Return on Capital Employed (ROCE)

What is Return on Capital Employed?

ROCE or return on capital employed expresses profit as a percentage of the capital employed in the business. ROCE is a useful measure of operational efficiency, particularly for capital-intensive industries such as oil & gas, telecom, transportation and manufacturing.

ROCE Formula

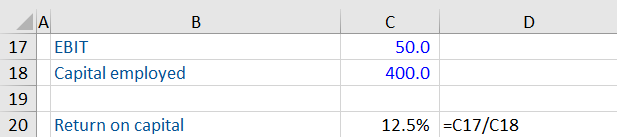

The formula is expressed as:

ROCE = EBIT * (1- tax rate)/Capital employed

Where:

- EBIT represents the recurring profit from a company’s operations and does not include expenses related to capital structure, such as interest. EBIT is multiplied by 1 minus the tax rate to deduct tax from the operating profits of the business. This can also be expressed as EBIAT, or earnings before interest and after tax. Money paid out in tax is not available to financiers and must be adjusted to show this.

- Capital employed represents the net operational assets of the business.

Key Learning Points

- Return on capital employed is a profitability measure which compares a company’s recurring operating profit after the impact of tax to the capital employed

- Earnings before interest after taxes is the recurring operating profit of the business multiplied by one minus the tax rate

- Capital employed represents the net operational assets of the business

- ROCE is also used to appraise projects based on their returns and cost of investment

- When comparing companies in a peer group, goodwill is typically excluded to allow for like for like comparisons

Calculating ROCE

Let us understand ROCE with a simple example.

The business has generated earnings before interest and taxes or EBIT of 25. This earnings figure has been generated through its investments in its net operational assets of 300 million. However, not all the 25 is available to financiers as the business is required to pay an expense to the tax authorities. This means the EBIT figure must be adjusted for the tax expense:

EBIAT = 25 * (1-30%)

= 17.5

Then, the 17.5 earnings available to the financiers is divided by the 300 of capital employed:

ROCE = 17.5 / 300

= 5.83%

This means for every 100 invested in the company’s operations, the financiers should expect a return of 5.83.

Which Assets & Returns to Use?

Let us understand these adjustments in detail.

Assets to be Used

The choice of assets is a matter of individual preference and dependent on the analysis. Total assets (current + non-current assets) help measure the return as a percentage of the total assets available at management’s disposal. Total assets less current liabilities is another method of calculating capital employed. Total assets less adjusted current liabilities deduct only the non-financing current liabilities from the assets. Examples of non-financing current liabilities are accounts payable, deferred revenues, accrued expenses, etc.

Return or Profit

The return or the profit figure is determined by the assets included in calculating capital employed. If the analyst is measuring the overall profitability of a business against the total capital employed (total assets), a logical figure of profit should include all types of return on the assets (including investments) included in the capital employed. This should therefore be before charging interest on any type of financing included in capital employed. If the year-end capital employed includes loans, overdrafts, and finance lease obligations, the return should be the profit before all interest charges, including interest on bank loans, overdrafts, and finance lease obligations. Thus, the relevant profit would be profit for the year before deducting interest payable and taxation.

This approach does not distinguish between different financing methods and relates profits before all financing costs to the assets/capital employed. This approach helps measure a company’s operational ability to generate returns from the funds available at its disposal, irrespective of the method of financing. Financial ratios, such as gearing and interest cover, examine the relationship between different financing methods as a separate exercise.

Average or Year-end Capital Employed

Another decision is whether to use the year-end figures or the average capital employed. This calculates the average capital employed using the current and prior years’ reported capital figures. The use of year-end figures can sometimes be problematic as the denominator uses balance sheet numbers, which offer a financial snapshot at a point in time. In contrast, the numerator represents the company’s earnings over the course of the full year. Events like acquisitions or raising of funds can distort the ratio if year-end numbers are used. To adjust for such events, analysts use the return on average capital employed (ROACE)

Return on Capital for Projects

ROCE can also be used to measure the profitability of individual projects. ROCE can help measure the average annual dollar return for every dollar invested in a project.

The formula is expressed as:

ROCE = Return/Cost of investment.

Here is an illustration:

ROCE for projects helps in quantifying the project value and helps in measuring the profitability of individual projects. Here, the return on capital provides an extra data point for comparing different projects and aiding decision making.

Difference Between ROCE for Public and Private Companies

When looking at the ROCE calculations of public companies, it is calculated as EBIT as a percentage of total capital employed (debt and equity.) Public companies use this method because from an external investor’s perspective, they do not control how much cash a business holds within the assets on its balance sheet. They are getting their returns on that cash (net of interest and taxes), and they must provide capital for the business to hold as cash (irrespective of the financing method).

However, for a private company and for M&A analysis, cash and interest income are excluded from ROCE calculations. Also, EBIAT is a more relevant metric for M&A analysis as you are valuing the net cash-generating ability of a business.

ROCE in Practice

Here is a snapshot from the 2019 annual report of E.ON Group. The company defines ROCE as follows:

E.ON Group – Extract from annual report 2018

The company uses adjusted EBIT as its earnings figure for ROCE. This is a public company, so EBIT is a more relevant metric for its investors.

E.ON Group – Extract from annual report 2018

Should Capital Employed Include Goodwill?

There are two different answers to this question depending on what you are looking at. If you are evaluating a single asset allocation decision within a firm e.g. an acquisition and you are calculating return on capital employed then you would include goodwill, in fact, capital employed in the context of an acquisition is the acquisition enterprise value plus any deal fees.

However, if you are comparing companies and looking at the return on capital employed in the context of the peer group you want to evaluate the firms on a like for like basis – i.e. excluding the impact of acquisition accounting where goodwill gets put on the balance sheet (and ideally any other step up revaluations if you know what they are), then you would exclude goodwill from capital employed.