Asset Backed Loans

What are “Asset Backed Loans”?

Asset backed loans or ABLs, as they are more commonly known, are senior revolving credit facilities that are secured by specific assets, primarily current assets such as inventory and receivables. The facility amount and borrowing levels are set by a formula based on the perceived liquidation value of the assets securing the loan. Due diligence on assets is critical to a successful deal, therefore the pricing and fees are richer than a traditional loan. ABLs are typically driven by sponsor relationships.

Key Learning Points

- ABLs are primarily secured by more liquid current working assets as opposed to long term assets

- Typically, one financial covenant, a debt service coverage ratio, is used to monitor the credit

- Lenders can actually take control of assets and cash flows if covenants are breached

The ABL Market

The primary candidates for asset backed loans are sub-investment grade or middle market companies that are asset rich. These companies are not necessarily cash poor but either have significant swings in cash flow or require significant working capital investment. Asset backed lenders look for companies that have demonstrated the ability to convert working capital investment to cash. Funding is typically sought to drive future growth, help recover from past poor performance, solve seasonal or cyclical cash flow swings, or bridge other debt maturities. Sponsor-driven deals drive this market. In assessing a company’s assets, the primary focus is on accounts receivable and inventory. This is due to the liquidity of those assets relative to others. For each account, a lender must conduct extensive due diligence.

Accounts receivables are aged to determine which are most likely not to be collected. Aging of accounts receivable is the process of sorting receivables by their due dates in an effort to estimate the amount of uncollectible accounts. In other words, the aging process classifies the existing past due receivables into categories based on their past due date in an attempt to estimate an allowance to each account. The remaining collectible accounts are referred to as the net orderly liquidation value or NOLV. Typically, ABL facilities are calculated on a base rate calculation of 75 to 90% of the NOLV.

A similar calculation is done for inventory to determine the NOLV. Raw materials and finished goods are tested for value while work in process is disregarded. Loans are calculated based on approximately 75 to 90% of the NOLV here as well, depending on the type of inventory.

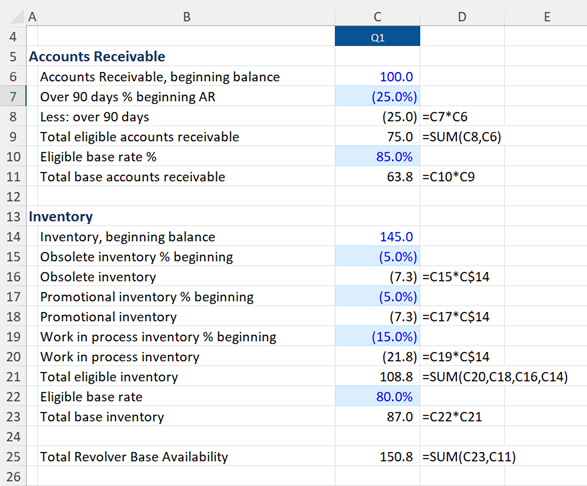

The determination of the borrowing amount for the ABL facility based on the asset levels is called the borrowing base calculation. The total borrowing base is the sum of the base rate calculation for the assets included in the facility, in this case, the account receivable and the inventory.

Borrowing Base Calculation Example

While loans based on long term assets are uncommon, in cases of good relationships or very strong assets, they are possible. Typically these loans are made at 25 to 40% of NOLV. For companies with significant real estate or property value, a sale-leaseback might be a better option.

Asset Backed Loan Maintenance

Despite the intense due diligence in these loans, ABLs tend to have only one covenant, which is typically some variation of debt service coverage ratio (EBITDA-CapEx)/Interest. This ratio is often adjusted to reflect any sponsor management fees that are paid reflecting the prominence of financial sponsors in this market.

Learn more about