Real Estate Investment Trust (REIT)

March 29, 2023

What is a REIT?

A real estate investment trust (REIT) is a company that owns or finances income-producing real estate. Most REITs are traded like stocks, making them much more liquid than traditional real estate investments. Equity REITs are the most common, owning and managing properties that generate revenue through rents. Mortgage REITs invest in mortgages or mortgage-backed securities related to residential and/or commercial real estate.

A REIT can be a public or private corporation that acquires properties outright or from owners who contribute their property in exchange for shares in the REIT. REITs are required to pay out the majority of net income in dividends (75 to 90% depending on the jurisdiction). Those dividends are “passed through” to the investors who are then taxed at the personal level. Minimal taxes (excluding real estate taxes) are deducted at the corporate level.

Key Learning Points

- REITs are structured to minimize tax obligations by using a pass-through structure in which 90% (in the US) of net income is paid out in dividends. A management team manages the REIT assets, which are held in a separate subsidiary.

- REITs can be a public corporation, a private company, or a hybrid that registers with the SEC but does not offer publicly traded shares.

- 75% of total assets must come from cash, treasuries, real estate, mortgage loans (in the case of a mortgage REIT), or shares in other REITs (limited to a 10% stake).

- 75% of gross income must come from rental properties or interest on mortgages (mortgage REITs).

- As REITs are consistently acquiring and developing properties, they require significant access to new capital.

- REITs tend to form based on the type of property, such as commercial or residential.

How REITs Work

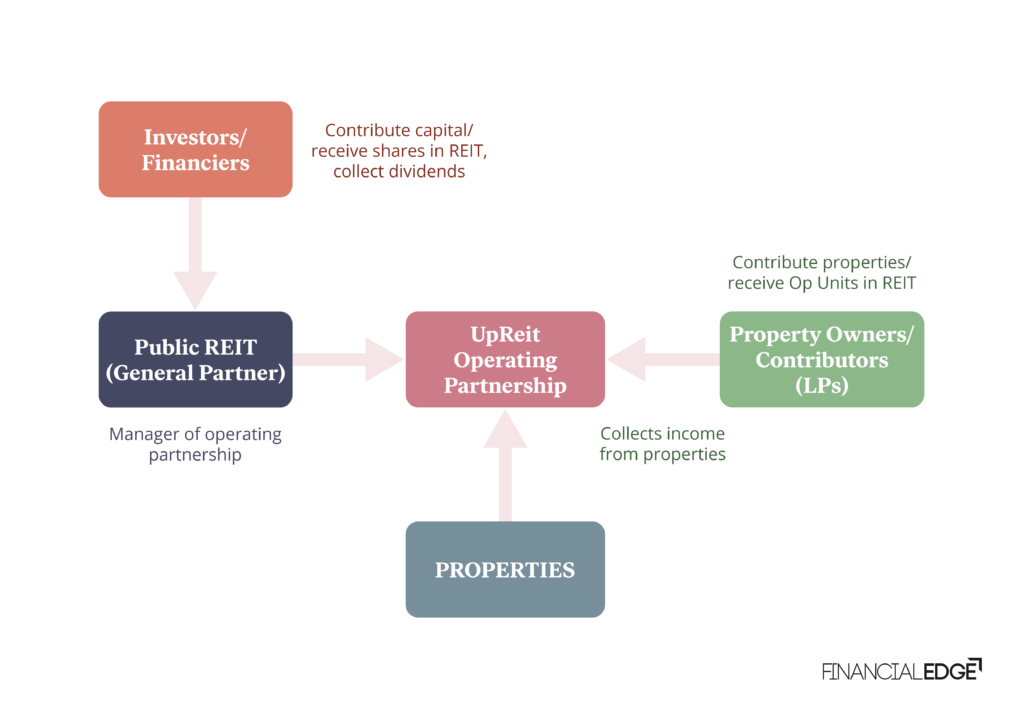

REITs are primarily tax-driven structures. However, there are other factors that make investment in a REIT desirable, such as the ability to diversify investment into a holding of many properties. A company or partnership is formed and capital is raised from investors or LPs, depending on the nature of the investment vehicle. Debt can also be raised and secured by the value of the properties acquired. As assets are acquired, they are put into an operating company. Shares in the operating company are held by the owners and also by contributing property owners who receive their consideration in shares as opposed to cash.

The REIT management will then make all decisions about running the company – acquisitions, development, asset sales, rent increases, expenditures, etc. Profits are distributed to all the investors, including those who exchanged property for capital.

How to Analyze a REIT

REITs are part real estate investment and part corporation, so analysis is a hybrid process. Single asset real estate investment analysis is generally based on cash flow, while REITs, which are pooled vehicles, use Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO). These metrics are very important because of the high dividends paid out each period. Since the dividends are based on net income, which is an accrual accounting measure (not cash flow based), FFO and AFFO are attempts to get closer to the actual cash basis of REITs earnings. Like EBITDA, neither calculation is a pure cash number, although AFFO is considered closer than FFO. Also, like EBITDA, FFO and AFFO are not GAAP measures.

As REITs are asset intensive and growth is driven by assets, one result is significant annual depreciation. With a manufacturing or even technology company, you can make the case that assets are being utilized and thus will likely lose value over time. However, in real estate that is not necessarily true. Most assets will appreciate over time so the depreciation that is on the income statement, in addition to being a non-cash charge, is also very misleading. Although REITs do buy and sell assets frequently, gains and losses on real estate transactions can also be misleading as they represent purely accounting gains.

FFO = Net income + (depreciation + amortization + losses on asset sales) – (gains on asset sales + interest income)

AFFO addresses two other accounting peculiarities, straight line rent increase amortization and the amortization of leasing commissions and tenant improvements as well as gains and losses from early retirement of debt. It also deducts maintenance capex.

AFFO = FFO – maintenance capex – amortization of tenant improvements and lease commissions +/- straight line rent adjustment +/- losses/gains on early retirement of debt

On the valuation side, comparables and DCF are used. Another methodology, net asset value (NAV) is frequently employed. NAV uses current cap rates to determine the market value of the real estate assets on the balance sheet as well as the revenue streams from ancillary activities, such as management fees. A full exploration of these metrics, REIT valuation, and many other topics related to real estate and REITs is available in Financial Edge’s Real Estate Analyst Microdegree.

Conclusion

REITs are a unique structure for holding real estate assets. For both the property contributors and the investors, tax avoidance is a key factor. In both cases, taxes will eventually be paid, but when compared to receiving dividends from a traditional corporation or selling real estate without a tax avoidance scheme, the tax burden is much lower, or at least deferred. There are many regulations governing REITs and to maintain REIT status, rules addressing dividends, ownership structure, and asset and revenue composition must be followed.