What is ROACE?

ROACE stands for the return on average capital employed. ROACE is one of the several methods used to calculate the return on capital. The return on capital is a financial ratio that helps determine the profitability of a business compared to the money that has been invested in that business. Businesses that can generate higher profits from their investments have a higher return on capital. Return on average capital employed is based on the same principle as return on capital.

It is calculated as EBIAT/average capital employed. EBIAT stands for earnings before interest after taxes. EBIAT represents the operating income after tax. Interest is not deducted meaning that this measures the businesses profitability ignores its capital structure.

Capital employed represents the amount of capital invested by a business towards running its operations. ROACE uses the average capital employed for a period and not the year-end figure reported in the balance sheet. This is a key difference between ROACE and return on capital employed (ROCE). Unlike the ROACE, ROCE uses the year-end capital employed as its denominator.

Both ROACE and ROCE are used for measuring profitability in capital intensive industries such as oil and gas, airlines and telecommunications.

Key Learning Points

- ROACE is the abbreviation of return on average capital employed and is a financial metric used to determine the profitability of a business relative to the money invested

- Earnings before interest after taxes is the recurring operating profit of the business multiplied by one minus the tax rate

- Capital employed represents the net operational assets of the business

- The average capital employed figure is used to remove the effect of acquisitions, funds raised at the end of the financial year and any other activities which may skew trends

- Depreciation represents the consumption of long term assets and may cause a decrease in the ROACE figure, care should be taken to review the depreciation policies of the company in question

Average vs Year-end Capital Employed

Ideally, the profits for the year should be compared with the operating assets used throughout the year. Using year-end figures of capital employed can sometimes skew trends and comparisons between companies or different review periods. Here are a couple of examples:

Acquisitions

When companies make acquisitions, they include the acquired companies’ profits only from the date of the acquisition in their financial statements. However, the balance sheet at the year-end includes all the assets of the acquired subsidiary. This artificially decreases the ROACE because the numerator consists of returns for a smaller period, whereas the denominator would show the assets being employed for the full year.

Funds raised towards year-end

If a company raises funds in the last quarter of the year, its assets at the year-end will show the cash being employed for the full year. However, the funds have been employed to generate profits only for a quarter.

Averaging the capital employed helps remove distortions and gives a more accurate measurement of the returns on capital employed across the entire period.

Calculating ROACE

There are two key steps to calculate the ROACE.

EBIAT

EBIAT is also referred to as NOPAT, which stands for net operating profit after tax. EBIAT is an indicator of a company’s ability to generate profits from its core operations, net of interest, and taxes. EBIAT excludes non-operational income and expenses such as financing items (interest income/expenses), income generated from investments and non-recurring income. EBIAT is calculated as EBIT x (1-tax rate.)

If a company has no non-recurring items, EBIT (or earnings before interest and taxes) is the same as operating profit.

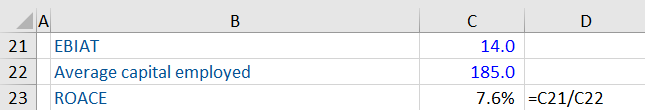

Here is an illustration of calculating EBIAT.

Average Capital Employed

Capital employed is calculated as total assets less any operating liabilities. When we say total assets, we mean the operational assets or assets used in the business’s day-to-day functioning. Examples of such investments include inventory, property, plant and equipment, accounts receivables, and other fixed assets. Financial assets, such as investments, are excluded from capital employed.

Here is an example of calculating the average capital employed:

Calculating ROACE

From the examples above, here is how we can calculate the ROACE.

The ROACE of this business is 7.6%.

Limitation of ROACE

While using ROACE, analysts should be mindful of the effects of depreciation. This is where assets such as plant and equipment or other machinery lose their financial value over time. However, their operational value may remain the same with no reduction in the income generated from those assets. In such scenarios, the ROACE may appear unrealistically high in the latter years of a business. The ROACE increases because the denominator is reducing, while the numerator not experiencing the same decline.

ROACE in Practice

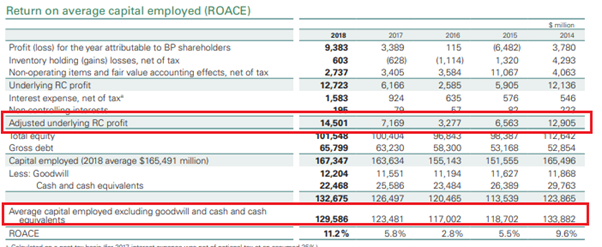

Here are some excerpts from the 2019 annual report of British Petroleum.

Here the numerator is the adjusted underlying replacement cost (RC) profit of 14,501. This number is calculated by adjusting the net profit (9,383) for non-operating items, interest expense (net of tax), and the amount generated for non-controlling interests. These numbers (excluding the NCI proportion) are added back to the net profit because they are not related to the business’s core operations. This is not true for the NCI adjustment, since this profit has been generated by the operations of the business, but the starting point 9,383 is for BP shareholders only.

The denominator (129,586) is the average of the opening capital employed (126,497) and the closing capital employed (132,675.)

This calculation gives us a ROACE of 11.2% (14,501/129,586).