What is “ESG Integration”?

ESG integration is the process of incorporating environmental, social, and governance factors into an investment strategy. By adding these features to the investment decision-making process, portfolio managers aim to enhance returns while limiting potential risks. There is no hard and fast rule around how ESG integration is applied, however, including ESG considerations could require offloading of a position in the portfolio. These factors can be included across multiple asset classes, mostly equities and bonds, and could work with various investment styles – for example, both value and growth equities. The value of integrating material ESG considerations into the investment process has been the subject of debate, but it essentially amounts to an added layer of due diligence when researching a company.

Key Learning Points

- ESG integration is the inclusion of environmental, social, and governance considerations into the investment decision-making process

- ESG integration can be applied across multiple asset classes such as equities and fixed income, as well as various investment styles and market capsizes

- ESG integration enhances the due diligence process on a company by further assessing material ESG considerations

- The overall aim of ESG integration is to enhance the portfolio’s risk-adjusted returns profile

- According to data from JP Morgan, 89% of empirical studies find a positive link between ESG factors and the financial performance of a company

How Does It Work?

Although there is no universal approach to ESG integration, below are some of the most popular factors that portfolio managers take into account:

Environmental

- Climate change

- Waste and pollution

- Deforestation and water scarcity

Social

- Work conditions and forced labor

- Health and safety

- Inclusion and local communities

Governance

- Board diversity

- Executive pay

- Transparency

These are just a few out of the many considerations that can weigh on investment decisions, but to add further complexity there is currently no consensus on the underlying factors and how these can be approached. For example, a fund that invests in UK equities screens out mining companies due to environmental concerns, but another fund that also invests in UK companies includes some of the miners with the idea of engaging with the management and advocating for more environmentally friendly policies. In both cases, the portfolios integrate environmental factors, but take different approaches, therefore setting targets and measuring against these to prove impact is key.

What Are the Benefits?

Due to the increasing demand from investors, the number of strategies that integrate ESG has been rising sharply more recently – both in the active and passive space. Proponents of the idea would argue that adding these factors would lead to picking the higher-quality companies, which could also lead to higher financial returns over the long term. While data and reporting can still be challenging, providers such as Sustainalytics and MSCI can make the life of portfolio managers easier. Various studies have shown that companies with strong ESG credentials are far less likely to go bankrupt. In addition, these companies tend to have stronger share prices when compared to firms with lower ESG scores due to the potential of the latter being screened out.

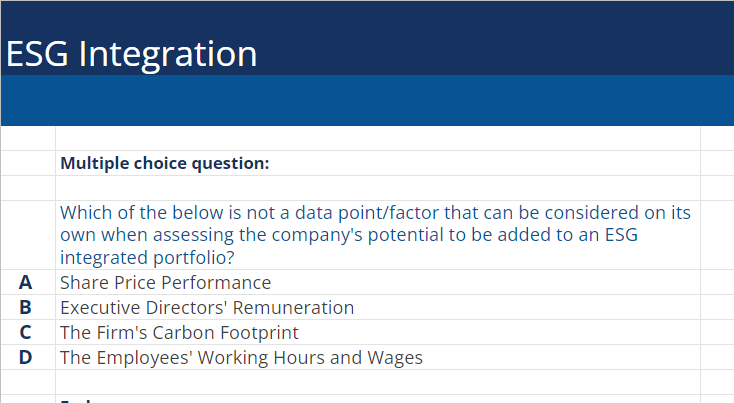

Below is a multiple-choice question to test your knowledge, download the accompanying excel exercise sheet for a full explanation of the correct answer.