What is the “Efficient Market Hypothesis”?

The Efficient Market Hypothesis (EMH) is a theory that explores the relationship between the availability of information and asset prices. It argues that all available information is already reflected in the price of a stock (i.e. assets are trading at their fair value) and therefore it is impossible to beat the market over the long-term. The theory is closely associated with Eugene Fama, who explored three different forms of market efficiency – weak, semi-strong and strong. It also supports the case for passive investing in more efficient areas of the market since finding opportunities with potential upside in excess of the market are considered as non-existing.

Key Learning Points

- The Efficient Market Hypothesis states that markets are perfectly efficient and all available information is already reflected in the asset prices

- EMH implies that all stocks trade at fair value on exchanges as the price reflects all known information

- It supports the theory that it is impossible to consistently generate excess returns over the long-term

- The EMH considers three forms of market efficiency – weak, semi-strong and strong

- Proponents of the EMH argue that investors could benefit from the efficiency and attractive costs of passive investing, where opponents of the theory believe stock prices could deviate from their intrinsic value

- Outperform the market over long periods of time is attributed to luck and good timing according to EMH

The Three Forms of Market Efficiency

Weak

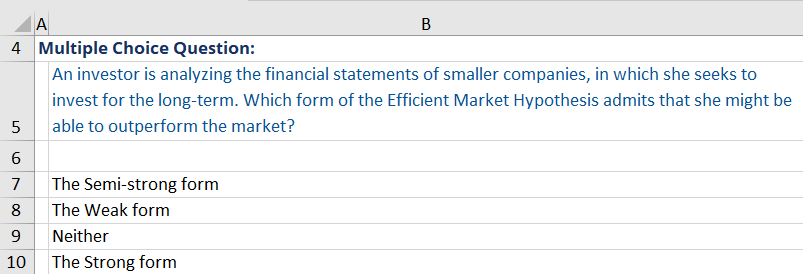

The weak form of the EMH suggests that stock prices reflect all publicly available information, but may not include information that is yet to be made publicly available, i.e. there are higher information barriers. In addition, historical prices, trading volumes and returns are not considered to have an impact on future prices. As a result, the weak form basically implies that technical analysis cannot provide consistent alpha over the long-term since future prices will be based on new information which has no relationship to historical prices. However, when it comes to fundamental analysis, the weak form admits that it might be possible to beat the market using this approach.

Semi-strong

The semi-strong form of the EMH holds that prices are quick to react to any public information that becomes available and therefore suggests that neither technical nor fundamental analysis could deliver excess returns over the long run. For example, when major economic data is released, the prices of assets adjust rapidly and therefore fundamental analysis is unable to predict future prices as it is assumed in the weak form.

Strong

The strong form of the EMH states that prices reflect all information available, being historical or new and both public and private, including insider information. For example, even information that is only known to the company’s directors and is yet to be revealed is assumed to be factored in in the current stock price. Therefore, according to the strong form markets are fully efficient and even insider information does not have predictive powers and cannot deliver above-market returns.

The Bottom Line

The EMH is one of the most debated investment theories and has been at the forefront of the active versus passive investing dispute. Its weak form admits fundamental analysis could deliver excess returns in less efficient areas of the market where information is more difficult to access, for example in emerging markets and/or smaller companies. The semi-strong and strong forms rule out the possibility of beating the market. Therefore, proponents of passive investing often reference the EMH to support their investment case.