interest rate risk. In addition, most floating-rate funds demonstrate lower correlation relative to major asset classes such as equities and bonds, making them attractive to investors wishing to diversify a portfolio.

Key Learning Points

- Floating rate funds provide investors with variable interest rates and therefore are less sensitive to interest rate raises compared to fixed interest products.

- Floating rate funds invest in a range of debt instruments in order to achieve their objective – mostly bonds and bank loans. The interest that these funds pay fluctuates in line with the interest offered by their underlying holdings.

- The majority of floating rate funds offer exposure to senior debt, which means that investors would have a priority claim on a company’s assets in the event of default.

- Different strategies may target securities with specific credit quality or duration. Generally, higher yield is achieved by securities with lower credit quality, which means higher risk.

How Do Floating Rate Funds Work?

Floating rate funds invest in debt instruments that pay variable interest and are tied to a specific benchmark plus a predetermined spread, for example, the London Inter-Bank Offered Rate (LIBOR) + 150 bps. These securities can include corporate bonds, bank loans, mortgages, and in some cases preferred stocks. The loans that offer a floating rate of interest are a type of credit that is lent by banks to companies and are packaged into a product that is then sold to various investors like mutual funds and hedge funds. The process is similar to mortgage-backed securities, which are packaged mortgages that investors can buy and receive a rate of return derived from the multiple mortgage rates in the fund. Floating rate loans are typically considered a senior debt, which means that they have a priority in a claim on a company’s assets in the event of a default, where subordinated debt holders would usually be the next in line.

These funds can be either open or closed-ended with the main difference between the two being that closed-ended funds are allowed to use gearing (also known as leverage) to enhance their returns. However, it should be noted that this is a higher risk operation compared to open-ended funds since this additional funding is borrowed by the fund. For example, if the total assets of a fund are worth £200 million, and the manager borrows £20 million, this is expressed as 110% gearing.

What Are the Key Advantages?

Diversification

Unlike the typical fixed-income funds, floating rate funds offer diversification benefits since they tend to show a lower correlation to the return of major asset classes such as shares and bonds. That creates the opportunity to use floating rate funds as a satellite holding in a broader portfolio, which would reduce the overall risk and support returns during periods of market turbulence.

Mitigating Duration Risk

Investing in fixed-income securities with a longer duration could have both positive and negative effects, depending on the prevailing market environment. When interest rates decline, having a long duration is usually a benefit as newly issued securities would provide a lower yield. However, in periods of rising interest rates, normally triggered as a result of higher inflation levels, a long duration would be a detractor and have a negative impact on returns since newly issued bonds offer more attractive yields than the existing ones. Therefore, having exposure to floating rate instruments provides efficient duration risk management.

Flexibility

Floating rate funds offer exposure to returns that are linked to a benchmark rate which makes them attractive investment opportunities during inflationary periods where higher returns are perceived. In addition, the majority of them are daily traded, which makes them accessible to various types of investors. As with all investment products, some floating rate funds have individual specifics like rules on selling – some may require investors to sell their holdings monthly, quarterly, or semi-annually instead of daily.

What Are the Risks?

The major concern that is involved with investing in floating rate funds is credit risk. This type of product may appeal to investors seeking yield, but they might also be hesitant to take this additional risk relative to safer instruments like US Treasurys, which are backed by the U.S. government.

Corporate bonds with poorer quality that are at the lower end of the investment-grade are sometimes included in the portfolios of floating rate funds, which increases the default risk. Nevertheless, this is often the price that investors would need to consider before buying a floating rate product, which would not have its yield fixed and may provide a higher risk-return opportunity, depending on the market climate.

Although it is often difficult for individual investors to access the full list of holdings that a floating rate fund is invested in, it might be a good idea to research the composition of the portfolio, its overall credit quality, and duration, and top holdings and then compare to similar products in order to gain a better perspective of the existing product-specific risks. Some fund managers also provide regular commentary on the product’s factsheets or website, which is often a very useful read.

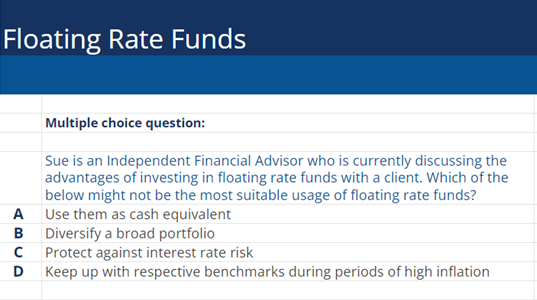

Floating Rate Funds Versus Money Market Funds

Money market funds are mutual fund that invests in highly liquid and cash equivalent and debt-based securities often with high credit quality. They are perceived as a better place to park cash until further investment opportunities arise due to their highly liquid nature and extremely low risk (which also limits the potential upside significantly). They usually have short-term maturity, normally 12 months. In contrast, floating rate funds carry a higher risk as they may invest in securities with lower credit quality and therefore are not traditionally viewed as a cash-like instrument.