Paper LBO

December 10, 2025

What is a Paper LBO?

A paper LBO is the most minimal form of a leveraged buyout model, using nothing more than a pen and paper. Paper LBOs are commonly used in PE interviews to test your understanding of how an LBO behaves and your mental math abilities. The interviewer gives you a short scenario and asks you to estimate the investor’s return, typically the IRR and the equity multiple.

What is asked during the Interview?

- You will receive a short prompt describing a hypothetical company (revenue, EBITDA, margins, growth, capex, tax rate, leverage, interest rate, entry and exit multiples).

- You will be given around 5–10 minutes in the quickest versions, and up to 30 minutes in longer formats, to determine the implied IRR and MOIC.

- You may be explicitly asked to decide whether the deal meets a target return and whether you would “do the deal” or not.

The goal is not beautiful formatting. The goal is to show that you:

- Understand the logic of an LBO.

- Can simplify and round without losing the core economics.

- Can stay calm, structured and numerate under time pressure.

Paper LBOs tend to appear early in the interview process. Sometimes they are administered by head hunters, and are used to quickly eliminate candidates before reaching more detailed Excel-based modeling tests or case studies.

The Core Building Blocks of any Paper LBO

Regardless of the exact prompt, you’re always working with the same conceptual skeleton:

1. Transaction price and capital structure: You translate the entry multiple into an enterprise value, then split that into debt and equity using a leverage multiple.

2. Operating performance: You forecast revenue growth, margins, capex, and sometimes working capital to estimate EBITDA and free cash flow over, typically, a five-year holding period. In some instances, a conversion ratio % is provided as a shortcut to forecasting FCF.

3. Debt schedule: Depending on the prompt, you either assume:

- All free cash flow is used to repay debt (a common simplification), or

- Certain tranches amortize while others are bullet maturities, or

- No principal is repaid at all, as in some simplified interview examples.

4. Exit and equity returns: At exit, you apply an exit multiple to the final year’s EBITDA to get exit enterprise value, subtract net debt to get exit equity value, then compute MOIC and IRR.

Paper LBO Example – Excel Template

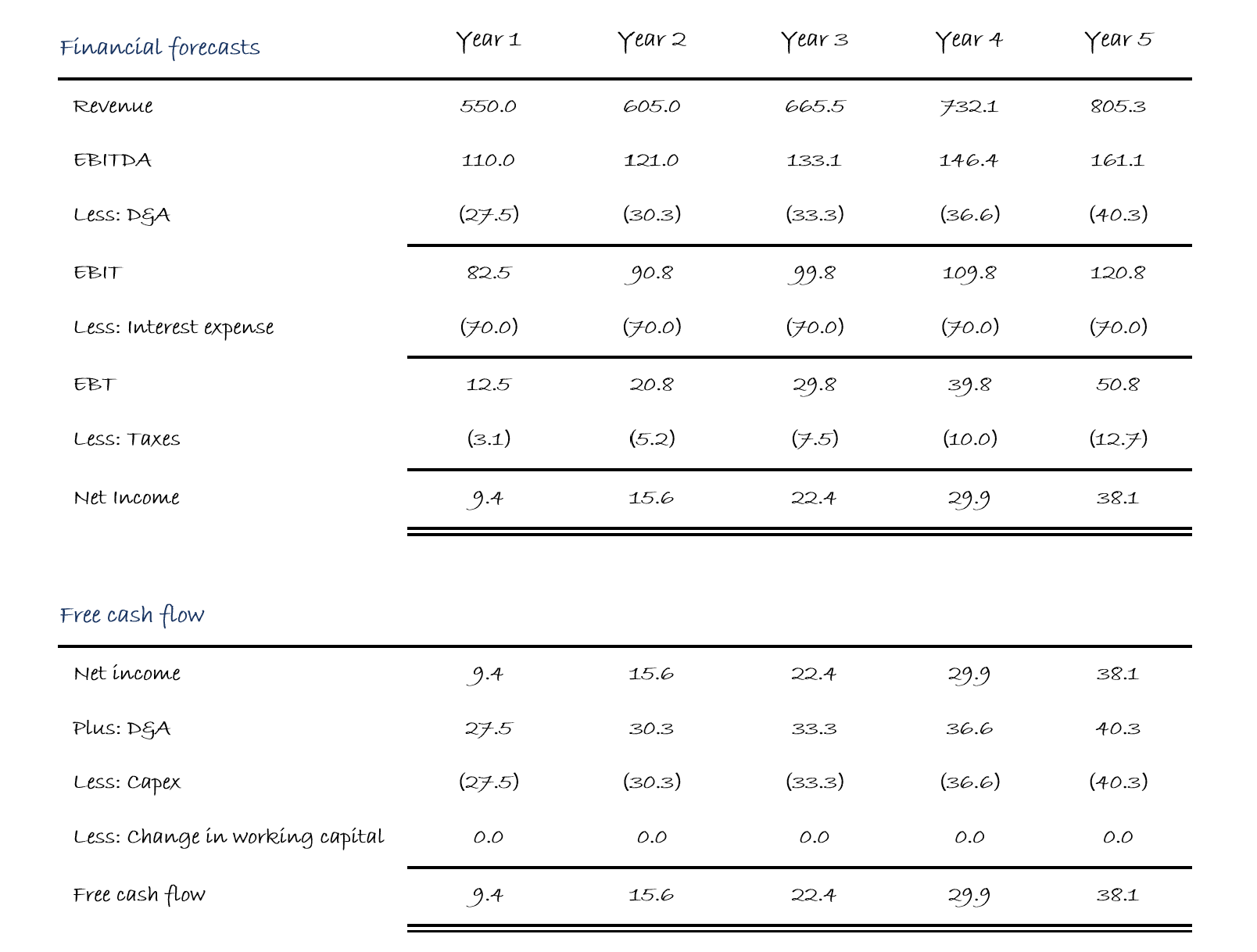

RevCo, a consumer products business, generated $500mm in last-twelve-months (LTM) revenue, and management expects this figure to increase at a growth rate of 10% annually over the next five years.

RevCo’s LTM EBITDA was $100mm, reflecting an EBITDA margin of 20%, and management believes this margin will remain stable going forward.

Management also expects depreciation & amortization (D&A) and capital expenditures (Capex) to each total 5.0% of revenue, with no change in net working capital (NWC) and an effective tax rate of 25%.

If a private equity firm were to acquire RevCo at 10.0x EBITDA and exit at the same EBITDA multiple five years later, what are the implied internal rate of return (IRR) and multiple on invested capital (MOIC)?

For the financing of the LBO, assume:

The initial leverage ratio is 7.0x LTM EBITDA

The debt carries an interest rate of 10%

There is no required principal amortization before exit (all excess cash flow is used to pay down debt)

The investment is sold at the end of Year 5

Download the Paper LBO template, which you can use to verify your calculations once you’ve worked through the exercise. For the most realistic practice, print the first tab of the worksheet and work through the problem using only pen and paper, just as you would during a live assessment

Paper LBO Cheat Sheet (Interview Ready)

A fast-reference guide for formulas to build a paper LBO modeling.

Input Transaction and Operating Assumptions

Purchase Enterprise Value (TEV) = LTM EBITDA × Entry Multiple

EBITDA Margin (%) = LTM EBITDA ÷ LTM Revenue

Sources & Uses of Funds

Debt Financing = Leverage Multiple × LTM EBITDA

Sponsor Equity = Total Uses – Debt Financing

Financial Forecast

Revenue = Prior Period Revenue × (1 + Growth Rate)

EBITDA = Revenue × EBITDA Margin

D&A = Revenue × D&A %

Interest Expense = Beginning Debt × Interest Rate

Capex = Revenue x Capex %

Change in NWC = Change in Revenue x Change in NWC %

Free Cash Flow (FCF) Calculation

FCF = Net Income + D&A – Capex – Change in NWC

Simplified FCF ≈ EBIT – Interest – Taxes

Exit Valuation & Returns

Exit Enterprise Value (TEV) = Exit Year EBITDA × Exit Multiple

Exit Equity Value = Exit Enterprise Value – Ending Net Debt

MOIC = Exit Equity Value ÷ Initial Equity Value

IRR = MOIC ^ (1 ÷ Holding Period) – 1

Top 10 Paper LBO Interview Tips from Finance Experts

- Begin by identifying the target IRR and MOIC the private equity firm typically aims for.

Understanding that most firms look for ~20% IRR over a five-year hold (~2.5x MOIC) helps you immediately evaluate whether the deal is directionally attractive.

- Simplify revenue and EBITDA assumptions by rounding to clean, easy-to-use numbers.

Interviewers do not expect precision; they want to see that you can create reasonable forecasts quickly under time pressure.

- Maintain constant EBITDA margins unless the prompt explicitly tells you otherwise.

This saves time and keeps your projections consistent while signaling that you understand which assumptions matter most.

- Use the simplified free cash flow formula to speed up your calculation.

Because Capex and D&A often offset each other and working capital changes are ignored, FCF ≈ EBIT − Interest − Taxes is perfectly acceptable in interview settings.

- Assume a single debt tranche with a blended interest rate to eliminate unnecessary complexity.

This approach aligns with how candidates are expected to think in paper LBOs and keeps the math manageable without a calculator.

- Allocate all free cash flow directly to debt paydown unless told otherwise.

This widely used assumption reflects common PE modeling practices and makes your debt schedule easier to compute on paper.

- Perform sanity checks at key steps to ensure your math makes economic sense.

Cross-checking MOIC, IRR, leverage reduction, and EBITDA growth prevents errors and demonstrates strong investment judgment.

- Approximate IRR using the MOIC shortcuts rather than detailed math.

Relying on the fact that 2.0× ≈ 15%, 2.5× ≈ 20%, and 3.0× ≈ 25% shows you understand how returns scale in a private equity context.

- Clearly articulate each assumption you make as you build the model.

Interviewers care deeply about how you think, so explaining your logic often matters more than achieving perfect numerical accuracy.

- Focus on creating a structured narrative that mirrors a real PE investment process.

If you can walk the interviewer through entry valuation, cash flow generation, debt paydown, exit economics, and returns in a logical sequence, you will outperform the majority of candidates.

The PE Associate is a comprehensive certificate covering everything from the foundations, PE funds, accounting for PE, valuation, legal and how PE deals work. The PE Modeler skills certificate demonstrates how to build simple to advanced LBO models. Complete the PE Interview completion certificate to find out what you can expect in the PE interview process, how to tackle tough questions, and watch examples successful interview answers. Watch 2 expert interviews from a PE Partner and top PE recruiter to find out what PE Funds are actually looking for from candidates.