Capital Employed

What is Capital Employed?

Capital employed is the net operational assets of the business. It is used in many financial metrics which are used to measure a company’s ability to utilize its capital effectively.

Key Learning Points

- Capital employed is defined as the net operational assets of a business

- It is widely used in many financial metrics (often called return ratios) to measure the profitability and capital efficiency of a business

- All operational assets are included at their book value in the calculation of capital employed and these can be found in the company’s balance sheet

- Capital employed and invested capital return the same calculated number but capital employed has a management focus rather than an investor perspective

Understanding Capital Employed

Capital aims to generate earnings and maintain growth. The capital employed is what the company has purchased with this capital and is summarized as the net operational assets of a business. It is calculated by adding the total operational assets less operating current liabilities. This figure shows all the net operating assets, common examples include:

- Operating current assets such as inventories, accounts receivable, less operating current liabilities such as accounts payable, known as ‘operating working capital’

- Property, plant, and equipment

- Intangible assets needed by the business

- Any other operational assets less operational liabilities the business needs to operate

These items are the net values or assets that are used in the business’s operations, less the liabilities used in the business’s operations.

Capital Employed Calculation Example

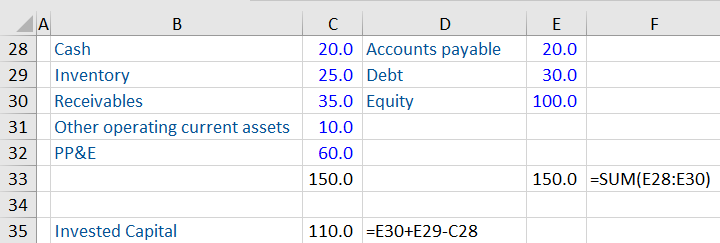

A company has the following balance sheet:

The company has raised capital of 150 via debt and equity. However, it has not employed the entire amount in the operational business. It reports a cash balance of 20, which is deposited in a bank and not part of the company’s operations. This is an example of idle capital and is not included in the company’s capital employed calculation. This leaves 130 invested in operational assets such as working capital, PP&E, or any other operational asset less operational liability the business needs to operate. The 130 represents the capital employed. This is the required investment in the business to run its operations.

Book Value or Market Value

A common question is whether to use book values or market values for calculating the capital employed. The book value is the amount reported on the balance sheet and should always be used in the calculation.

The market value represents the current market value and is likely very different from the book value. When measuring the operating efficiency of a business, investors calculate the returns earned relative to the initial invested amount. A company’s stock price may have soared since its report date, but the benefit is only on paper. Investors are interested in measuring how their invested capital has been utilized.

Calculating Capital Employed

Below is a simple balance sheet of a company. This reports a snapshot of the company’s financial position. We can use this information to calculate the capital employed.

The calculation sums all the operating assets (inventory, receivables, PP&E, and other operating current assets) less current operating liabilities (accounts payable). Accounts payable represents short-term obligations a company owes its suppliers for goods or services purchased to run its operations. It is an operational current liability and needs to be deducted to calculate the working capital.

Capital Employed and Invested Capital

Invested capital looks at the capital from the investor’s perspective. It is calculated as net debt plus the balance sheet value of shareholders’ equity. The formula is expressed as:

Invested Capital = Owner’s Equity at book value + Net debt

We can calculate the invested capital using the same information as before:

Cash is an example of idle capital and needs to be subtracted from debt to calculate the net debt. The result is the same as capital employed but instead, focuses on calculating the capital from the investor’s perspective.

Return Ratios

Capital employed is used in return ratios, which express a company’s operational earnings as a percentage of its assets used to generate those earnings. Investors and analysts are interested in the efficiency of a business in generating returns on its capital employed. Here is an example of three common ratios used relative to the capital employed:

- Return on Invested Capital (ROIC)

- Earnings before interest after taxes (EBIAT) / Capital Employed

- Return on Average Capital Employed (ROACE)

Conclusion

Understanding capital employed offers invaluable insights into how effectively a company utilizes its capital to generate profits. It serves as a key metric for investors and stakeholders to assess a firm’s operational efficiency and profitability, highlighting the importance of strategic asset and capital management. By evaluating capital employed, businesses and investors can make informed decisions to enhance financial performance and value creation. For more comprehensive details and examples, consider exploring our online finance certifications today.