Net Realizable Value

September 18, 2025

What is Net Realizable Value?

Net Realizable Value (NRV) is a valuation approach used under both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) to value and report assets in a conservative manner. It is most commonly used for inventory and accounts receivable valuations.

The concept is rooted in the principle of conservatism, which requires accountants to exercise caution when recognizing income or valuing assets. Under this principle, financial statements must reflect adjustments or disclosures whenever the realizable value of a transaction is uncertain.

While NRV is primarily applied to inventory and receivables, it can also be used for other assets expected to be converted into cash within one year. For instance, if a company sets aside large machinery for sale due to an equipment upgrade, the asset would be valued at the lower of its NRV or its book value (net of depreciation). This blog, however, specifically focuses on the application of NRV in valuing inventories and accounts receivable

Key Learning Points

- NRV is the estimated cash inflow a company expects to realize from an asset sale after deducting all costs necessary to complete and sell it

- Companies use NRV to value inventory and accounts receivable

- To remain conservative, companies must value the inventory at the lower of NRV or cost, and accounts receivable at the lower of NRV or gross value

- When NRV falls below cost or gross receivable value, assets are written down to NRV, with the reduction recorded as an expense in the income statement

- This lowers net income and, in turn, shareholders’ equity on the balance sheet, although the impact on net income is partly offset by a tax benefit

- When NRV is more than cost or gross receivable value, assets remain valued at cost or gross receivable value, with no adjustment required

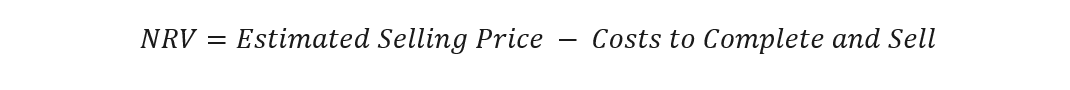

Formula and Calculation of Net Realizable Value

Net Realizable Value (NRV) represents the estimated selling price of an asset, less all costs necessary to complete the sale and bring the asset into a condition for its intended use.

NRV=Estimated Selling Price – Costs to Complete and Sell

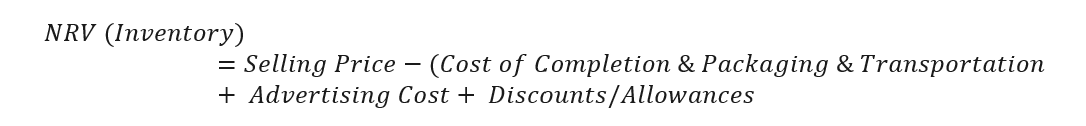

Net Realizable Value and Inventory

NRV for inventory is calculated as:

NRV (Inventory)=Selling Price-(Cost of Completion & Packaging & Transportation+ Advertising Cost+ Discounts/Allowances

Example of Inventory in Net Realizable Value

An agricultural produce trader has an inventory of grains with an estimated selling price of $1,000,000. To sell it, the trader must incur:

- 5% packaging costs = $50,000

- Advertising costs = $2,000

- A 15% trade discount = $150,000

This is detailed in the Excel below:

So, although the inventory has a gross selling price of $1,000,000, its net realizable value is $798,000. This is the figure that will be used in the accounting process.

Net Realizable Value and Receivables

NRV is calculated as:

NRV (Receivables)=Gross Receivables – Allowance for Doubtful Accounts

Example of Receivables in Net Realizable Value

A trader sells goods worth $1,000,000 on credit, due in 60 days. Based on past experience, only 95% of receivables are expected to be collected.

Thus, the net realizable value of receivables is $950,000. This is a conservative estimate and assumes that there is a high likelihood (in line with historical trend) that not all bills will be settled in full.

Download the free Financial Edge NRV template. This Excel tool contains further examples with the calculation steps laid out ready for use.

How Net Realizable Value is Used and How it Works?

Both IFRS and GAAP require that current assets (such as inventory and receivables) be reported at the lower of:

- Net Realizable Value (NRV)

- Cost (for inventory) divided by the Gross Amount (for receivables)

Practical Application of NRV

These are the general rules of Net Realizable Value:

If NRV is higher than cost (for inventory): or gross receivable amount, no adjustment is required. Assets will remain recorded at cost or gross value.

If NRV is lower, the asset is written down to NRV: The reduction is recorded as an expense in the income statement, decreasing net profit. This reduction in profit also decreases shareholders’ equity (since retained earnings fall). However, the impact on net profit after tax is less than the write-down amount because the company receives a tax benefit. That tax benefit increases the cash balance on the asset side of the balance sheet. This way, the valuation and financial statements remain consistent and accurate.

Continuing the earlier illustration of inventory valuation, if the actual cost of inventory is $800,000, but its NRV is $798,000, the inventory would be recorded at $798,000 on the balance sheet. The difference of $2,000 would be recognized as an inventory write-off expense in the income statement.

In practice, however, most corporations include inventory write-downs within Cost of Goods Sold (COGS) or Selling, General & Administrative expenses (SG&A), unless the amount is material, in which case it is disclosed separately.

Real World Examples of Net Realizable Value

Inventory Example

As noted earlier, corporations generally do not present inventory write-offs as a separate line item in the income statement. Only material write-downs require specific disclosure. Instead, most companies disclose the methodology used to value inventory in the notes to the financial statements.

For instance, the following excerpt is taken from the inventory valuation note in the Form 10-K of General Mills:

Source: Felix

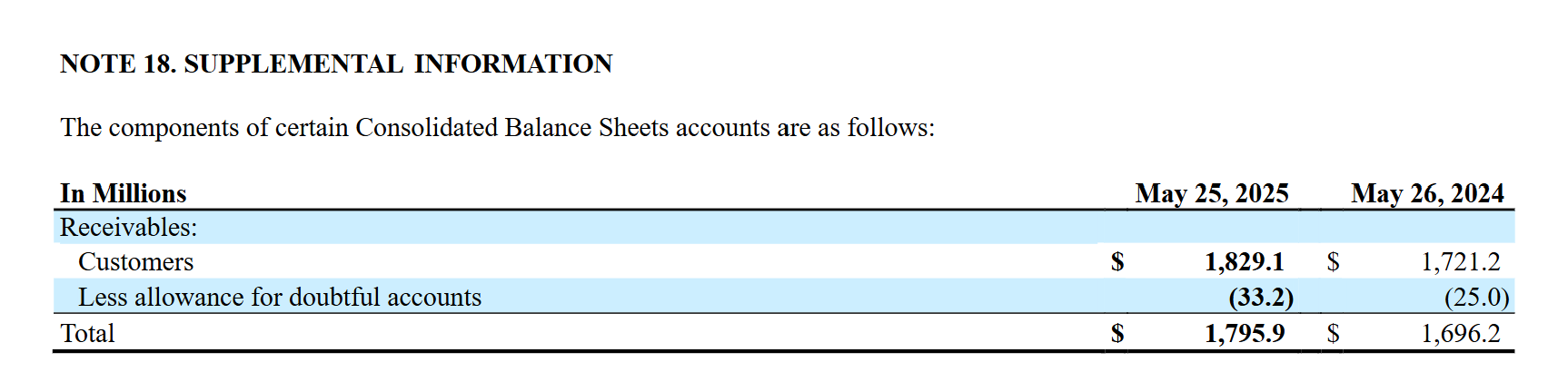

Accounts Receivable Example

The same principle of materiality applies to the valuation of accounts receivable. Companies are expected to disclose their approach to recognizing allowances for doubtful accounts, but the level of detail depends on materiality and management’s judgment.

In the case of General Mills’ Form 10K, the allowance for doubtful accounts is less than 2% of gross receivables. Since this is not considered material, it is disclosed at the company’s discretion rather than as a separate, detailed line item.

Source: Felix

Advantages and Disadvantages of Net Realizable Value

Using net realizable value can have its advantages and disadvantages:

Advantages

Conservatism Principle – In terms of advantages, using net realizable value ensures assets are not overstated, giving a more prudent and reliable view of financial position.

Reflects Economic Reality – It also captures the current market conditions and realizable value of assets keeping an up-to-date record of market values. This is particularly important when items such as inventory are linked to commodity or utility pricing and the fluctuations.

Enhances Transparency – NRV provides stakeholders with clarity on potential losses in inventory or receivables in a timely manner.

Protects Investors & Creditors – It also reduces the risk of a company stating misleadingly high asset values, this will support better decision-making both within the business and for external investors and creditors.

Disadvantages

Subjectivity in Estimation – One potential disadvantage of NRV is that is requires management judgment on decisions such as estimating selling costs or doubtful accounts, which may reduce consistency.

Potential for Earnings Management – Using net realizable value can create subjective assumptions which can then be used to manipulate profits. When taking the most conversative (or lowest) value of an accounting item, analysts should read the financial statements carefully to fully understand the valuation rationale.

Volatility in Financial Statements – Frequent changes in market prices may cause fluctuating asset values and earnings which in turn will impact the financial statements.

Conclusion

NRV acts as a safeguard against overstating assets and ensures that financial statements present a realistic and conservative picture of a company’s position. By requiring that assets be valued at the lower of cost or NRV, both GAAP and IFRS reinforce investor and creditor confidence in reported numbers.

While NRV enhances transparency and reliability, it also introduces subjectivity in estimation and potential volatility in financial results. Understanding its application in both inventory and receivables helps stakeholders appreciate how companies balance accuracy, prudence, and disclosure requirements in financial reporting.

Ultimately, NRV provides a balance between accuracy and prudence, ensuring stakeholders are neither misled by inflated asset values nor blindsided by hidden risks.