How to Build a Merger Model

What is a “Merger Model”?

Merger models are constructed to simulate the impact of two companies merging, or one company taking over the other. The analysis represents the potential combination of two companies that come together via an M&A process. The model helps understand how an acquisition would be facilitated and assesses the impact on the acquirer’s financials.

The key steps or components involved in building a merger model are M&A model inputs (making assumptions about valuation inputs and financial statements that are necessary to drive the rest of the analysis), followed by a range of M&A model assumptions, model analysis, and model outputs.

In simple terms, Mergers and Acquisitions (M&A) are transactions resulting in the purchasing and/or joining of one business with another and this requires some due diligence to assess whether deals can be beneficial or not. Attention must be paid to whether acquirers pay an acquisition (or control) premium above the target company’s share price, assess what the potential value creation is driven by, and analyze potential synergies.

Key Learning Points

- Merger models are used to explore the potential financial implications of putting two companies (or more) together

- The key steps involved in building a merger model are: M&A model inputs, followed by a range of M&A model assumptions, model analysis and model outputs

- The merger model can allow analysts to look at different scenarios for a potential deal, such as varying the purchase price, or looking at the best funding option for the deal (equity or debt)

Merger Model – Key Inputs

Given below are the inputs to build a simple merger model:

M&A model inputs: this is the first step in building a merger model. The inputs will be used to make assumptions that will drive the rest of the M&A analysis. In general, such analysis will including the following:

- Valuation inputs: this includes the latest share prices of the target and acquirer companies (if listed), the basic number of shares outstanding, potentially dilutive securities, net debt, current credit rating, and other adjustments to EV (e.g. underfunded pensions) of both companies.

- Financial statements inputs: this information is largely taken from the income statements and the most recent balance sheets of both companies. This typically includes Sales, EBITDA, EBIT, and EPS (including any company guidance), plus balance sheet data (including debt, assets, etc), the marginal tax rate (tax adjustment of incremental changes), and the effective tax rate (for NOPAT calculations).

M&A model assumptions: in order to start the analysis, the following assumptions are required:

- Acquisition/control premium: this is a key assumption that will affect all model outputs – typical historical premiums are between 20% – 40% of the price but there may be more data available that is relevant to recent activity in the sector or market.

- Assumption about financing mix: this is another key driver of the model as it can help make a decision on how to fund the offer – whether to offer cash (via debt issuance) or equity (via a stock for stock swap).

- Cost of financing: this needs to be considered in relation to the forecast cash flow assumptions of the new company and assess the cost of debt versus the cost of equity.

- Potential impact of debt financing on post-transaction credit ratings: is it likely that there will be an upgrade or downgrade in credit ratings?

- Acquirer’s debt raising capability: this investigates the acquirer’s ability to raise debt at the time of the deal and investigates the current debt status of the company.

- Impact of equity financing: this is the potential impact on the acquirer’s post-deal earnings and ownership.

- Potential flow-back issues: this also includes the preference of target shareholders.

- Assumption about transaction fees: M&A transactions require acquirers to pay advisory fees, debt issuance fees and equity issuance fees which will need to be funded.

- Synergies: potential cost reductions are the most common type of synergies although there may be others. Often there can be a range of synergies that may be possible depending on the projected spending plans of the newly merged company.

- Interest assumptions: this relates to the potential interest to service the new acquisition debt (%) and interest income on cash (%).

Having stated the above, it might be noted that synergy expectations should always be considered when assessing a deal, as it can significantly influence post-deal value creation.

M&A Model Analysis: there are several parts to the model analysis – firstly it should consider the acquisition value and the costs (including fees etc) of undertaking the merger. It also needs to consider the sources and uses of funds to pay for this process. A calculation to gauge the potential goodwill created (or lost) is a factor to consider with the deal valuation.

In addition, there needs to be a consolidated balance sheet (the pro forma balance sheet provides an insight on some key financing (such as debt and net debt) and operating updated figures (including PP&E and operating working capital, and goodwill). The income statement and cash flow will also need consolidation. Finally it is important to make sure the pro forma shares outstanding are carefully factoring in all the merger details. If there are new shares issued there will need to be added to the acquirer’s shares outstanding.

M&A Model Output: if all of the steps above are completed, it will then lead to the model outputs pertaining to EPS accretion (or dilution) and whether there will likely be additional synergies or whether the deal will breakeven. It also should prove a relative PE’s valuation versus pro forma ownership as well.

M&A models should also assess the potential impact on credit ratings, ownership dilution, consideration components, combination dividends, transaction ROIC vs WACC analysis, and premium paid versus present value of synergies. Analysis at various prices (AVP) is a common analysis that is completed as part of a merger model. AVP tables show how premiums at different levels translate into the EV acquisition multiple, usually compared to precedent transactions and trading comparables.

Model – Equity to Enterprise Value, Example

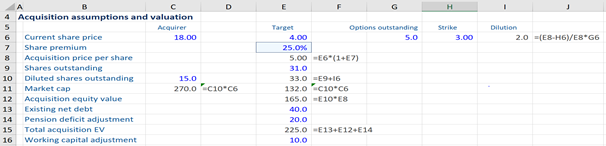

In the example given below, we understand how to arrive at the acquisition enterprise value. This section of the model involves the calculation of the acquisition equity value of the target and then calculating the total acquisition enterprise value.

We start by calculating the offer price i.e. the acquisition price per share – we take the current share price (US$4/share) and multiply it by the share premium (25%) – which is equal to US$5/share. Next, the number of shares outstanding is 31. We now need to calculate the diluted shares outstanding by adding any shares created by options.

For this, we have the options outstanding of 5.0 and a strike price of US$3 and we compare this to the offer price of US$5. Now, we calculate the dilution as equal to the number of options outstanding (5) multiplied by the maximum offer price of US$5 minus the strike price of US$3 divided by the offer price again (US$5) and 0, which gets us the dilution of 2. So, the diluted shares outstanding is going to be the 31 shares we had plus the 2 new shares, which is equal to 33.

Next, the market cap of each company is calculated as its current share price multiplied by its current diluted shares outstanding (for both acquirer and target). If we want to calculate the acquisition equity value this is done by multiplying the acquisition price per share multiplied by the diluted number of shares (US$165).

This now enables us to go to the EV equity bridge. We start by taking the acquisition equity value of US$165 and add on to it the net debt and debt equivalent (i.e. pension deficit adjustment) to get a total acquisition EV of US$225 for the total deal.

Gain practical experience building a merger model following instructor-led videos with our mergers and acquisitions course. As well as modules on M&A cash deals, earnouts, LBO and acquisition finance debt capacity.