Portfolio Backtest

February 13, 2026

What Does Portfolio Backtesting Stand for?

Portfolio backtesting is the process of reviewing how an investment or trading strategy would have performed in the past by using historical market data. It is a simulation exercise that aims to provide insight into the strategy’s specific features such as risk and returns profile, drawdowns, and behavior across different market regimes. This allows investors to determine whether a strategy has merit or needs refinement before real capital is deployed.

Key Learning Points

- Backtesting simulates historical performance to assess the viability of an investment strategy, its risk-adjusted returns, and identify any weaknesses before deploying real capital

- Accurate backtesting requires high-quality data, well-defined strategy rules, and realistic transaction costs

- Backtesting offers several benefits to investors by transforming speculation into analysis, it helps in areas such as risk management, and strategy validation and optimization

- Some common strategies like trend-following, mean reversion, momentum, factor, and statistical arbitrage typically require tailored backtesting to quantify their risk and return metrics, and their consistency across different market environments

Key Components of Portfolio Backtesting

Portfolio backtesting relies on several core components that create a more realistic simulation of past performance. It is crucial for investors to consider the integrity of each component as it directly affects the reliability of the simulation. A realistic backtest must integrate high-quality historical data, precisely defined strategy logic, and a comprehensive execution model that replicates market mechanics, including transaction costs and liquidity constraints.

Below are some of those key components that need to be applied:

- Historical price and market data: this component is very important and it could include any data variable, for example historical prices, volumes, corporate actions (such as dividends and/or stock splits), as well as market and macro figures. High-quality data would ensure the simulation reflects realistic market conditions.

- Strategy rules: this is another core component of a backtest that provides the details around the investment strategy. These include rules such as its buy and sell discipline, along with the approach to position sizing. The rules must be unambiguous and always interpreted in the same way.

- Transaction Costs: to come up with a real market simulation, investors would look into the various costs such as commissions, bid-ask spreads, taxes, slippage, etc. Backtests that ignore the cost component are risking overstating the strategy’s performance.

- Rebalancing process: most portfolios require regular rebalancing (for example monthly or quarterly) to maintain their target allocations.

- Risk controls: the risk management mechanisms that a strategy uses may include stop-loss rules, position limits, leverage caps, or volatility filters. These are designed to keep risks within the agreed boundaries during extreme market conditions.

Common Backtesting Strategies

Portfolio backtesting can apply to virtually any strategy. The table below outlines some common approaches.

Trend-Following

Trend-following relies on the assumption that price trends persist once established. Positions are entered and exited using predefined rules (such as moving average signals) rather than discretionary judgment. Typical users include systematic hedge funds, quantitative asset managers, and CTA funds (Commodity Trading Advisors). Trend-following has a medium-to-long-term time horizon.

Risk characteristics include:

- Moderate volatility

- Performs well in sustained trending markets but can suffer meaningful drawdowns during sideways or choppy periods

Example – Backtesting a 50/200-day moving average crossover on global equity indices (including transaction costs and monthly rebalancing).

Mean Reversion

Mean reversion exploits the tendency of prices to revert toward historical averages after extreme short-term moves, typically by taking contrarian positions when deviations become statistically significant. Typical users include quantitative strategies, short-term systematic traders, and proprietary trading. Mean reversion has a short-term time horizon.

Risk Characteristics include:

- Lower day-to-day volatility

- Vulnerable to large losses when markets undergo regime changes or trends persist

Example – Simulating a strategy that buys stocks trading more than two standard deviations below their 20-day average and exits once prices revert toward the mean.

Momentum Investing

Momentum Investing evaluates whether assets with strong recent performance continue to outperform by ranking securities over a fixed lookback period and rebalancing at regular intervals. Typical users include asset managers and smart beta ETF providers. Momentum Investing has a medium-term of typically 3–12 months.

Risk characteristics include:

- Higher volatility

- Periodic sharp drawdowns (especially around market regime changes)

Example – Backtesting a 12-month momentum factor across large-cap equities with monthly portfolio rebalancing.

Factor-Based Investing

Factor-Based Investing assesses long-term performance of portfolios built around systematic risk factors, testing whether factor premia persist across different market environments. Typical users of Factor-Based Investing are pension funds and other institutional investors, and multi-factor portfolio managers. Factor-Based Investing has a long-term horizon.

Risk characteristics include:

- Risk is diversified across factors

- Individual factors can underperform for extended periods

Example – Constructing and backtesting a value-oriented portfolio using historical price-to-earnings ratios with annual reconstitution.

Statistical Arbitrage

Statistical Arbitrage uses statistical relationships between securities to construct market-neutral long/short positions, often relying on correlation or cointegration models. Typical users include quantitative hedge funds and high frequency trading firms. Statistical Arbitrage has a very short-term, usually intraday to a couple of days.

Risk characteristics include:

- Low exposure to overall market risk

- High model risk and execution sensitivity

Example – Backtesting a pairs-trading strategy on historically correlated stocks using rolling correlations and predefined stop-loss rules.

Performance Metrics to Track in Backtesting

Beyond total returns, there are various metrics that investors look at to assess whether the strategy would have behaved in-line with the expectation. Examples include:

- Annualized returns involves converting the overall return into a yearly rate for comparability.

- Volatility, measured as the standard deviation of returns, quantifies how much a strategy’s performance fluctuates over a specific period.

- Sharpe ratio is a popular risk-adjusted return metric. It divides the excess return (i.e. the return achieved above a risk-free rate such as the 3-month Treasury bill) by volatility. Higher reading generally indicates better risk-adjusted performance.

- Maximum drawdown measures the largest peak-to-trough decline to illustrate potential losses during the worst period.

- Win/Loss ratio calculates the proportion of profitable trades relative to losing ones. It is useful for shorter term tactical strategies that use discrete trade signals.

- Beta is a common risk measure that quantifies the strategy’s sensitivity to market movements.

How to Backtest a Trading Strategy?

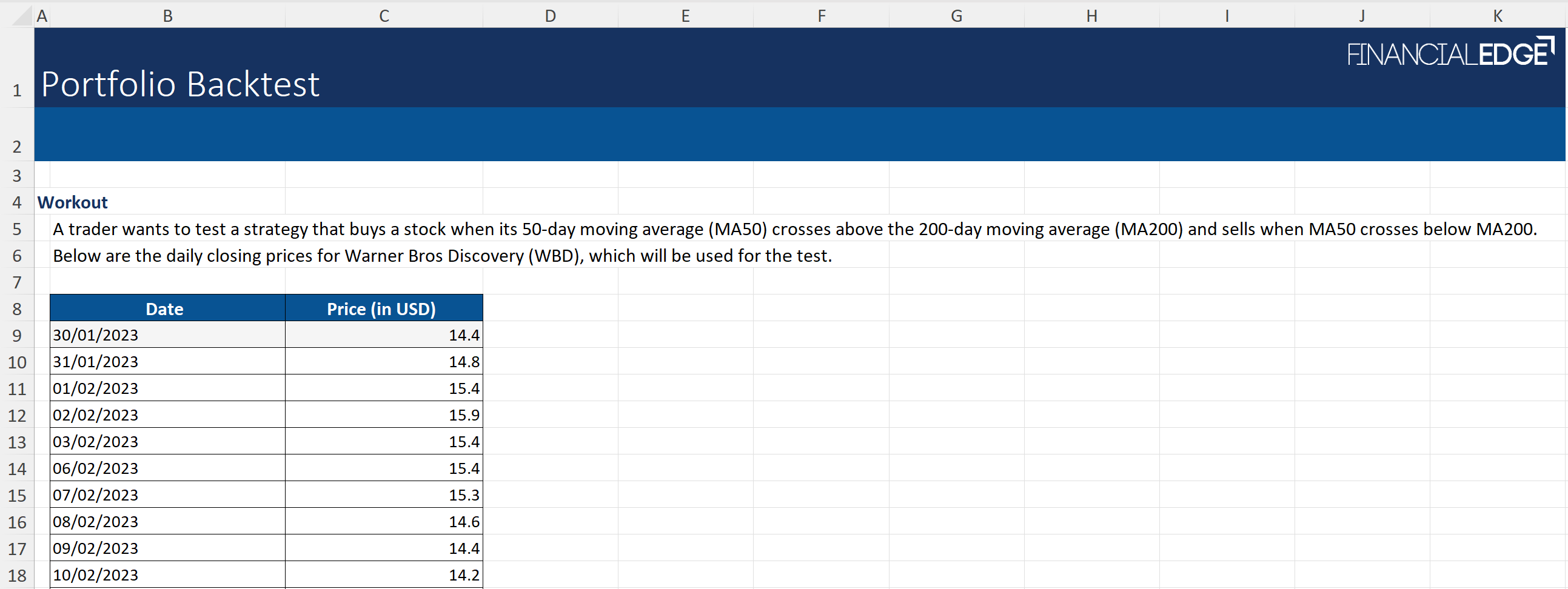

In this section, we show a real-life example of a backtest that applies a 50/200-day moving-average crossover strategy to historical daily prices and compares its performance with a buy-and-hold benchmark of the same asset. Download the free Excel Template with the full workout.

(Click to Zoom)

There are a couple of steps that the model follows.

- It calculates rolling moving averages.

- Generates “Buy” and “Sell” signals only after both indicators are fully formed with positions implemented using a one-day lag to avoid look-ahead bias.

- Strategy returns are earned only when the portfolio is invested, while periods out of the market earn zero return.

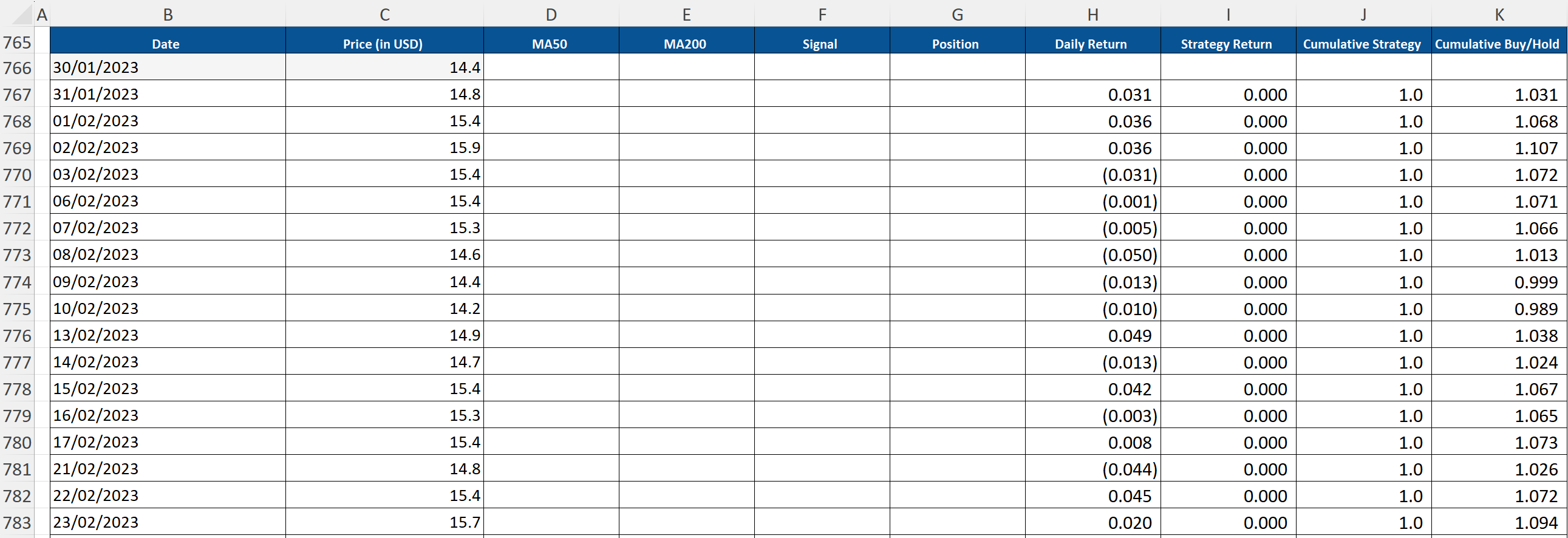

(Click to Zoom)

By compounding daily returns into cumulative value indices, the test shows how $1 would have evolved under the strategy versus passive ownership (the “Cumulative Buy/Hold” tab). This indicates whether the crossover rule improved returns.

Beware of Backtesting Pitfalls

Several pitfalls can significantly distort the results of a backtest if not carefully managed.

Overfitting, often referred to as curve fitting, occurs when a strategy is excessively tailored to historical data by optimizing parameters until past performance looks exceptional. These models frequently capture noise rather than genuine market structure and tend to break down when applied to live data.

Survivorship bias is another pitfall that arises when a dataset includes only securities that currently exist and excludes those that have failed, been delisted, or merged. This bias artificially inflates historical returns and understates risk, particularly in equity backtests that span over long time periods.

Similarly, look-ahead bias occurs when information that was not available at the time of the investment decision (such as future earnings or index constituent changes) is being used in the backtest.

Another common issue is ignoring transaction costs and market friction. Trading costs, bid–ask spreads, slippage and liquidity constraints can materially reduce performance, especially for high-turnover or short-term strategies. In addition, strategies should be tested across multiple market regimes and timeframes to assess their robustness beyond favorable conditions.

What Role Does Benchmarking Play in Portfolio Backtesting?

Benchmarking is a very important component of a backtesting exercise as it provides a reference to evaluate a strategy’s performance relative to the broader market or a specific peer group. Common benchmarks include major equity indices such as the US-focused S&P 500 or the global MSCI World. More sophisticated strategies may require the construction of custom benchmarks that reflect the asset allocation, regional or sector exposures, or factor tilts of the portfolio. Along with excess returns, metrics such as beta, tracking error and information ratio are also calculated relative to a benchmark. In addition, benchmarking allows investors to stress-test relative performance across different market regimes. This helps analyze underperformance and explore how a strategy reacts to periods of elevated market volatility.

Conclusion

Portfolio backtesting is a helpful tool that investors use to evaluate the plausibility and resilience of investment strategies under differing historical conditions. It plays an essential role in areas such as investment decision-making, risk management and strategy development. While past performance is not an indicator for future returns, backtesting provides a systematic framework to optimize allocation and enhance long-term returns generation.

Additional Resources

Best Portfolio Management Certification