Company Lifecycle

May 24, 2021

What is the “Company Lifecycle?”

All businesses, irrespective of size, go through a series of stages known as the company lifecycle. The company lifecycle begins with the startup or introduction stage. If the business survives this stage, it moves to a rapid growth stage. Thereafter, it reaches a maturity stage with growth and expansion slowing down. Finally, the business reaches a decline stage. Each stage of a company’s lifecycle is characterized by differences in its sales, costs, and profitability.

Key Learning Points

- All companies go through four stages: introduction, growth, maturity, and decline

- At each stage, a company experiences differences in its profitability, efficiency, and return on capital; and

- The specific stages of the company lifecycle are also likely to impact its financing requirements, financing sources, and returns to shareholders.

Company Lifecycle- Performance Metrics Example

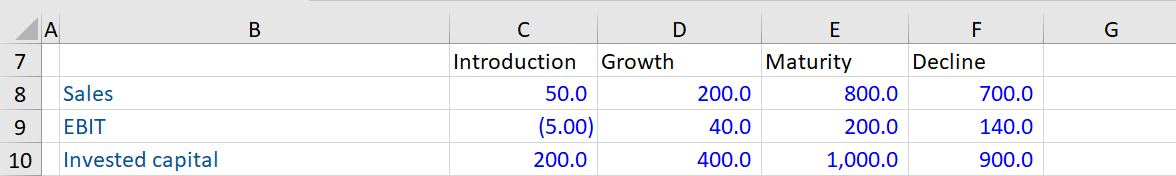

To understand how three performance metrics – profitability, efficiency, and return on invested capital (ROIC) – perform over different stages of a company’s lifecycle, given below is some information on how sales, EBIT, and Invested Capital of a company change over this cycle.

| Metric | Formula | What does it indicate? |

| Profitability | EBIT/Sales | The ability of the business to generate profits |

| Efficiency | Sales/Invested capital | The ability of the business to generate sales using the available capital |

| Return on Invested Capital (ROIC) | EBIT/Invested Capital | The ability of a business to generate returns for investors |

Based on the information above, given below are three different performance metrics throughout a company’s lifecycle:

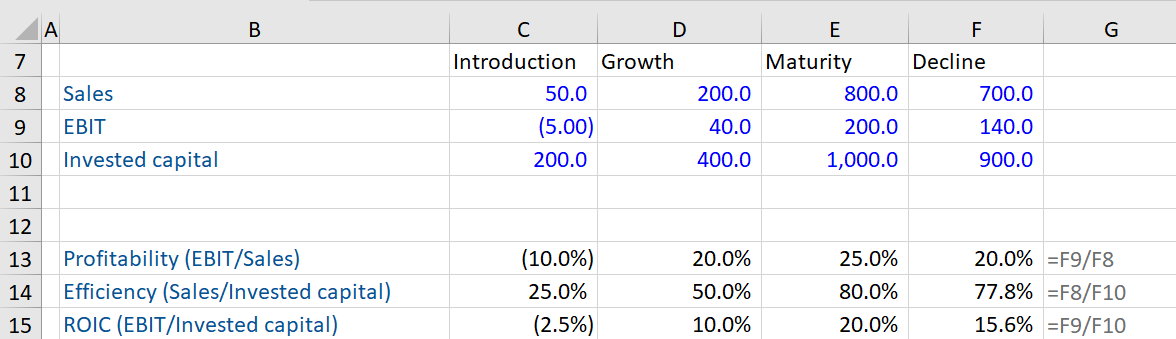

Computed below are the three-performance metrics for the different stages of a company’s lifecycle:

Introduction Stage

The introduction stage is the startup stage. As can be viewed from the table above, sales are lowest, most companies have zero or negative profitability, efficiency is comparatively much lower and the ROIC is negative.

Growth

In the growth stage, the company experiences an increase in sales and profitability. Consequently, the company is able to utilize its invested capital optimally, resulting in improved efficiency and ROIC compared to the introduction stage.

Maturity

In the maturity stage, growth slows down. However, costs reduce due to economies of scale, resulting in higher profitability and efficiency. As a result, the company is able to generate a strong ROIC at this stage.

Decline

In the decline stage, the declining sales adversely impact profitability and efficiency (both fall), eventually reducing the ROIC.

Company Lifecycle – Other Implications

In addition to the above, the company lifecycle has implications for its operating working capital. sources of financing and returns to shareholders.

Operating Working Capital (OWC)

In the introduction stage, a company’s suppliers are unwilling to extend credit to an unproven business. The higher payable days cause the OWC (= Operating Current Assets – Operating Current Liabilities) to be negative. In the growth and maturity stage, the OWC tends to be positive. Finally, In the decline stage, the OWC tends to be negative.

Sources of Financing

During the introduction stage, a company typically relies on equity financing. It is unlikely to get debt financing as lenders do not have enough confidence in the company’s ability to repay their debts. During the growth stage, the company may get more access to debt financing due to some reliability in its cash flows. In the maturity stage, a company’s strong and stable cash flows support debt financing. Finally, in the decline stage, its debt capacity reduces.

Returns to Shareholders

At the startup stage, the business may not generate enough surplus cash from its operations to pay dividends to its shareholders. The trend continues into the growth stage. In the maturity stage, there is significantly more pressure from shareholders to pay dividends and carry out share buybacks. In the decline stage, a business may choose to pay dividends to shareholders, due to a lack of investment opportunities.