Multi-Asset Funds

What is a Multi-Asset Fund?

Multi-asset funds are collective investments that combine different asset classes in their portfolio. The combination of these assets could vary widely as a result of the risk parameters of the strategy. Multi-asset portfolios could include traditional asset classes such as equities, bonds, cash or money market, along with real assets such as property and infrastructure. Some might include more complex segments such as private equity, commodities and derivatives. These types of funds are viewed as a ready-made solution for retail investors since they do not require much decision-making input. Purchases and sales of underlying holdings are usually done in order to keep the portfolio in line with the asset allocation model of the fund.

Key Learning Points

- Multi-asset funds combine different asset classes such as equities, bonds and cash into a single portfolio

- They are built to achieve a particular outcome, for example beating a representative or custom index, or achieving returns in excess of the inflation rate

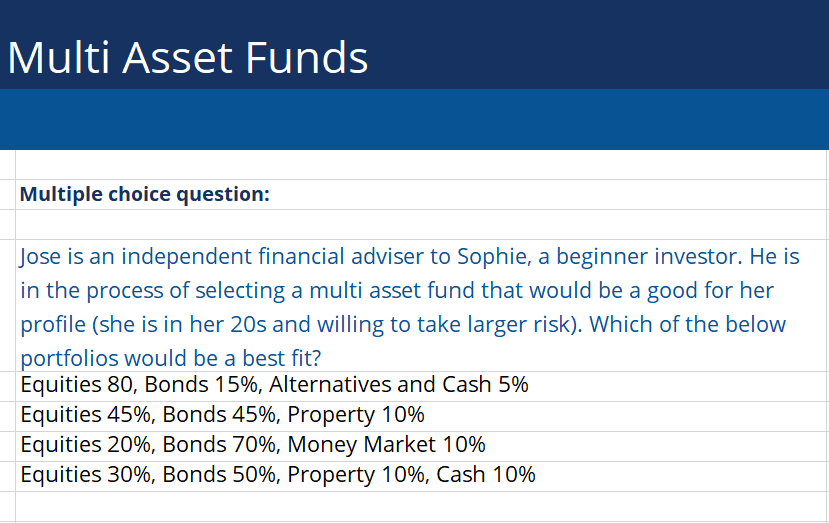

- Asset allocation is determined according to the strategy’s risk frame:

- Higher exposure to riskier assets such as equities is typical for more aggressive growth-focused funds

- A larger weighting in fixed income or cash is usual for rather risk-averse portfolios

- Multi-asset funds are constructed as a package for the end investor, where all management decisions are made on behalf of the client by a professional investor

Types of Multi-Asset Funds

There are various types of structures that are in fact multi-asset in their nature. Fund of funds (which are in practice mutual funds) and investment trusts (closed-ended funds) are popular among retail investors. Others such as pension funds, hedge funds, insurance funds, sovereign wealth funds or endowments are also run on a multi-asset basis but serve different purposes and investors. It is not unusual to also find single stocks, debt issues or other securities in the portfolios.

Advantages

One of the key benefits of investing in multi-asset funds is diversification through exposure to a broad range of asset classes and sectors, along with investment styles and single security exposure. This approach aims to reduce the risk and produce outcomes in terms of risk-adjusted returns. Performance is typically measured against a specific objective, custom benchmark or index.

A team of investment professionals, which designs the portfolio to navigate through different market conditions is in charge of the management process. Depending on the strategy, they can also employ tactical allocation in order to get most of the upside potential or mitigate the risk during market turbulence.

Another benefit of investing in multi-asset funds is the opportunity to get indirect exposure to areas of the market that are otherwise difficult to access. For example, a specialist emerging market strategy could hold stocks in the domestic Chinese market that cannot be bought through an ordinary retail channel/platform. In addition, getting access to the top, professionally selected third-party fund managers is an excellent opportunity to generate excess returns.

Disadvantages

While the reduction of risk is often considered as an advantage, it can also be a limitation for potentially higher returns. Some of the asset classes that form a multi-asset portfolio are negatively correlated, meaning that when one area of the market goes up, another decline. For example, equities and bonds have historically demonstrated a negative correlation.

Deep dive into the portfolio management process with our online portfolio management certification course.